Archives of “May 2021” month

rssFrom ‘Secrets For Profiting In Bull And Bear Markets’ – Weinstein 1988

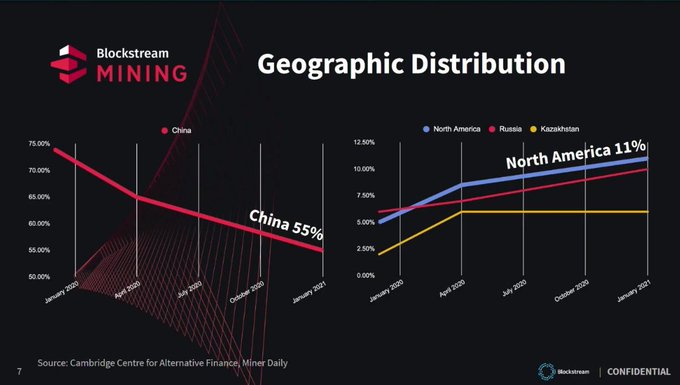

#Bitcoin mining is moving from China to the U.S.

#Bitcoin today vs 2017 price

Two of my favorite books!

Weekly CFTC Commitments of Traders data: Cable gets a bit of love

Weekly futures forex positioning data from the CFTC:

- EUR long 104K vs 100K long last week. Longs increased by 4K

- GBP long 31K vs 25K long last week. Longs increased by 6K

- JPY short 50K vs 51K short last week. Shorts decreased by 1K

- CHF short 1K vs 4K short last week. Shorts decreased by 3K

- AUD short 1K vs 3K long last week. Flipped to short

- NZD long 8K vs 8K long last week. No change

- CAD long 45K vs 44K long last week. Longs decreased by 1K

The pound was the top performer this month in the G10 space and it got a bit of late-month love from speculators as the net position grew to the largest since early March. The high for the year was +36K in March.

The overall net USD short is the largest since late February.

