Archives of “May 2021” month

rsscopper/gold ratio… clock’s ticking…

CFTC commitments of traders: USD shorts increase led by CAD longs

Weekly forex futures positioning data from the CFTC for the week ending May 11, 2021.

- EUR long 94K vs 85K long last week. Longs increased by 9K

- GBP long 28K vs 20K long last week. Longs increased by 8K

- JPY short 42K vs 41K short last week. Shorts increased by 1K

- CHF short 3K vs 0K short last week. Shorts increased by 3K

- AUD long 2K vs 1K long last week. Longs increased by 1K

- NZD long 9K vs 9K long last week. Longs unchanged

- CAD long 39K vs 26K long last week. Longs increased by 13K

Highlights:

- CAD longs continue to get larger and is now the 3rd largest position

- EUR longs have moved higher for 2 consecutive week

- CHF went from square to modestly short (by 3K)

- GBP longs increased

- A net change of +27K in currencies or -27K USD

The major US indices close higher for the 2nd consecutive day

Stocks close near session highs

The major US stock indices are close higher for the second consecutive day.

Some other highlights for the day/week

- Week ends with 2 strong days higher after three down days to start the week

- S&P has best day since late March 26th

- All 11 sectors of the S&P close higher

- Dow S&P NASDAQ had the worst week since February

- NASDAQ closed lower for the fourth consecutive week

- S&P lower for the first week in three weeks

- NASDAQ has the best day since March 11

the final numbers are showing:

- S&P index up 61.29 points or 1.49% at 4173.85

- NASDAQ index up 304.99 points or 2.32% at 13429.98

- Dow industrial average of 360.62 points or 1.06% at 34382.13

Technically,

- The NASDAQ index moved above intraday but is closing below its 100 day moving average of 13438.56.

- The S&P index closed just above its 100 hour moving average at 4173.67. The closing level for the S&P was at 4173.85

- The Dow moved back above its highest hourly moving average (the 50 hour MA) at 34358.48. The index is closing at 34382.13.

For the week:

- S&P index fell -1.39%

- Dow fell -1.14%

- Nasdaq fell -2.34%

some of the biggest winners today included:

- Doordash, +22.16%

- Snowflake, +11.47%

- Goodrx, +9.59%

- Palantir, +9.31%

- Novavax, +8.83%

- Western Digital, +8.29%

- Bed, Bath and beyond, +7.68%

- Nio, +7.11%

- Uber +6.59%

- Zoom, +6.12%

Some of the biggest movers this week:

- Doordash, +12.96%

- Box, +10.16%

- Koss, +8.89%

- FireEye +6.42%

- Roblox, +4.42%

- Zoom +4.29%

- Intuit, +4.05%

- Gilead, +3.01%

- Schlumberger +2.88%

- Charles Schwab, +2.06%

Looking at the Dow 30, the biggest winners for the week include:

- Procter & Gamble, +2.11%

- JPMorgan +1.71%

- J&J, +1.0%

- 3M, +0.63%

- DuPont, +0.58%

- Caterpillar, +0.56%

- Salesforce, +0.54%

- Bank of America, +0.4%

- Coca-Cola, +0.37%

- Walgreens, +0.35%

The biggest losers in the Dow this week include:

