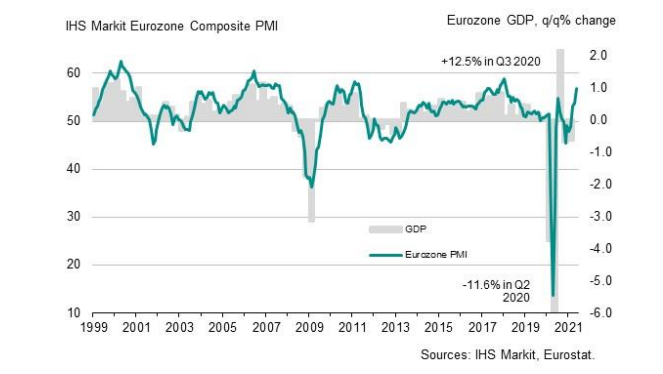

Latest data released by Markit/CIPS – 21 May 2021

- Prior 61.0

- Manufacturing PMI 66.1 vs 60.8 expected

- Prior 60.9

- Composite PMI 62.0 vs 61.9 expected

- Prior 60.7

Despite a bit of a miss on the headline estimate, this is still a strong report with overall business activity expanding at its quickest pace on record – reflecting strong growth in both services and manufacturing activity as the UK reopening gathers pace.

Pent-up demand is the obvious driver here although strong price pressures are still a downside to note in this report, much like everywhere else at the moment.