To read more enter password and Unlock more engaging content

Archives of “Crude” category

rssLibya says it could double oil output in four weeks to 1mbpd

Libya lifts force majeur

Leaders in Libya’s civil war signed a ceasefire today and now there are plans to quickly ramp up oil production.

The country’s NOC says it plans to boost oil production above 1 mbpd in four weeks. It’s around 500kbpd now, up from less than 200kbpd over the past few months.

The global market doesn’t need extra oil right now. Libyan production before the conflict was about 1.2 mbpd.

We’re going to see a big move in oil before too long.

Update: there was an insane delay on that trade and now crude has finally dropped.

Russia and Saudi rightly concerned about oil demand

Latest from OPEC+ JMMC

On Monday October 19 the OPEC+ JMMC meeting did not present any surprises to the oil market. There was no recommendation to change the previously approved policy for 2021 reducing the group’s collective output cuts to 7.7mln bpd from 9.7mln bpd.However, both Russia and Saudi Arabia highlighted the uncertain demand outlook given COVID-19’s resurgence. It is worth having a quick look at that in more detail as demand issues could drag on oil prices into November.1). More people are working from home. There are fewer business trips, less frequent commutes, and this could become a ‘new normal. In Singapore nearly 50% of people are working from home. Look at the drop in mobility on the table below: 2) Travel is way down. Flightradar 24, providing real time online flight tracking service, sees a potential 3.5mln bpd decline in jet fuel consumption. This is due to a 48% drop in global commercial flights.Jet fuel and gasoline inventory at major ports such as Amsterdam have soared to multi-year higher.Global road traffic is way down with Sa Francisco road travel down around 70%.

2) Travel is way down. Flightradar 24, providing real time online flight tracking service, sees a potential 3.5mln bpd decline in jet fuel consumption. This is due to a 48% drop in global commercial flights.Jet fuel and gasoline inventory at major ports such as Amsterdam have soared to multi-year higher.Global road traffic is way down with Sa Francisco road travel down around 70%. So, although OPEC expects global demand to exceed pre-pandemic levels in 2022 that could be overly optimistic. Furthermore, the widespread adoption of electric vehicles is almost a foregone conclusion now which will in the longer term weigh on oil demand too.The next JMMC meeting is November 17 and OPEC/OPEC+ meeting is November 30/December 01. It will be interesting to see how they respond to the mounting pressures that Saudi and Russia alluded to in their last meeting. Talk of production cuts will support oil prices.

So, although OPEC expects global demand to exceed pre-pandemic levels in 2022 that could be overly optimistic. Furthermore, the widespread adoption of electric vehicles is almost a foregone conclusion now which will in the longer term weigh on oil demand too.The next JMMC meeting is November 17 and OPEC/OPEC+ meeting is November 30/December 01. It will be interesting to see how they respond to the mounting pressures that Saudi and Russia alluded to in their last meeting. Talk of production cuts will support oil prices.

2) Travel is way down. Flightradar 24, providing real time online flight tracking service, sees a potential 3.5mln bpd decline in jet fuel consumption. This is due to a 48% drop in global commercial flights.Jet fuel and gasoline inventory at major ports such as Amsterdam have soared to multi-year higher.Global road traffic is way down with Sa Francisco road travel down around 70%.

2) Travel is way down. Flightradar 24, providing real time online flight tracking service, sees a potential 3.5mln bpd decline in jet fuel consumption. This is due to a 48% drop in global commercial flights.Jet fuel and gasoline inventory at major ports such as Amsterdam have soared to multi-year higher.Global road traffic is way down with Sa Francisco road travel down around 70%. So, although OPEC expects global demand to exceed pre-pandemic levels in 2022 that could be overly optimistic. Furthermore, the widespread adoption of electric vehicles is almost a foregone conclusion now which will in the longer term weigh on oil demand too.The next JMMC meeting is November 17 and OPEC/OPEC+ meeting is November 30/December 01. It will be interesting to see how they respond to the mounting pressures that Saudi and Russia alluded to in their last meeting. Talk of production cuts will support oil prices.

So, although OPEC expects global demand to exceed pre-pandemic levels in 2022 that could be overly optimistic. Furthermore, the widespread adoption of electric vehicles is almost a foregone conclusion now which will in the longer term weigh on oil demand too.The next JMMC meeting is November 17 and OPEC/OPEC+ meeting is November 30/December 01. It will be interesting to see how they respond to the mounting pressures that Saudi and Russia alluded to in their last meeting. Talk of production cuts will support oil prices.Oil – there is an OPEC+ JMMC meeting Monday 19 October 2020

An online, virtual meeting of the OPEC+ Joint Ministerial Monitoring Committee (JMMC) today.