- Walt Disney, -6.02%

- Home Depot, -4.54%

- Intel, -4.06%

- Boeing, -2.99%

- Visa, -2.21%

- Apple, -2.17%

- UnitedHealth, -1.93%

- Microsoft, -1.72%

- Nike, -1.36%

- McDonalds, -1.32%

- Amgen, -1.11%

Thought For A Day

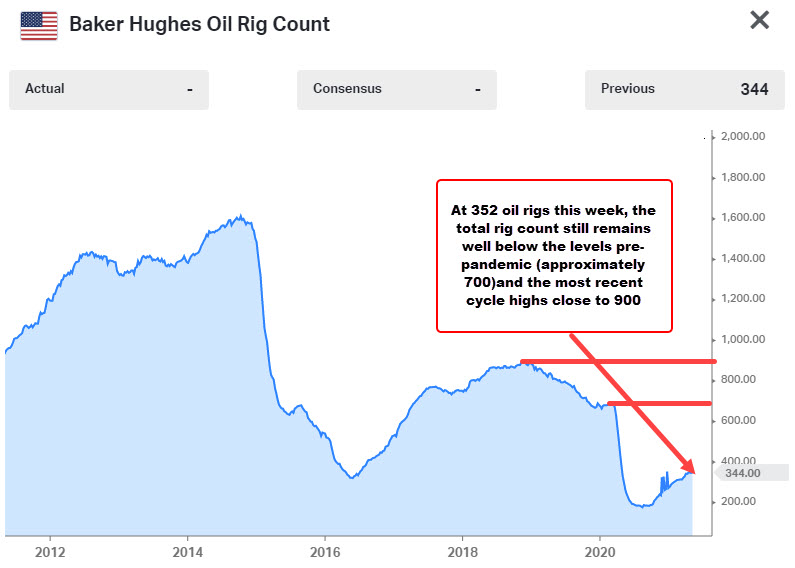

Baker Hughes oil rig count 352 versus 344 last week

Baker Hughes rig count for the week of May 14

- Oil rigs 352 versus 344 last week

- Gas rigs 100 versus 103 last week

- Total rigs 453 vs 448 last week

The price of crude oil before the report was at $65.31.

The current price is at $65.32

Dollar a little on the backfoot to start the session

EUR/USD trades back above the 1.2100 level

The greenback is slightly on the backfoot as we get things going in European morning trade, as major currencies look to stretch the ranges for the day.

Of note, EUR/USD is moving back up above 1.2100 to 1.2110 now though there is still some near-term resistance from the 100-hour moving average @ 1.2118.

As price action rests in between the key hourly moving averages, the near-term bias holds more neutral for the time being.

Likewise, cable is seeing a similar price action play as the spot price holds in between the key hourly moving averages @ 1.4003 and 1.4094.

Commodity currencies are also posting a slight advance against the greenback but nothing too overwhelming so far to start the session.

The risk mood is keeping rather firm with European indices opening with solid gains, as US futures are also marked higher. S&P 500 futures are up 0.6%.

Thursday US news – Cryptocurrency exchange Binance is under investigation

At this stage its an investigation only, the exchange has not been accused of wrongdoing:

- money laundering

- tax offences

An Achilles heel for the acceptance of crypto generally is its role in facilitating criminal activity payments. Indeed, it appears Colonial Pipeline paid hackers circa $5m in crypto re the network failure this week. Crypto defenders point out that plenty of fiat currency is used in criminal activities also. Which is true.

BTC update:

European Central Bank jawboning if EUR/USD heads above 1.2200

That’s the expectation from Westpac.

- EUR/USD looks set to breach its recent range (1.17-1.22) resistance

- ECB officials are likely to voice concern in order to dampen moves above 1.22

Further from WPAC:

- EU quarterly economic forecasts … lifts in growth for both 2021 and 2022 from their Winter profile (4.2% from 3.7% and 4.4% from 3.7% respectively).

- The uplift is due to the now successful regional covid vaccine rollout and expectations for easing of the majority of COVID-19restrictions during H2 2021.

- ECB officials have also stressed the flexibility of PEPP purchases, the pace of which was increased into the current quarter and now looks set to slow into mid-year as full ratification of the Recovery Fund appears imminent, given the EC summits

—-

Meanwhile, EUR/USD is not doing much at all during the timezone here, awaiting the US retails sales data Friday it would seem.

US Major indices snap three days losing streak

NASDAQ still 7% below the all-time high

NASDAQ still 7% below the all-time high

The major indices snapped there three days losing streak. However,

- The Dow, S&P are on track for the worst week since late January.

- The NASDAQ is on track for its worst week since February 26

- The NASDAQ is still 7% below its all-time high

On a positive note Dow has the best day since March 26

The final numbers are showing:

- S&P index rose 49.45 points or 1.22% at 4112.49. The high reached 4132. The low price extended 24079.80. At the high the index was up 1.7%

- NASDAQ index rose 93.31 points or 0.72% at 13124.99. The high reached 13247.87. The low extended to 13007.24. At the high the index was up 1.66%. The index did turn negative and traded down -0.19% at it’s lows

- Dow industrial average closed up 433.79 points or 1.29% at 34021.45. It’s high reached 34181.77. The low reached 33623.49. At the low, the Dow industrial average was up 0.11%. At the high the index reached 1.77%.

After the close Disney is reporting higher earnings but missing on the revenues and Disney+ subscribers. As a result the price has moved sharply lower and trades down around 4% in after-hours trading.

AirBNB is also trading lower by around 5% in after-hours trading as markets react negatively to their earnings report.

NASDAQ still 7% below the all-time high

NASDAQ still 7% below the all-time high