Modest losses

- S&P closes at 1% below all-time high

- NASDAQ 4% below all-time high

- Dow closes 2% below all-time high

- Dow, S&P on track for a monthly gain

- NASDAQ index on track for a monthly loss

The final numbers are showing:

- S&P index fell -8.94 points or -0.21% at 4188.14. The high price reached 4213.42. The low price extended to 4182.52

- NASDAQ index fell -3.99 points or -0.03% at 13657.18. The high price reached 13751.14. The low extended to 13631.80

- Dow fell -81.52 points or -0.24% at 34312.46. The hi it reached 34511.35. The low extended to 34266.03

Winners in the Dow 30 included:

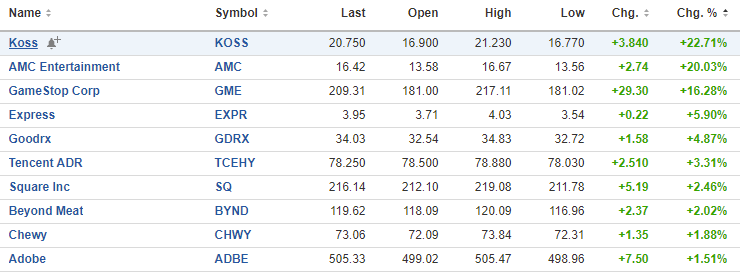

Some other big winners today include:

In the forex, the snapshot of the market currently shows the EUR as the strongest, while the GBP is the weakest. The USD has gained in the NY session and trades near NY session highs vs the EUR, GBP, CHF, CAD, AUD and NZD.

In the forex, the snapshot of the market currently shows the EUR as the strongest, while the GBP is the weakest. The USD has gained in the NY session and trades near NY session highs vs the EUR, GBP, CHF, CAD, AUD and NZD.