The JMMC discuss compliance issues – how OPEC members and friends (the “+” part) are coming along with sticking to agreed output cuts.

The cuts come with the background of a renewed drop in demand due to the fresh wave of COVID-19 outbreaks and the restrictions therefore imposed by governments.

OPEC+ have plans to further scale back production on January 1 from 7.7m b/d to 5.8m b/d. Any firm commitments on this (there are calls for this step in output cuts to be put on hold) will come from the full group meeting on 30 November/1 December, not today. But that does not preclude the usual chatter and headlines. Stay tuned.

An Update : #BRENT ,#WTI #Crude #NaturalGas – Anirudh Sethi

To read more enter password and Unlock more engaging content

EIA weekly US crude oil inventories -3818K vs -2100K exp

Weekly oil inventory and production data from the DOE

- Prior was +501K

- Gasoline -1626K vs -1300K exp

- Distillates -7245K vs -962K exp

- Cushing+2906 K vs +470K prior

- Refinery utilization -2.0% vs -0.9% exp

- Production 10.5 mbpd vs 11.0 prior

- Crude -5422K

- Cushing +2199K

- Gasoline -1513K

- Distillates -393K

Oil battles: Saudi Aramco invest further in oil

While BP and Shell reduce investment

“The reports of my death have been greatly exaggerated”.This quote was attributed by some to Mark Twain when there were reports that he was ill/dead. Mark Twain was in fact alive and well. It seems Saudi Aramco feel a similar way now about the reports of the end of the oil market.BP and Shell move to renewablesHowever, is the future green? That’s the move that BP and Shell have taken. They are planning to cut oil production so they can invest in renewable and green energies as they get ready for a low carbon world. However, Aramco question the timing. Speaking to Reuters Aramco said, ‘We expect oil demand growth to continue in the long term, driven by rising populations and economic growth. Fuels and petrochemicals will support demand growth … speculation about an imminent peak in oil demand is simply not consistent with the realities of oil consumption’. The future is green, just not totally green right away.So, Aramco want to boost their production capacity, so that when demand returns they are well placed to benefit. They want to raise their capacity to $13 million barrels per day from the present 12 million barrels per day. Saudi have around 20% of the world’s known oil reserves and it only costs them around $4 per barrel to produce. Aramco’s plan is to undercut rivals and ensure they are well placed to provide low cost oil for years to come. If US oil stay around the $40-60 range for the next couple of years this will knock out some US shale producers.

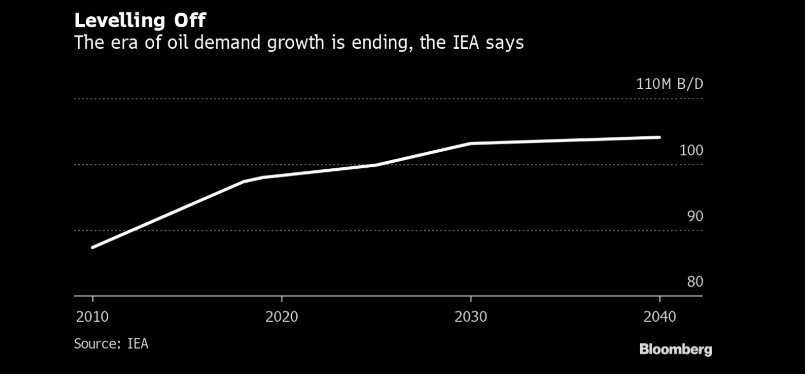

IEA sees oil demand taking years to recover from the coronavirus crisis

IEA remarks on the oil market

- Oil demand to fall by 8% this year

- Global oil consumption will only return to pre-crisis levels in 2023

- That is provided the coronavirus is brought under control next year

- Global oil demand will plateau around 2030 at best

- But that will be at lower levels than forecast last year

- If the coronavirus impact is more severe, global oil consumption won’t recover to pre-crisis levels until ‘the latter part of the 2020s’

As for their projections of demand/consumption, a lot still depends on how the virus crisis develops and we’ll have to go through that day-by-day.

Crucial Update :WTI ,BRENT ,Natural Gas -Anirudh Sethi

To read more enter password and Unlock more engaging content

Norwegian oil strike called off

Crude oil has moved lower on the news

A headlines crossing the wires saying that Norwegian oil strike has been called off. That has led to a move back down in the price of WTI crude oil futures. After trading as high as $41.47 today, the price has moved back down to a low of $40.58. We currently trade at $40.64 $-0.55 for -1.3% on the day.Technically, the price moved above its 200 day moving average at $41.12 on its way to the high price of $41.31. However the news did send the price back below that level and toward the rising 100 day moving average at $40.27.