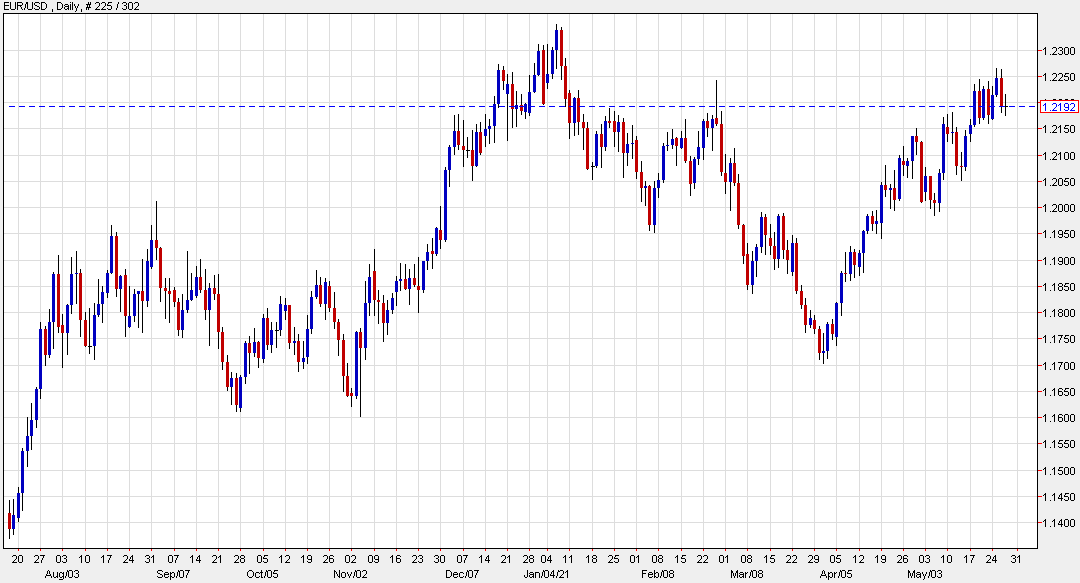

Archives of “May 2021” month

rssEuro could test 1.2350 ahead June 10 ECB – Credit Suisse

EUR/USD is flat at 1.2192 today

Credit Suisse discusses EUR/USD outlook ahead of the ECB June 10 meeting.

“The risk the ECB faces is that, if it takes its eye off the ball as the Fed retains its dovish bias, EURUSD could take out 2021 highs around 1.2350 and push higher into an entirely new, and possibly very uncomfortable, trading range. It’s true that rising euro area inflation expectations and growth prospects likely make the ECB comfortable with EURUSD levels at the top end of the 1.0340 – 1.2555 range that has prevailed since the start of 2015. But we are less confident it would be excited about seeing EURUSD move back towards the average level near 1.3500,” CS notes,

“It is for this reason that, while we have assumed that EURUSD will likely test the top of our expected 1.1950-1.2350 range for the rest of Q2 ahead of the 10 Jun ECB meeting, we have held the view that the ECB will contrive to sound just dovish enough to prevent a material and sustained upside breach,” CS adds.

OPEC+ likely to stick to the existing plan – report

Sources cited by Reuters

Oil has been on the move this hour and is up $0.35 to $66.55. It’s flirted with this area a bunch of times in the past few months but at this level it would be marginally the best closing level since 2018.

I brought the Iran news a short time ago and now there’s this. I don’t think this is market moving because the plan is baked in. OPEC+ meets on Tuesday and the plan is to keep adding oil through July.

The Reuters report mentions Iran’s oil as an x-factor. OPEC has just under 6 mbpd in spare capacity and it’s coming back to the market, the question is how patient they will be.

Yellen says will carefully review sanctions if Iran returns to nuclear agreement

There’s a subtext here that’s important for oil

There’s a sequencing problem in Iran nuclear negotiations.

Iran says that once the US returns to the agreement and lifts sanctions, it will eliminate its nuclear stockpile. The US wants Iran to go first. Negotiators are trying to work out something where they act at the same time.

Yellen seems to be indicating that Iran needs to go first and they say that’s a non-started because it was the US that left the agreement, not them. So the US should come back into compliance first.

I don’t think this is what’s giving the latest lift to oil, which is up 38-cents to $66.60 — which is highest since May 18.

China said to raise limits on offshore borrowing for foreign banks

This will be a slight boost to foreign lenders in the country

It is being reported by Bloomberg that China has expanded limits for smaller lenders and foreign banks to borrow offshore, raising the leverage ration for such funding to 2.0 from 0.8 previously for institutions with less than ¥100 billion capital.

This will be a boost for foreign banks looking to expand investments in the country considering that onshore operations have always been a little regulation-heavy.

Onshore Chinese yuan finishes the day at strongest level against the dollar since May 2018

USD/CNY keeps the break below 6.40

That despite the PBOC fix earlier in the day being above the 6.40 level. While this isn’t quite yet having broader reverberations in the market, it is one to keep an eye out for if the uptrend in the yuan against the dollar continues to run from hereon.

China measures may not be enough to cool soaring commodity prices – CBA

CBA says strong demand would limit China’s ability to cool commodity prices

The firm argues that China’s regulatory measures may not be enough to temper with the mood in commodities because of the strong underlying demand in the economy.

“China is a big economy, it’s a fast-growing economy and uses lots of commodities in doing so. Ultimately, it probably can’t pick the price it wants but it can affect the path of those prices.”

In particular, CBA’s agricultural strategist, Tobin Gorey, says that the firm remains “reasonably bullish” on agricultural commodities in particular as there is a risk for supply to tighten moving forward for corn and soybeans among others.

I reckon there’s not much arguing with that sentiment for now. China’s intervention was a good reason to take some money off the table after the sizzling run in commodities this year but the larger underlying trend hasn’t been derailed surely.

China’s state planner asks state-owned oil companies to report on their use of imported crude

The National Development and Reform Commission of the People’s Republic of China (NDRC)

- companies to report on their use of imported crude oil over the past few years

- NDRC focus on resales and tolling schemes

- The urgent notice issued to Sinopec Group, China National Offshore Oil Corporation (CNOOC), Sinochem Group, ChemChina, and China North Industries Group

Info via Reuters, citing unnamed sources.

—

Hard to not see this as part of China’s current examination of commodity price surges.

China says it supports probe in COVID-19 origins

Statement from China’s Embassy in the US

- says it supports a comprehensive study of all early cases of Covid-19

- it supports ‘thorough investigation into some secretive bases and biological laboratories’ around the world

- says politicizing covid-19 origins will hamper investigations

- says smear campaign and blame shifting are making a comeback

Coronavirus – Australia’s second-largest state, Victoria, sent into a 7-day lockdown

The whole of the state, not just capital city Melbourne (Australia’s 2nd largest city by population) to enter lockdown.

- this is lockup number 4 for Melbourne

- from 11.59pm local time today

5 reasons to leave home in Victoria.

- Food and Supplies

- Authorised Work

- Care and Caregiving

- Exercise (for up to 2 hours and with 1 other person)

- Getting vaccinated.

Victorian authorities have shown themselves once again to be the most incompetent in Australia at managing outbreaks. Federal authorities have a lot to answer for also.

Nore that coronavirus-related Federal government job/wage support has ceased. No safety net this time around for impacted workers (i.e. no pay).

- note also that the vaccination rollout in Australia is at a snail’s pace, one of the slowest in the developed world.

Service industries will once again bear the brunt of the economic costs … business owners and employees.