IEA remarks in its latest update on the oil market

- Overhang in global oil stocks built up last year has already been worked off

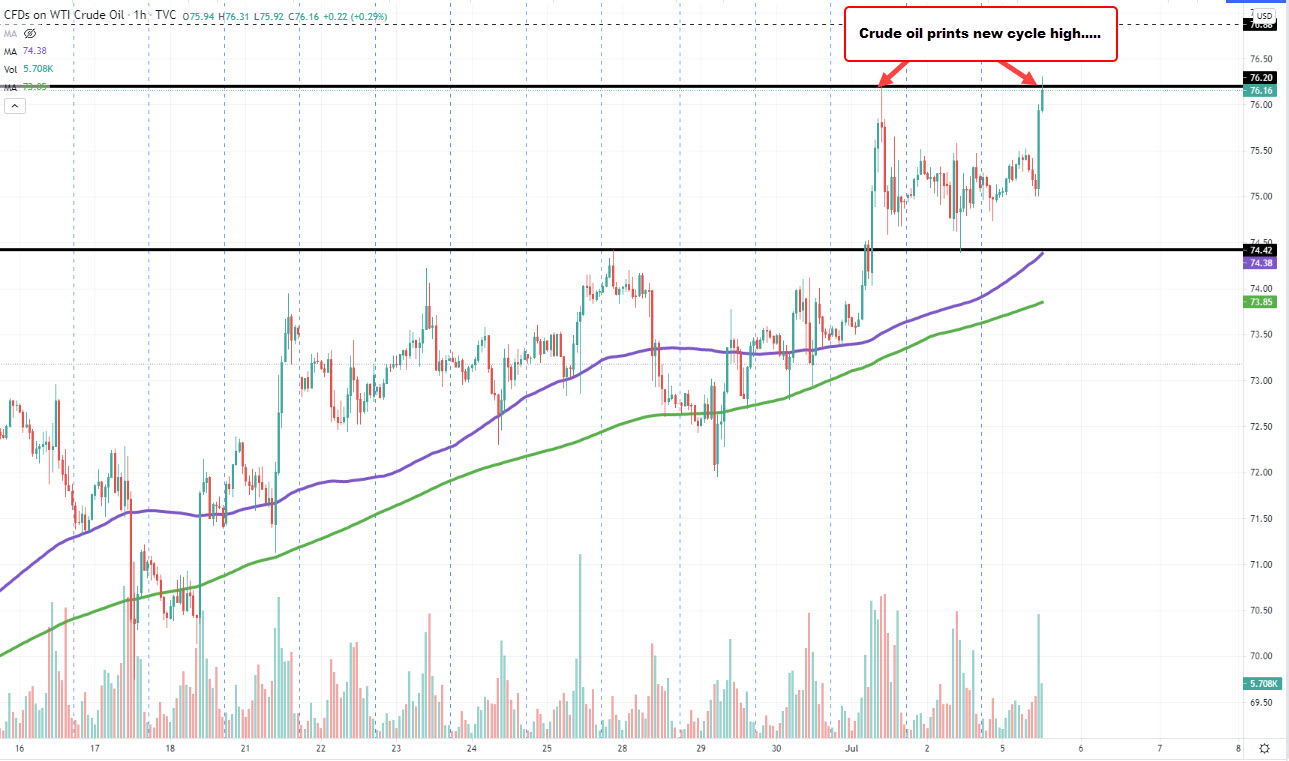

- Preliminary Q3 data suggests that we could see the largest crude oil stock draw in at least a decade

- Possibility of a market share battle by producers, looming over the market

- Oil market to remain volatile until there is clarity on OPEC+ policy

That pretty much sums up the entirety of the oil market landscape but I think the risk pointed out on producers battling for market share is one that cannot be underestimated. The UAE already kicked things off and it may not take too long before others, especially Russia, would want a larger slice of the pie.