Archives of “May 2021” month

rssMore and more S&P 500 companies are exceeding earnings estimates.

“Candles”

Berkshire Hathaway’s stock price is too high, NASDAQ temporarily suspended prices

Warren Buffett is doing something right … the Wall Street Journal report how his firm’s stock price is too high

- Berkshire Hathaway is trading at more than $421,000 per Class A share,

- On Tuesday, Nasdaq Inc. temporarily suspended broadcasting prices for Class A shares of Berkshire over several popular data feeds.

- Nasdaq’s computers can only count so high because of the compact digital format they use for communicating prices. The biggest number they can handle is $429,496.7295. Nasdaq is rushing to finish an upgrade later this month that would fix the problem.

Link here for more, its the Journal so it may be gated.

How long before BTC catches up though? Or Ethereum … or DOGE 😀

Yellen says she has regular meetings with Fed Chair Powell but believes strongly in Fed independence

US Treasury Secretary Yellen says its entirely up to the Fed how they manage monetary policy.

ICYMI Yellen is a past Chair of the Federal Reserve System. Her and Powell are currently on the same page. Let’s see how that changes when the Fed does decide its time to raise rates (which, we are told repeatedly, is not on the near-term horizon).

“Hi Jerry! As a heads up, I shall crush you like a bug if need be …”

“Hi Jerry! As a heads up, I shall crush you like a bug if need be …”More from Yellen – says we don’t have an adequate cryptocurrency regulatory framework

US Treasury Sec Yellen is on fire today.

Its not enough to trash stocks (comments from earlier that sent stocks down):

- Yellen: Rates might have to rise to keep the economy from overheating

Now its crypto’s turn!

US stocks close mixed. Dow industrial average closes higher in late day surge

NASDAQ index was down over 400 points at the lows

the major indices rebounded into the close and settled mixed. The Dow industrial average surged to positive territory at the bell and is closing near the session highs. The NASDAQ and the S&P index remains negative.

A snapshot of the closing levels shows:

- S&P index -27.61 points or -0.66% at 4165.05

- Nasdaq -261.62 pointsor -1.88% at 13633.50

- Dow +22.11 points or +0.06% at 34135.34

- Russell 2000 index -29.18 points or -1.28% at 2248.27

Thought For A Day

Fed’s Kaplan repeats call to “at least start discussing” taper

Kaplan spoke with MarketWatch

Dallas Fed President Kaplan has been busy lately, doing a media tour for his hawkish turn on rates.

Today’s edition is with MarketWatch, where he said something he’s said before:

“I think it will make sense to at least start discussing how we would go about adjusting these purchases and starting having those discussions sooner rather than later,” Kaplan said.

Kapan said he didn’t know if that discussion about tapering would start at the June 15-16 FOMC meeting or later, saying it would be a ‘group decision.’

It’s a good time to be watching Fed Presidents to see if this starts a trend, at least among the hawks. For me though, I think it can be safely ignored until we hear it from a Fed Governor.

Another interesting comment from Kaplan was on inflation and supply-chain bottlenecks. He said business contacts are less confident that it’s transitory.

“A number of them are a little less sure now. The time frame is getting pushed back,” he said.

European shares follow the US stocks lower. German Dax leads the way

German Dax falls -2.5%

The major European indices all fell led by the German Dax which fell 2.5%. The Spain’s Ibex and UK FTSE 100 were positive at the start of the North American session, but has moved solidly into negative territory at the close.

The provisional closes are showing

- German Dax, -2.5%

- Frances CAC, -0.9%

- UK’s FTSE 100, -0.7%

- Spain’s Ibex, -0.7%

- Italy’s footsie MIB, -1.8%

Looking at other markets as European/London traders look to exit:

- S&P index is trading down -60.46 points or -1.45% at 4132.20. The index is making new session lows

- NASDAQ index -398 points or -2.86% at 13497.30. It too is trading at session lows

- Dow is down -273 points or -0.80% at 33841. The low price reached 33765.68.

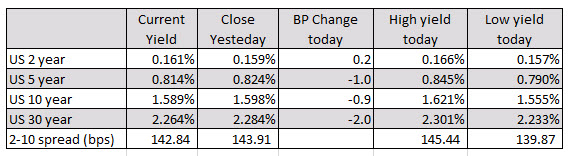

In the US that market, yields are mostly lower with the two-year up 0.2 basis points.

In the European debt market, the benchmark 10 year yields all fell with the Italian yield down -1.1 basis points. The UK 10 year was down -4.6 basis points.