Archives of “May 2021” month

rssDollar mixed, US futures steady so far on the session

Little change in the major currencies space

It is all about the US non-farm payrolls report today as the market feels rather lethargic at the moment. The dollar is trading more mixed, holding a slight advance against the commodity currencies while trailing behind the euro and pound.

That said, changes are relatively minor with EUR/USD keeping around 1.2080-90 after ECB policymaker Kazaks talked up scaling back PEPP purchases.

European stocks are faring well, keeping a modest advance, but US futures are not doing a whole lot as they keep steady and little changed on the session.

S&P 500 futures are up 0.1%, holding thereabouts since Asia Pacific trading. Meanwhile, 10-year Treasury yields are flat on the day at 1.57% and that isn’t giving traders much to work with during European morning trade.

Tick tock. Tick tock. The payrolls data can’t come soon enough.

Global tapering has begun – BofA

BofA notes that gold funds attracted its largest inflow in three months in the week to Wednesday but warns of the outlook

Citing EPFR data, BofA highlights that gold funds garnered $1.6 billion in the week to Wednesday, the largest inflow in three months. However, the firm warns that “the bad news is global tapering has begun”.

As such, that could see bond/real yields start to march higher eventually and weigh on gold as well. Adding that the stronger the macro environment is in Q2/Q3, the quicker and bigger the taper will be from major central banks.

This not just only applies to gold if you consider the context. Obviously, the Fed is the key one to watch here and if they start to move towards that direction later in the year, it will also present a world of hurt for risk assets in general.

That said, if the Fed doesn’t “go with the plan” and sticks to its guns as we approach Jackson Hole in August, perhaps bond markets will have some rethinking to do.

China April exports +32.3% y/y (US dollar terms)

China trade balance data for April 2021, surplus of 276.5bn yuan

Exports

- +32.3% y/y in USD terms

- +22.2% y/y in yuan terms

Imports

- +43.1% y/y in USD terms

- +32.2% y/y in yuan terms

China’s exports to the US +49.3% (yuan terms).

Do note that April 2020 was a tough month for China, the COVID-19 outbreak impacting. This has led to very strong y/y figures (base effects). Nevertheless, still great numbers.

CNH – offshore yuan at its strongest since late February

There is no stopping the yuan, the PBOC set the reference rate for onshore (CNY) stronger again today.

CNH is gaining further during Friday trade hitting his (ie lows for USD/CNH) not seen since late Feb. USD softness is one factor, the Fed continues to insist it will not be tightening for a good while to come (despite some concerns raised in its stability report out earlier in this season)

USD/CNH:

Interesting definition. From ‘The Sophisticated Investor’ – Burton Crane 1959.

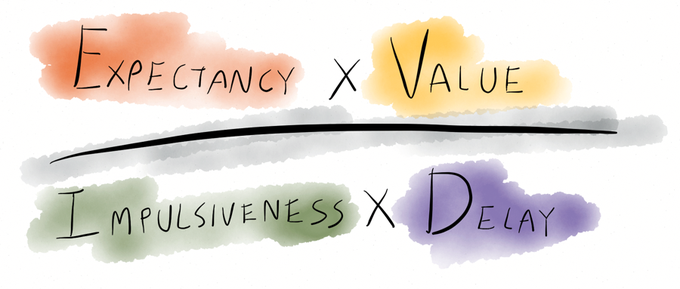

Here’s the formula to increase your motivation.

PBOC sets USD/ CNY central rate at 6.4678

The People’s Bank of China sets the onshore yuan (CNY) reference rate for the trading session ahead.

- USD/CNY is permitted to trade plus or minus 2% from this daily reference rate.

- CNH is the offshore yuan. USD/CNH has no restrictions on its trading range.

- Reuters estimate from their survey was 6.4685, Bloomberg 6.4651 …. (A rate that’s significantly stronger or weaker than expected is typically considered a signal from the PBOC)