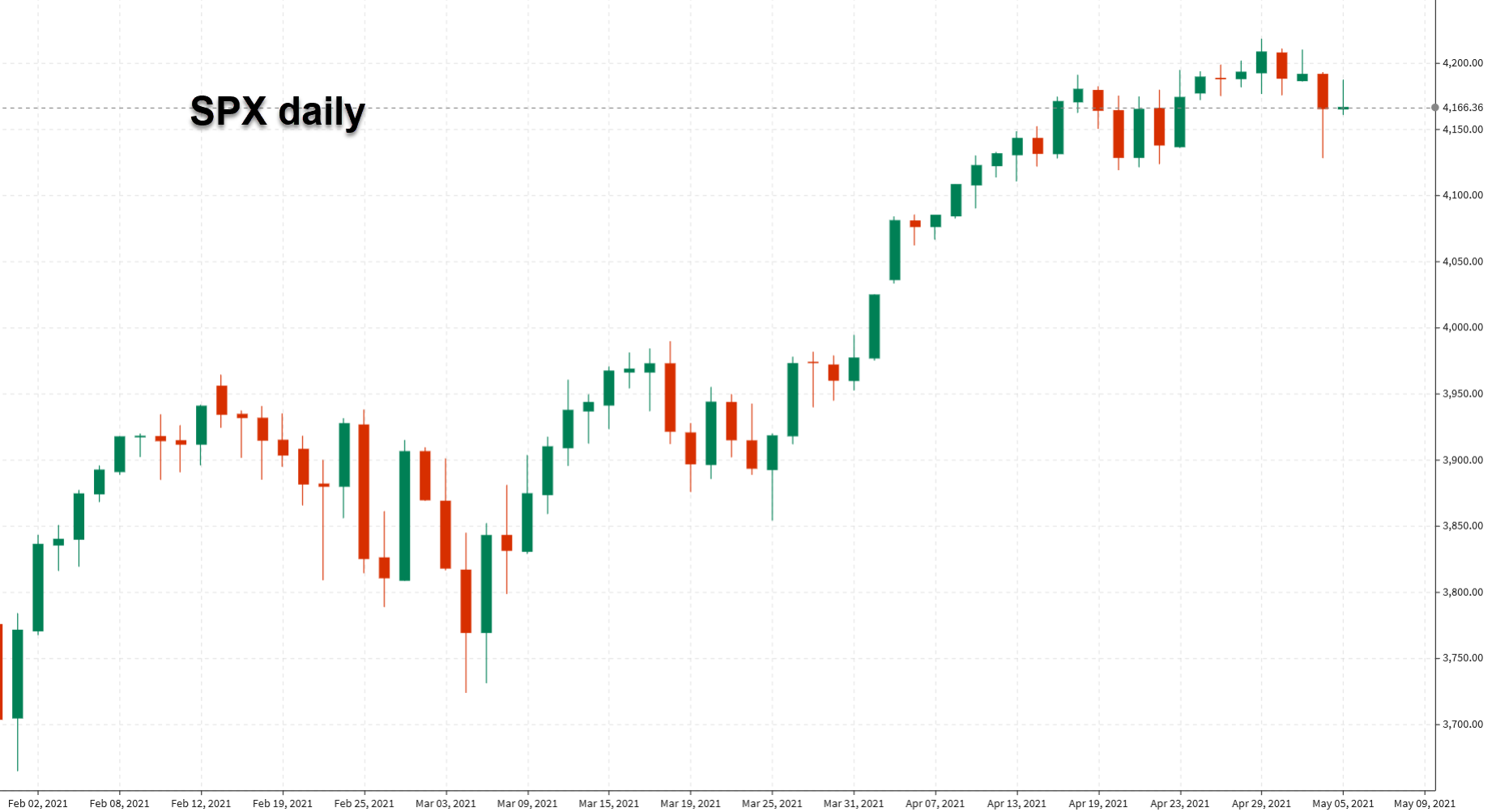

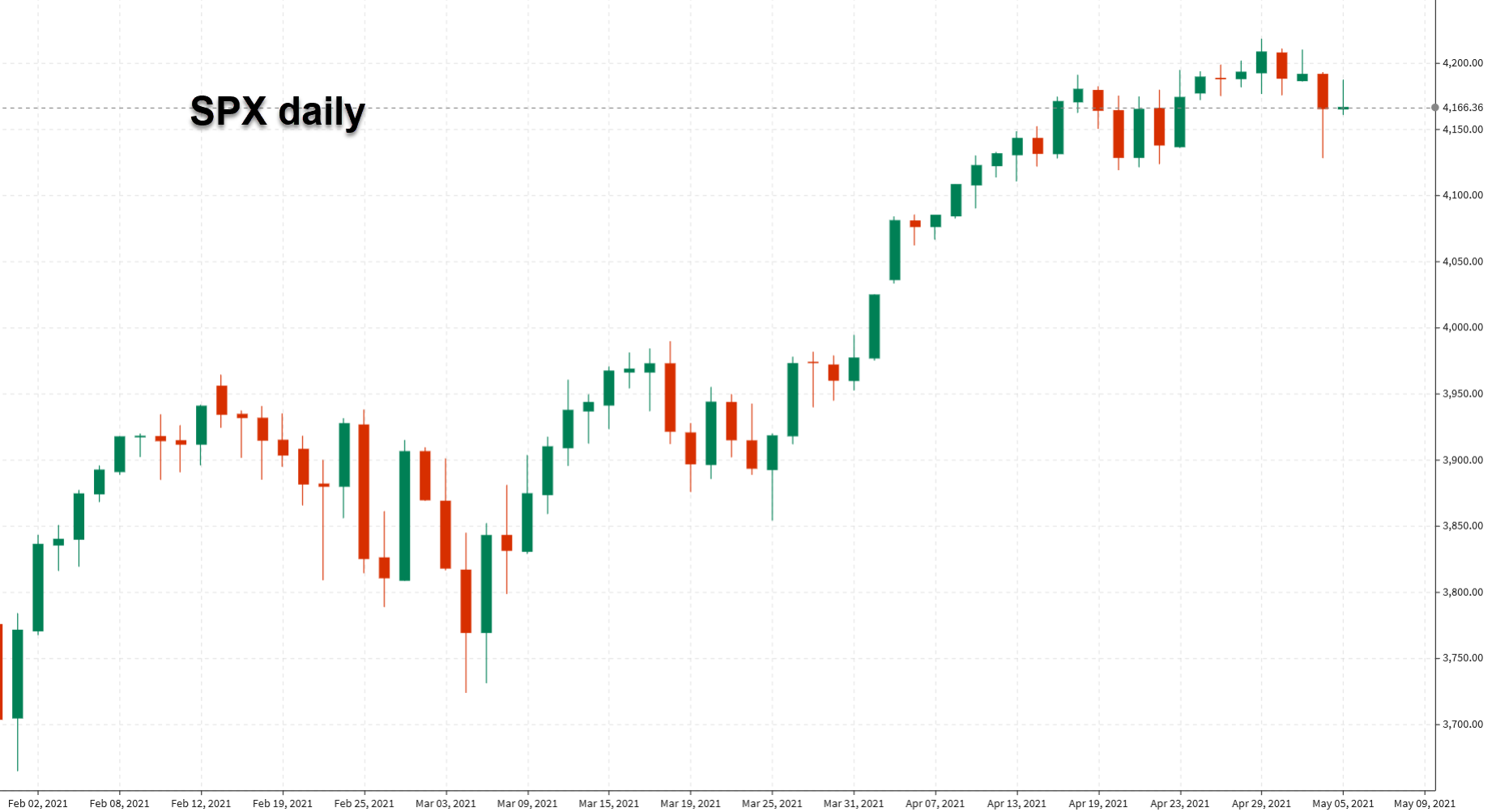

Up and down but unchanged at the end

- S&P 500 +3 points to 4167

- Nasdaq -0.4%

- Dow +0.3%

- Russell 2000 -0.4%

- Toronto TSX +0.6%

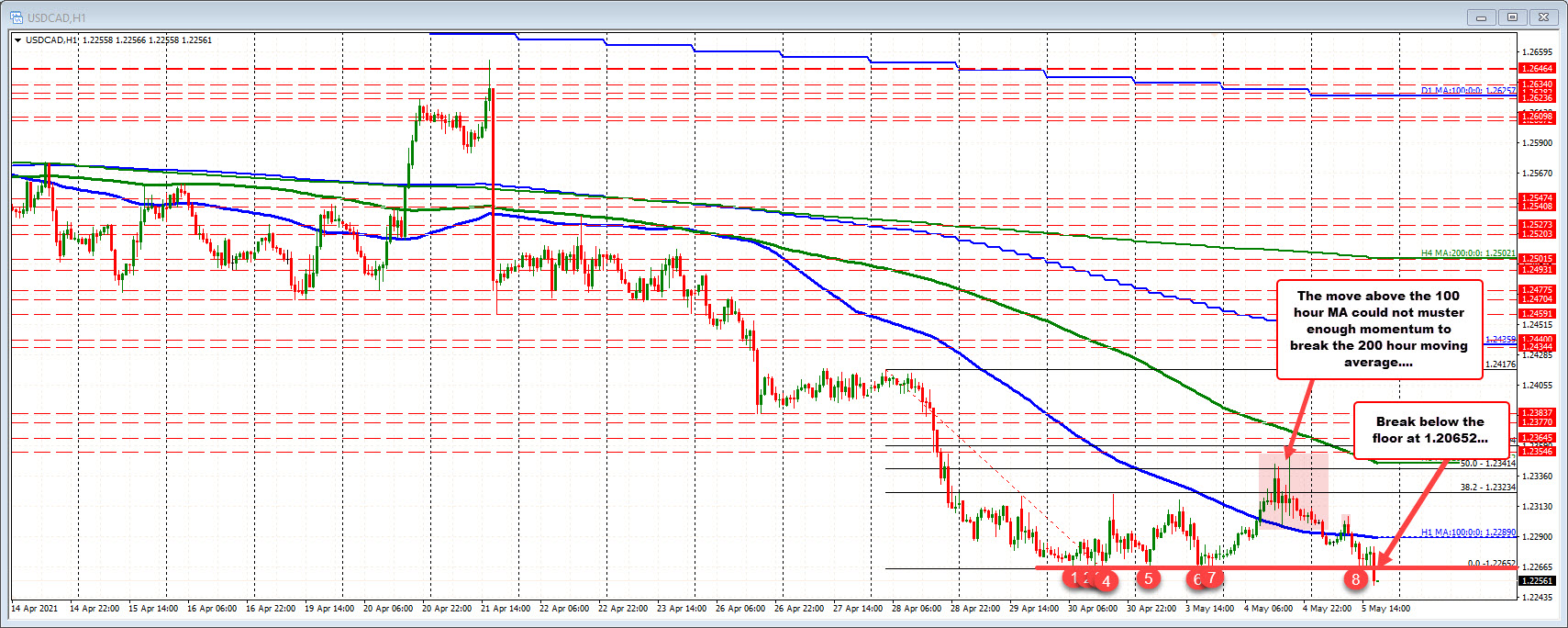

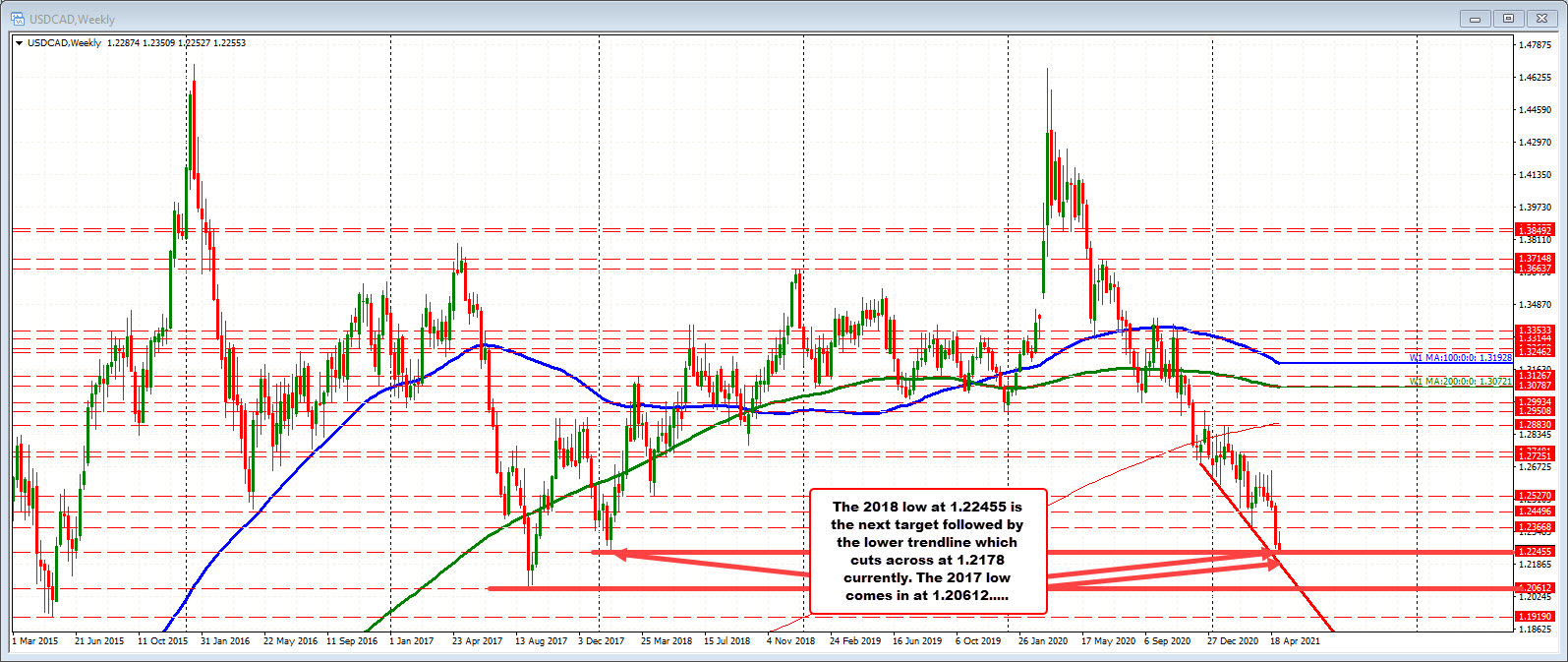

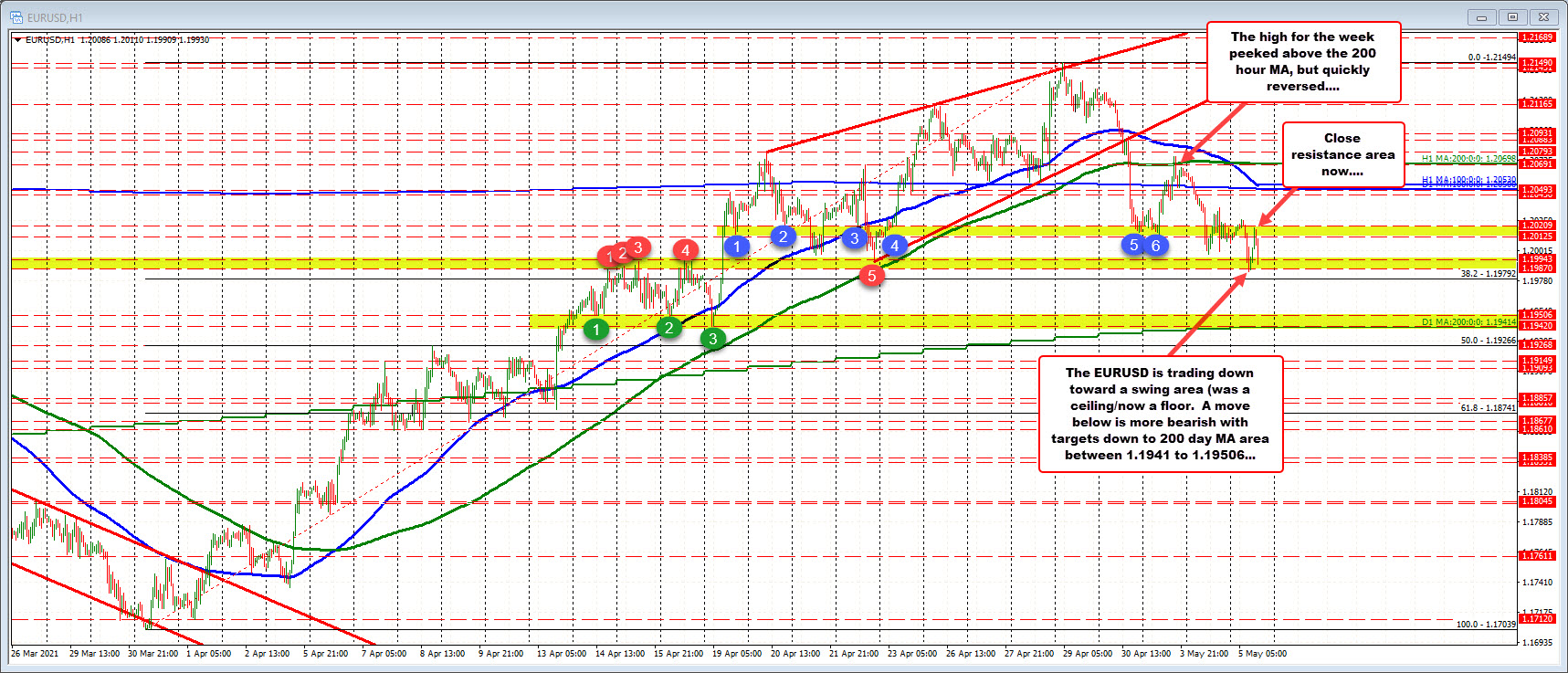

