Oil flat today

I did a video recently where I talk about the importance of watching markets that aren’t moving and aren’t grabbing headlines.

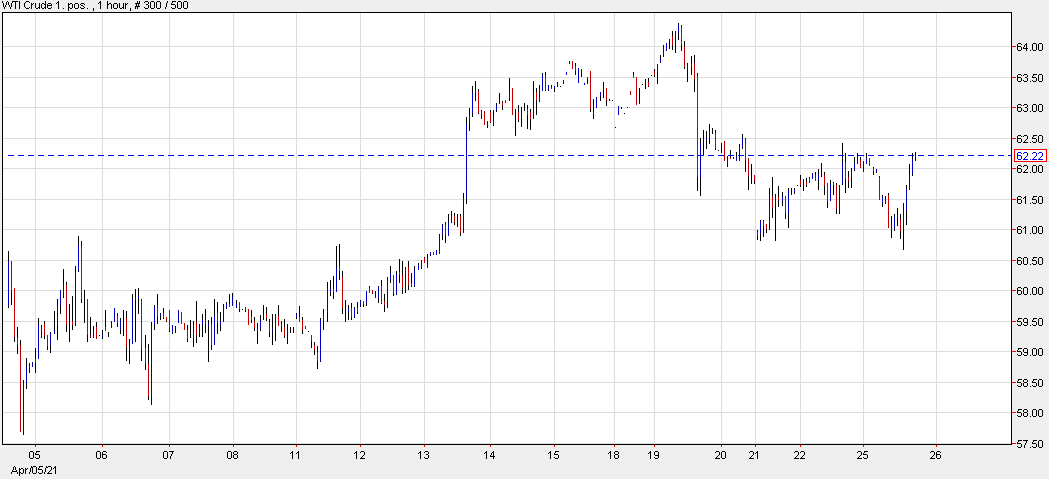

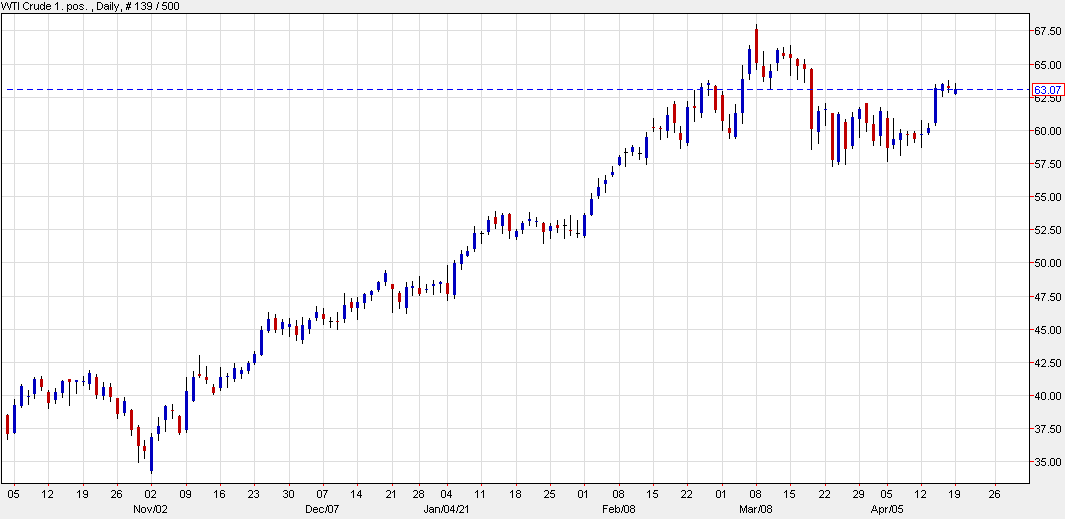

At the moment, that’s oil. WTI is flat today and looks like it will stack up another doji star on the chart. It’s normally one of the most-volatile assets but it’s been stuck in a sub-$5 range since March 18.

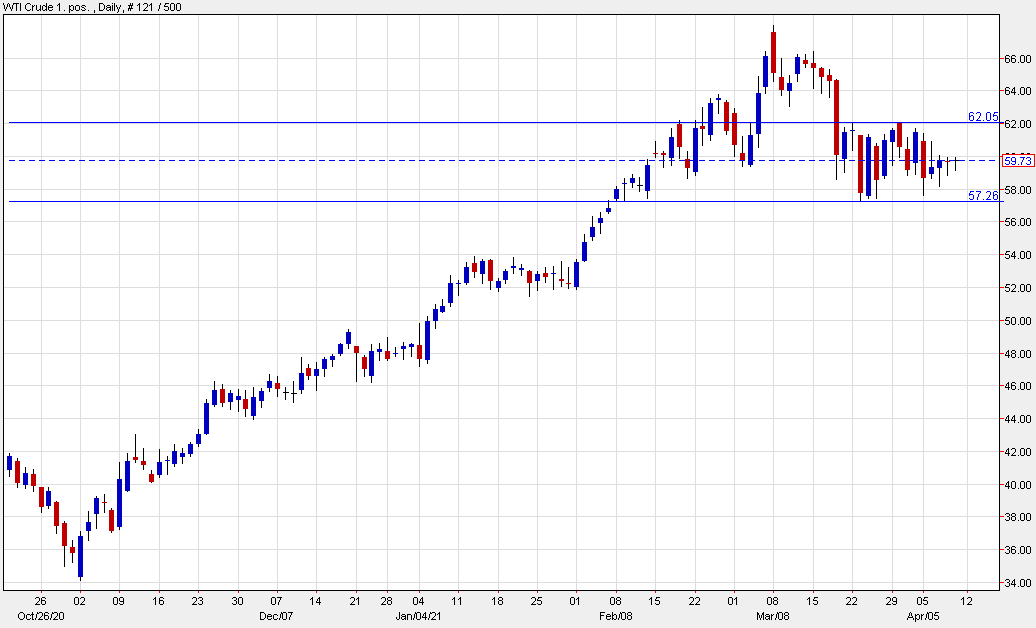

I’m a big time oil bull and I have been for many months but this is the kind of chart that makes people on both sides of the trade worried. A break is inevitable and the longer it stays here, the more likely it is to be a violent one.

Platts’ survey today showed OPEC+ is wavering in its compliance and that Iranian and Libyan barrels continue to increase (they’re not subject to quotas). Russia has been particularly lax in compliance.

We’ve got 2 mbpd coming back online through July and the WHO is warning about rising covid cases and deaths globally.

On the flipside, the US reopening is looking impressive in almost every way. Gasoline and travel demand is way ahead of where almost anyone thought it would be and will keep getting better. At these levels of production, global inventories are being drawn down.

So there are two trades (from my perspective):

- Hang onto longs and hope the trend continues

- Cut longs and hope to buy back cheaper

If it’s #2, the question is where to buy? The area around $52-54 looks attractive but a flush to $48 would be the real pain trade and a magnificent level to buy oil or oil companies.