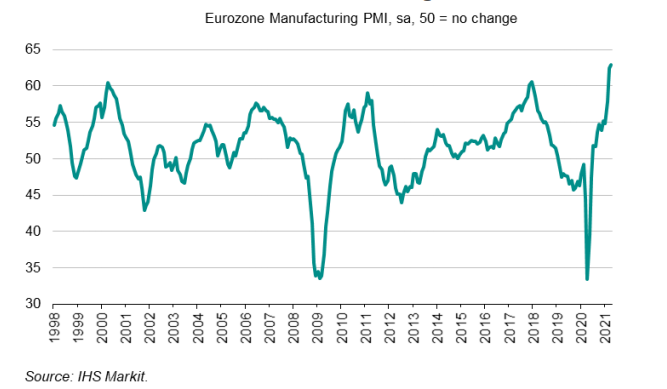

Latest data released by Markit – 3 May 2021

The preliminary report can be found

here. A slightly softer revision but the headline is still a record high reading as the manufacturing sector in the region continues to hold up strongly despite the virus situation and tighter restrictions since Q1.

Output and new orders are holding close to record highs seen in March while input cost inflation is seen ticking higher once again, which should feed back into higher consumer price inflation over the coming months. Markit notes that:

“Eurozone manufacturing is booming, with a new PMI record set for a second month running in April. The past two months have seen output and order books both improve at rates unsurpassed since the survey began in 1997, with surging demand boosted by economies opening up from COVID-19 lockdowns and brightening prospects for the year ahead.

“However, supply constraints are also running at unprecedented levels, leading to a record build-up of uncompleted orders at factories.

“The consequence of demand running ahead of supply is higher prices being charged by manufacturers, which are now also rising at the fastest rate ever recorded by the survey.

“The big uncertainty is how long these upward price pressures will persist for, and the extent to which these higher charges for goods and services will feed-though to consumers.

“Encouragement comes from the sharp increase in employment and investment in machinery and equipment signalled by the survey, which suggests firms are scaling up capacity to meet resurgent demand. This should help bring supply and demand more into line, taking some pressure off prices. But this will inevitably take time.”