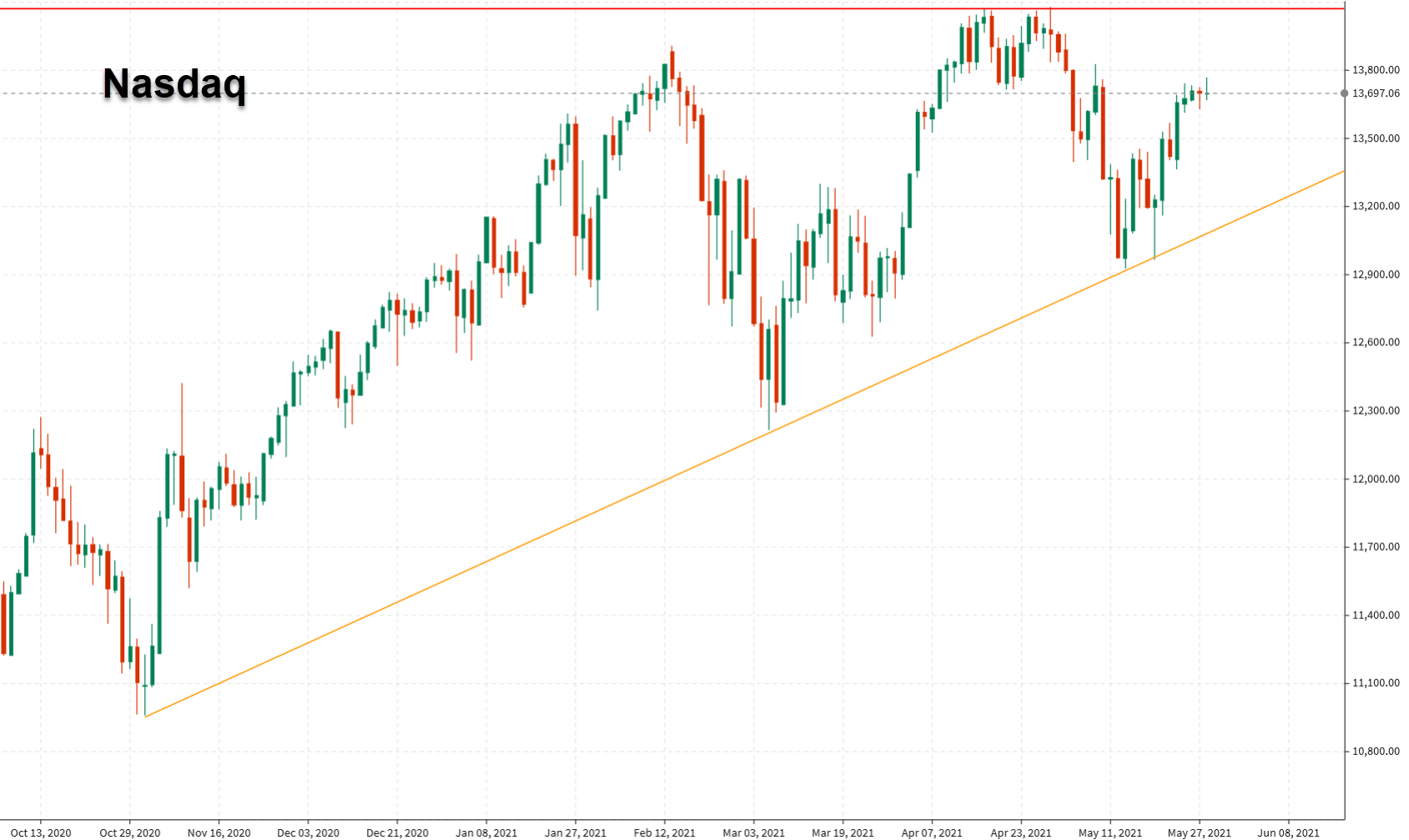

US Indices stumble into the long weekend, giving back most gains

Meme stocks had a big turnaround

Shares of AMC went for a wild ride today in the latest meme stock mania. The company closed Thursday at $26.75 then soared to $36.72 at the open before turning around to finish 1.5% lower at $26.12.

Shares of GME finished 12.6% lower after opening 3% higher as well.

The selling in meme stocks and the overall market accelerated late ahead of the US month end and a long weekend that will keep markets closed through Monday.

On the day:

- SPX up 3 points to 4204 (high of 4218) +0.1%

- DJIA +0.2%

- Nasdaq +0.1%

- Russell 2000 -0.2%

- Toronto TSX +0.4% (new record)

On the week:

- SPX +1.2%

- DJIA +0.9%

- Nasdaq +2.0%

- Russell 2000 +2.4%

- Toronto TSX +1.6%

On the month:

- SPX +0.6%

- DJIA +1.9%

- Nasdaq -1.5%

- Russell 2000 +0.1%

- Toronto TSX +4.1%

The chart of the Nasdaq above is an interesting one. The drama for the year certainly isn’t over because that’s eventually going to break in one direction or the other. Lately, it’s shown it can handle a bit of taper talk and that’s a positive.

Thought For A Day

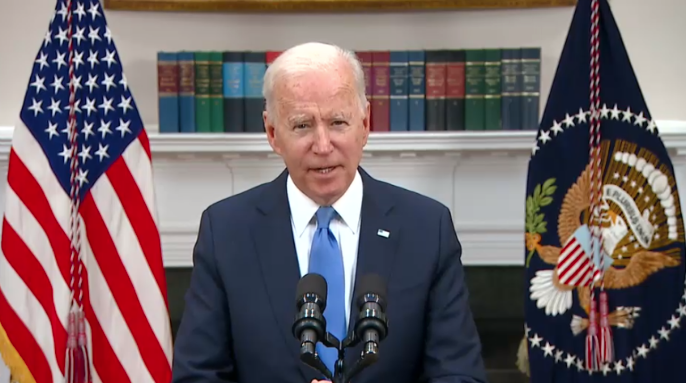

Biden budget forecasts 10-year deficit of $14.531 trillion

Highlights of the White House budget plan

Note that all these plans need to get through Congress, which means that they’ll be fundamentally different.

- FY 2021 deficit forecast at $3.669T

- 2022 at -$1.837T

- 2023 at -$1.372T

- Calls for 16.5% increase in revenue over 2021 (those are taxes)

- Sees public debt at 117% of GDP by 2031

- Sees 5.2% GDP growth this year, 4.3% in 2022, 2.2% in 2023

- Sees CPI at 2.1% in 2021, 2.1% in 2022 and 2.2% in 2023

- Sees US jobless rate averaging 5.5% in 2021 vs 4.1% in 2022 and 3.8% in 2023

Those GDP forecasts are for the fiscal year so they look different than private economists’ numbers. In any case, those look to be conservative to me.

All the pertinent details from this budget leaked in the past couple days.

Baker Hughes US oil rig count 359 vs 356 prior

US weekly oil rig data

- Prior was 356

- Gas rigs down 1 to 98

WTI crude is up 12 cents to $66.97 today after rising as high as $67.52. Brent remains just below $70.0.