Archives of “Crude” category

rssAn Update :#WTI #BRENT Crude #NaturalGas -#AnirudhSethi

To read more enter password and Unlock more engaging content

Oil posts its worst day in three weeks, falling $2

WTI crude oil down $1.99 to $82.66 in the worst fall since Oct 6

There was a report of a 200k bpd outage in Libya today and some other issues in Nigeria but the market didn’t see enough demand in the weekly inventories reports to keep the bid alive for oil.

To be far, a correction is way overdue. Oil has risen for nine straight weeks. Lately there have been impressive late-day bids in the US in oil but that didn’t materialize today. Instead, WTI went into settlement down $1.99 to $82.66.

There have only been a handful of bad days for oil in this run that started Aug 20 and even those days weren’t particularly bad. Technically, though, you can see the momentum waning in the past week or so:

Saudi Aramco warns that spare oil production capacity is shrinking, a “huge concern”

Saudi Aramco is the world’s largest oil exporter, its head spoke in a Bloomberg interview.

- said that “spare capacity is shrinking”, adding that it was a “huge concern”.

- forecast that a pick up in the aviation sector in 2022 could deplete spare capacity

- “It’s now getting to a situation where there’s limited supply — whatever is left that’s spare is declining rapidly.”

OPEC+ next meet on November 4 and so far there is no indication of an increase in supply beyond what is already planned. A tight market is contributing to high prices, these comments from Saudi Aramco indicate that won’t be changing much soon.

Goldman Sachs on oil – see demand rising to 100m bbls/day or more

GS cite as a partial driver a switch from expensive gas to oil.

- Say that’ll drive demand further by at least 1m bbls a day

Putin said OPEC+ countries are increasing oil output a bit more than agreed

Russian President Vladimir Putin said the OPEC+ group of leading oil producers was increasing output slightly more than agreed, but:

- “Not all oil-producing countries are in a position to ramp up production quickly”

Putin also provided some broader background comments, none of this is new but a useful recap if you need:

- “From 2012-2016, investment in oil production totalled around $400 billion/year, and in recent years, even before the pandemic, this decreased by 40%, and now it amounts to $260 billion”

- said that investment cycles for energy projects are 15-30 years

Underinvestment is contributing to the recent rise in prices for oil.

Oil price update:

ING on oil and OPEC – cartel under pressure to pump more but is reluctant

Noting this snippet from an ING note on oil and OPEC.

- Continued strength in oil prices means that pressure on OPEC+ to pump more will only grow.

- Already there are calls from the US, India and Japan for the group to increase output more aggressively

- However, OPEC+ is reluctant to do so, which suggests that oil prices will remain well supported for the remainder of this year

The next 22nd OPEC and non-OPEC Ministerial Meeting (OPEC+) is scheduled for 4 November

Brent crude oil has risen to its highest in three years, above $86/bbl

No let up for the oil price rally. Another fresh high for this cycle.

Meanwhile coal prices in China continue to get smashed. NDRC threats of intervention to tame the surging price seems to have uncovered some supply ….

US weekly oil inventories coming up next

US inventory data coming up next

There are some divergent views on today’s weekly oil inventories report, in part because of a surprise build last week.

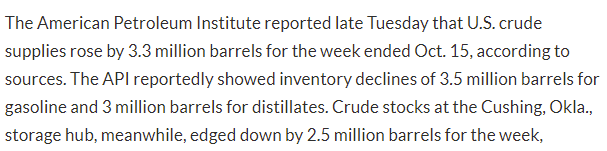

API data released yesterday:

- Crude +3294K

- Gasoline -3500K

- Distillates -3000K

- Cushing -2500K

Consensus today:

- Crude +1857K

- Gasoline -1267K

- Distillates -700K

- Refinery utilization -0.1%

WTI is down 94-cents to $82.02 today.

Private oil survey data shows build in crude oil inventory

Estimates were:

- Crude +1.9m bbls

- Gasoline -1.3m

- Distillate -3m