Taking a broader look at the weekly chart, although the price fell below a key floor on the hourly chart, it is also approaching another key level at the 2018 low price of 1.22455. So there is another key target to get to and through. There is more work to do for the sellers.

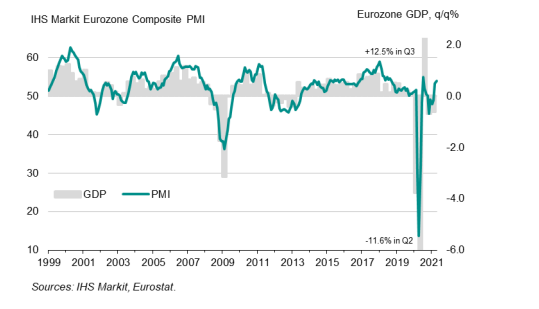

“April’s survey data provide encouraging evidence that the eurozone will pull out of its double-dip recession in the second quarter. A manufacturing boom, fueled by surging demand both in domestic and export markets as many economies emerge from lockdowns, is being accompanied by signs that the service sector has now also returned to growth.

“Barring any further wave of infections from new variants, Covid restrictions should ease further in the coming months, driving a strengthening of service sector business activity which should gain momentum as we go through the summer.

“The intensity of the rebound will naturally depend on the extent to which Covid restrictions can be removed – and some measures relating to international travel are likely to remain in place for some time to come – but experience in other countries hints that the bounce in domestic activity could be strong as pent up demand and savings power a surge in spending.

“While the revival in the economy is bringing a rise in inflationary pressures, these so far seem largely confined to the manufacturing sector, with service sector costs – which form a major component of the core inflation measures tracked by the ECB – remaining only modest.”