Archives of “May 2021” month

rssThe power of the FAAMG.

Major earnings releases next week

A number of newer issues will be reporting

next week as a number of newer issues reporting. Along with some old standbys including Marriott, Toyota, Wendy’s, Disney, and Honda.

Below is a day by day summary of the major releases:

Monday:

- Marriott

- Tyson Foods

- Roblox

Tuesday

- EA

- Nissan

- Lemonade

- Palantir

Wednesday

- Toyota

- Softbank

- Wendy’s

- Bumble

Thursday

- Disney

- Alibaba

- AirBNB

- Coinbase

- Doordash

Friday

- Honda

CFTC commitments of traders: The loonie longs increased by 10K in the current week

Weekly forex futures positioning data from the CFTC for the week ending May 4, 2021

- EUR long 85K vs 81K long last week. Longs increased by 4K

- GBP long 20K vs 29K long last week. Longs trimmed by 9K

- JPY short 41K vs 49K short last week. Shorts trimmed by 8K

- CHF square vs 1K short last week. Shorts decreased by 1K

- AUD long 1K vs 1K short last week. Longs increased by 2K

- NZD long 9K vs 7K long last week. Longs increased by 2K

- CAD long 26K vs 16K long last week. Longs increased by 10K

Highlights:

- The CAD longs increased by 10K as the loonie moves to new highs going back to 2017.

- The largest position remains the largest of the positions.

- The JPY is the largest and only short but it’s position was trimmed by 8K this week.

- The CHF and AUD are near square.

Dow and S&P close at record levels

Major indices all close higher

The major US indices are closed higher. The gains were led by the NASDAQ index. The S&P and Dow industrial average both closed at record levels.

The final closing levels are showing:

- S&P index up 30.81 points or +0.73% at 4232.42 . The high for the day reached 4238.04. The low was that 4201. 64

- NASDAQ index closed up 119.4 points or 0.88% at 13752.24. The high for the day reached 13828.62. The low reached 13690.75

- Dow Rose 228.9 points or 0.66% at 34777.43. It’s high reached 34811.39. The low reached 34464.31.

- The Russell 2000 index rose by 30.21 points or 1.35% at 2271.

For the trading week, the NASDAQ index declined while the Dow and S&P both rose.

- S&P index rose 1.23%

- NASDAQ index fell -1.51%

- Dow industrial average rose 2.67%

The biggest gainer of the Dow 30 this week was DuPont which rose by 7.43%. Other leaders this week included:

- Chevron, +6.74%

- Goldman Sachs, +6.41%

- Amgen +6.03%

- Caterpillar, +5.65%

- Merck, +5.25%

- Cisco, +4.91%

- JPMorgan, +4.83%

Losers in the Dow this week included:

- Salesforce, -6.0%

- Apple, -0.96%

- Visa, -0.6%

- Disney, -0.59%

- McDonalds, -0.51%

Thought For A Day

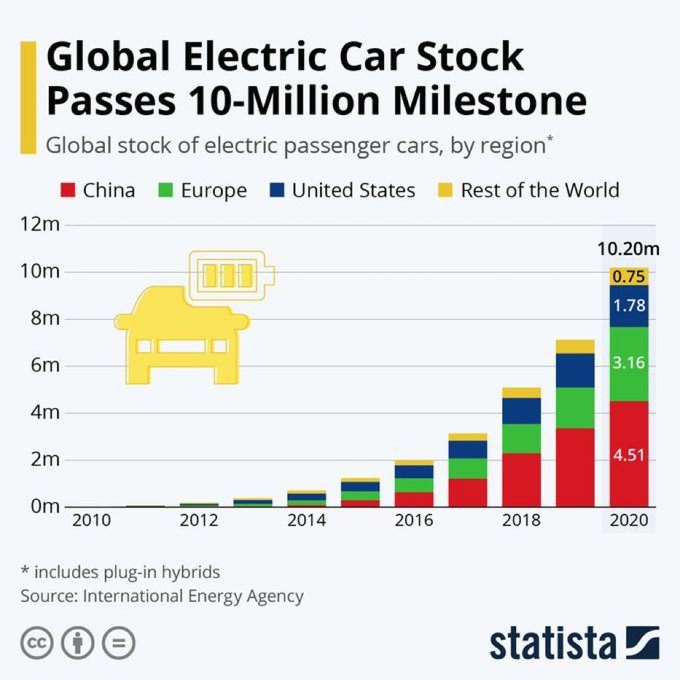

More than 10,000,000 #ElectricVehicles worldwide!

European shares close higher. France’s CAC trades closes at a new high going back to 2000

Solid week for the major indices as well

The European shares a closing higher with the German DAX rising 1.2% leading the way. The major indices also closed higher for the week.

A look at the provisional closes shows:

- German DAX, +1.2%

- France’s CAC +0.3%

- UK’s FTSE 100, +0.7%

- Spain’s Ibex, +0.8%

- Italy’s FTSE MIB, +0.35%

For the week, the major indices also are ending higher on the week

- German DAX, +1.6%

- France’s CAC, +1.65%

- UK FTSE 100, +2.3%

- Spain’s Ibex, +2.6%

- Italy’s FTSE MIB +1.8%

The CAC index is closing at the highest level since October 2020.

Iran nuclear talks will continue this weekend and they’re a big risk for oil

A deal is a risk for oil

There are positive indications on an Iran nuclear deal, something that could add 2 million barrels per day to global oil supply.

A fourth round of negotiations began today in Vienna and both sides sound optimistic.

Here’s what a senior State Dept official said in a media briefing yesterday:

Let me just start by saying that there’s been a lot of reporting about whether this is the final round, whether this is the decisive one, whether a deal needs to be reached in the coming weeks. And I would simply say that we feel that the last three rounds have helped to crystallize the choices that need to be made to – by Iran and by the United States in order to come back into a compliance-for-compliance return – well, returning to mutual compliance with the JCPOA. We think that those – that it’s a pretty clear set of choices that needs to be made, because we’re not inventing something new. It is written in the JCPOA. And if Iran makes the political decision that it genuinely wants to return to the JCPOA as the JCPOA was negotiated, then it could be done relatively quickly and implementation could be relatively swift.

It seems to me that the old nuclear agreement is on the table. Iran took that deal before and so I don’t know why they wouldn’t take it again.

The official said that from the US side, there is no hesitation: