More platinum demand?

This is one area to watch/investigate further that I cam across this week and wanted to bring to readers attention. Some of the research I read is quite hard to actually extract the significant information from, so here is a potted summary of the main points:

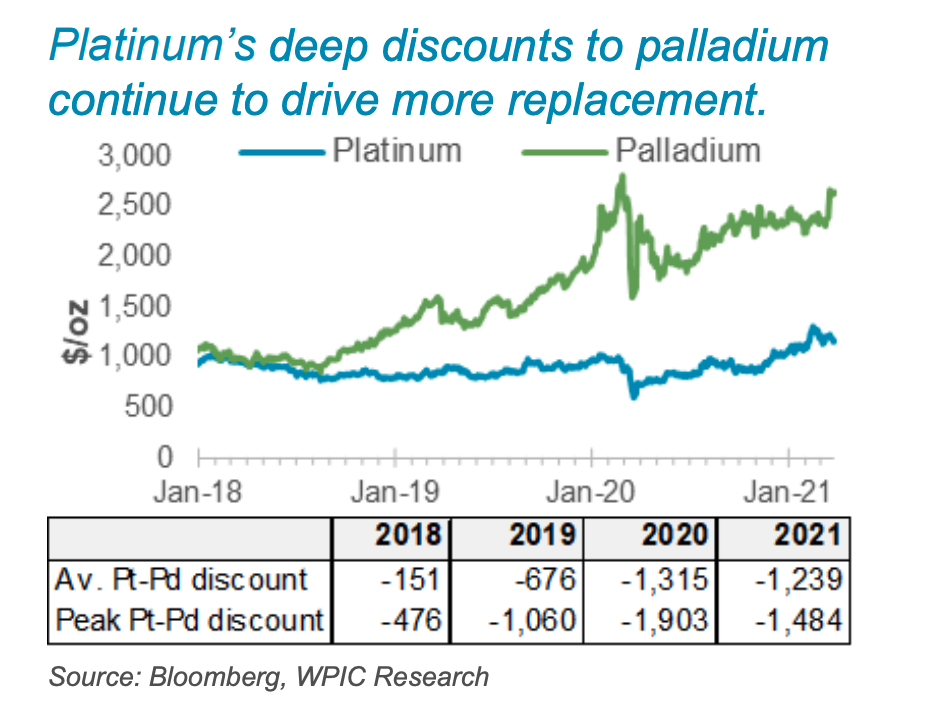

- Platinum is discounted in price compared to Palladium. See the chart below and notice how from 2018 the price of Palladium went soaring higher, while Platinum moved flat to sideways.

- Since 2016 car makers have been in discussion about replacing Palladium with Platinum. This was due to Palladium shortage and not Platinum prices. See here.

- Fabricators expect platinum demand to increase from c.150koz this year to c1.5moz in 2025.

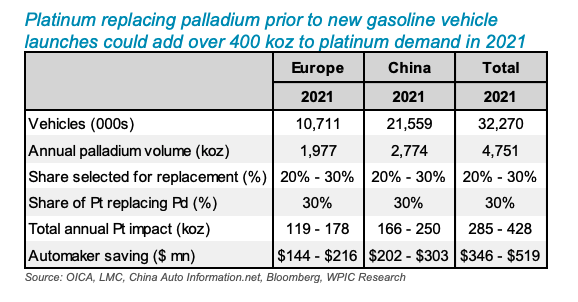

- In Europe and China new lower emission levels have to be met by a specific data so all car models to be sold in Europe and China in 2021 had their emissions systems redeveloped over the preceding three years. This means that Platinum could already be used in place of palladium. This could add as much as 400koz to platinum demand in 2021

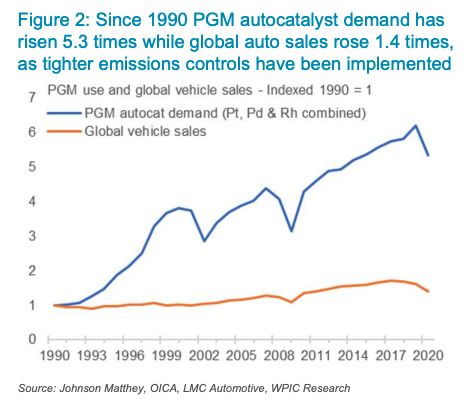

- The drive for better emission levels means that more active metal is needed to work it’s purpose. This means that more platinum will be needed in each catalytic converter, so demand would only grow in order to meet higher emission standards. Look at the chart below to see how the combined demand for Platinum, Palladium and Rhodium is growing

See here and here for some more detail on the above points from the World Platinum Investment Council. The caveat is that the group’s purpose is to stimulate Platinum investment, but facts are facts so don’t dismiss the research out of hand.