WTI climbs above $55

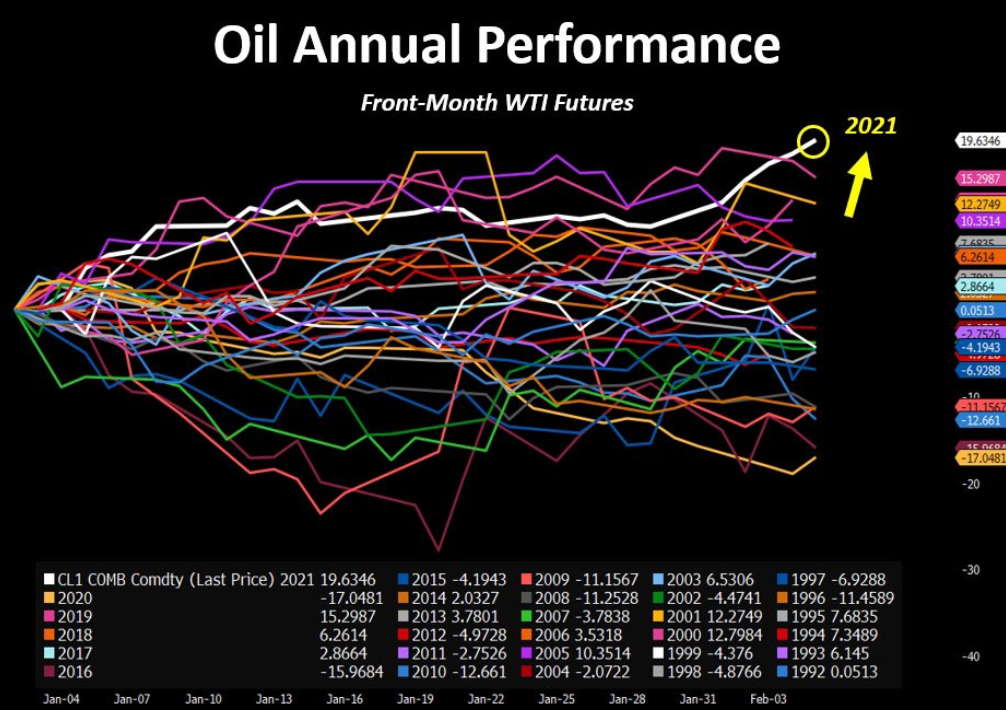

Oil prices are breaking out of a sideways trade with a 2.3% rally. WTI briefly touched $55 for the first time since January 2020.

The break from the range is also a rise above the Feb 2020 high of $54.50.

It comes at the start of a strong seasonal period for oil.

OPEC today lowered its 2021 oil demand growth forecast to 5.6 million bpd from 5.9 million bpd but the market is looking more at inventories, which may be quickly drawn down in the coming months.

OCED inventories will be 100 million barrels above the 5-year-average by the end of March 2021, in the forecasts. But by the end of June, they will be lower than the 5-year-average. This year stockpiles will be drawn down each month and fall a total of 406m barrels under the base case.

I believe that oil and oil companies are among the most undervalued assets in the world. The transition to green energy is coming but it will take decades and the lack of investment in oil production is going to cause much higher prices within 2 years.