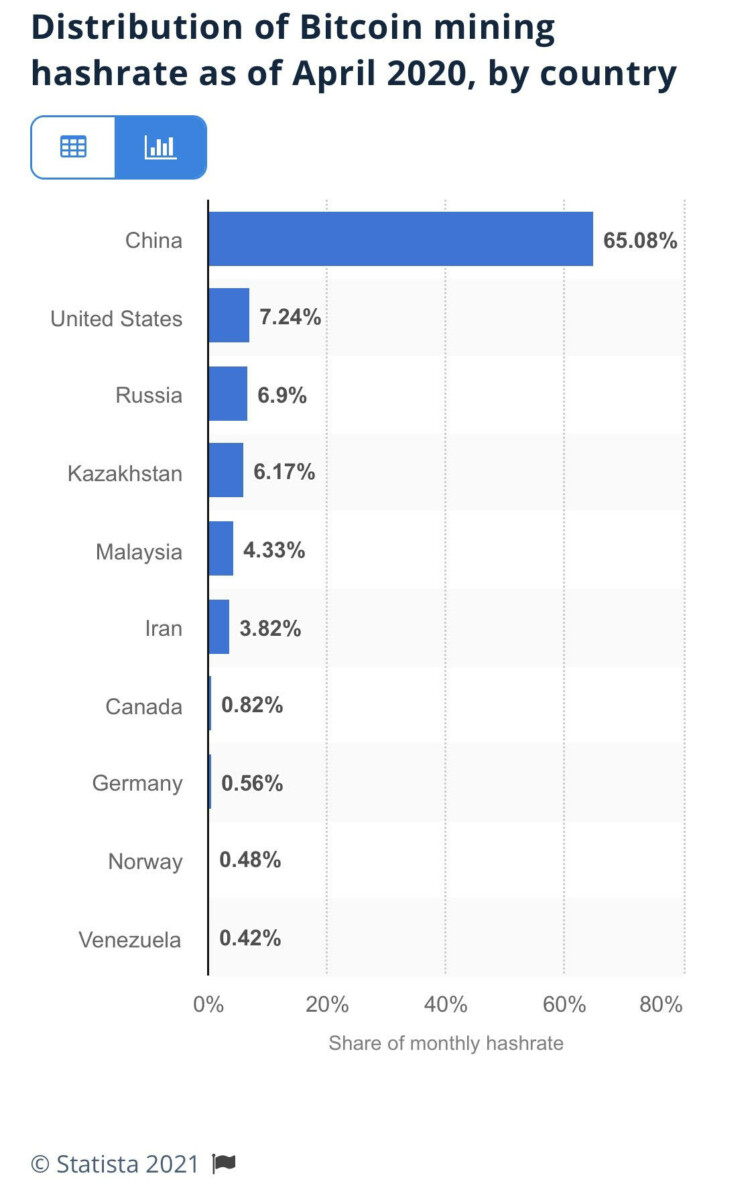

Securities Times on the yuan.

As long as the People’s Bank of China sets a reference rate each day and pledges intervention if the onshore yuan moves plus or minus 2% from it I am calling b/s on this.

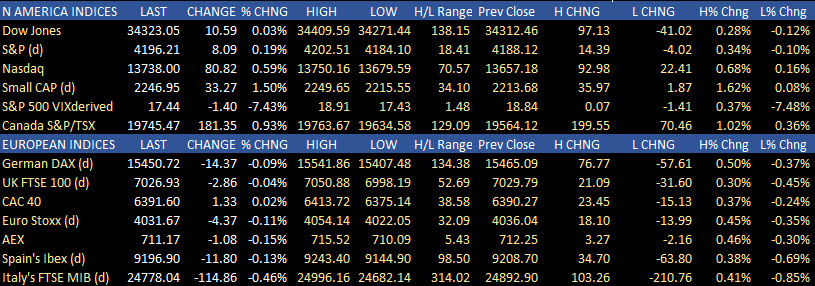

the major US indices are ending the session with mixed results. The Dow 30 is closing lower. The Russell 2000 index up small-cap stocks is closing up around 2%.