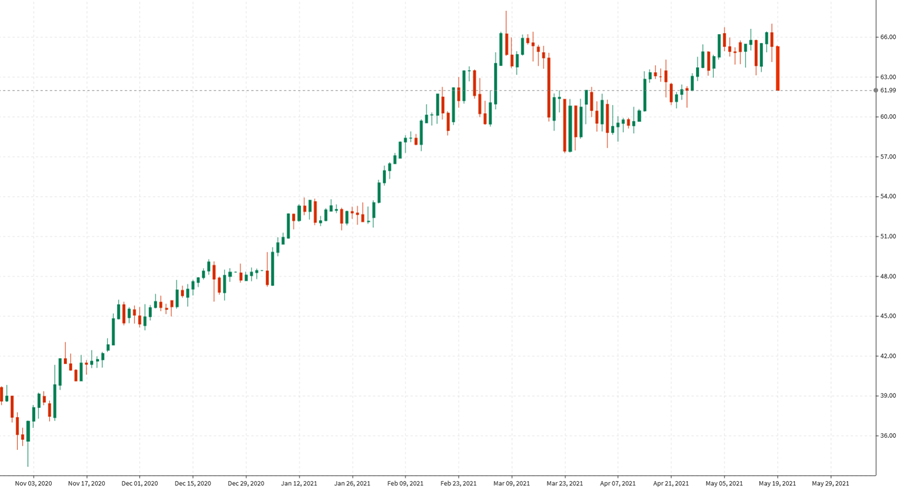

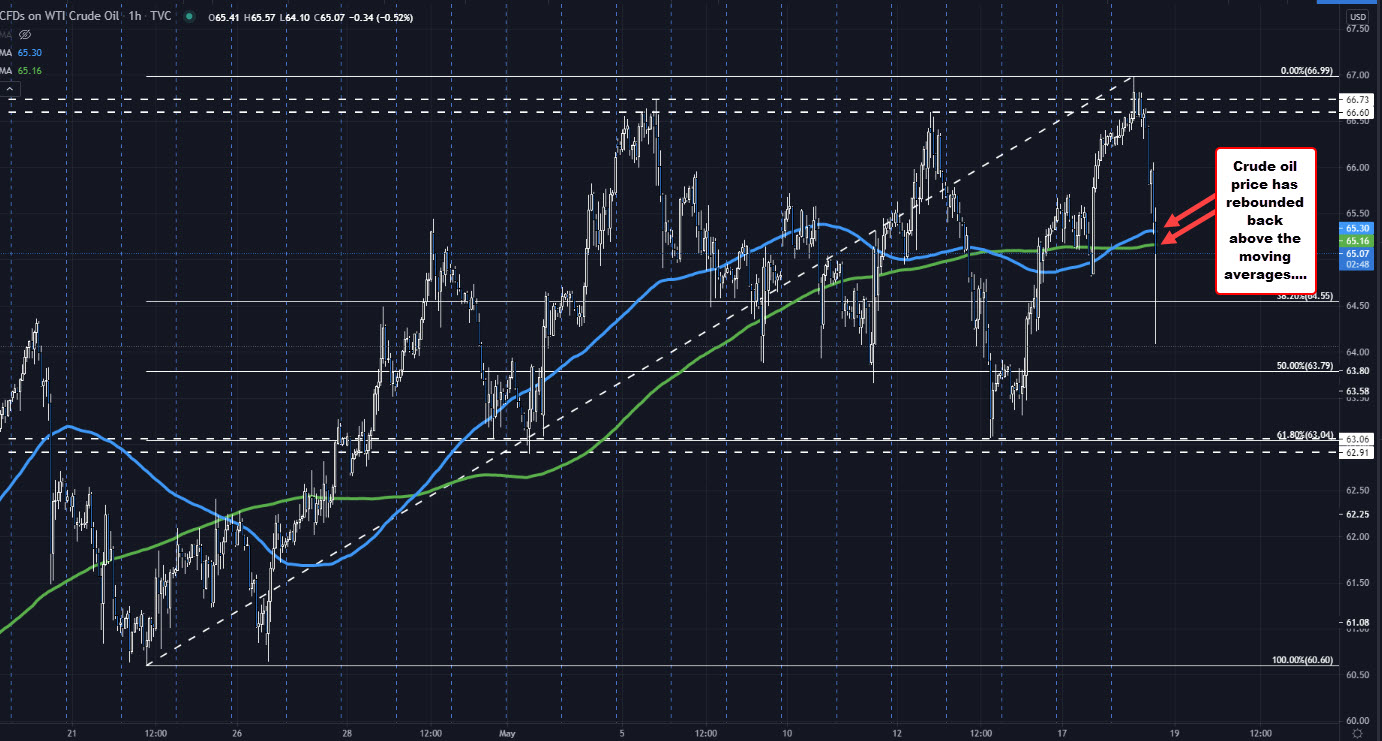

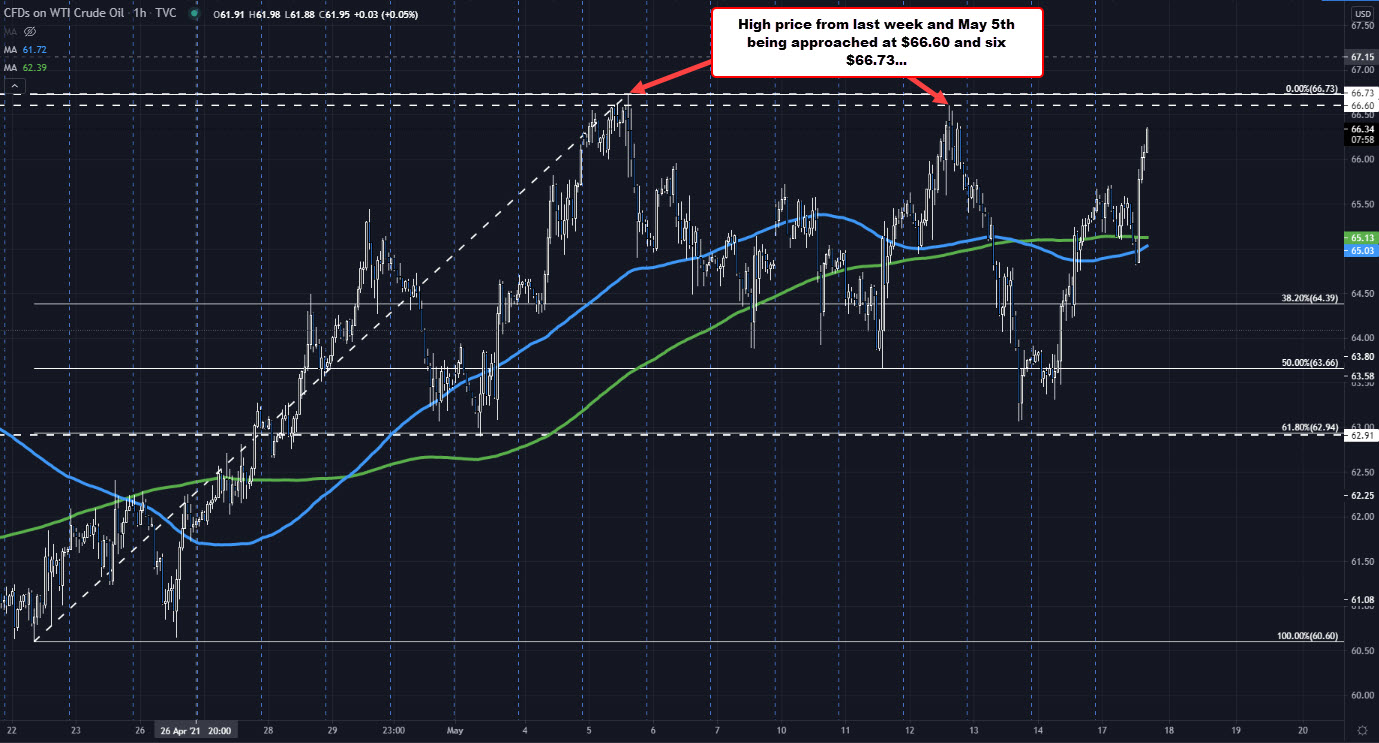

WTI up 1% just above $67 currently

Oil is trading close to its best levels for the year and from a technical perspective, may be set for a surge of gains if it can hold a daily close above $67 with a firm break above the $68 level preferable for buyers to extend the upside momentum.

Iran remains a wildcard but the OPEC+ meeting tomorrow will be among the focal points in trading this week.

On the latter, I don’t see OPEC+ upsetting the status quo but the market will be looking for hints on any step up in production later in the year. That is one risk to watch during the week besides the technical considerations and risk sentiment.

In the bigger picture though, there will be growing expectations – certainly not misplaced – that OPEC+ will eventually flood the market with oil again. That said, demand conditions are also expected to be strong enough to take all that in by then.

As such, there is still a strong bullish consideration for oil as long as the reflation narrative keeps up over the next year or so.