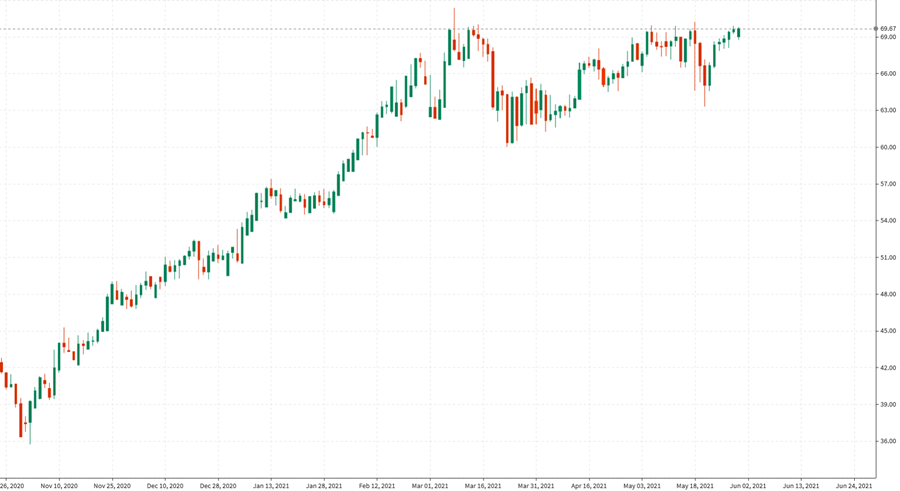

Big week for oil. Brent up 95-cents to $69.68

Meetings between Iran and the world powers are ongoing in what Russian officials called the ‘final round’ of talks. They aim to reach a deal that will lift sanctions and allow Iran to resume pumping at a full pace.

Tomorrow, OPEC+ will also meet to discuss production quotas. They’re fully expected to rubber stamp an earlier agreement on July quotas but there will be talks about what to do afterwards.

A hint today came from OPEC’s JMMC monitoring group, which said the inventory overhang will be mostly gone by the end of June and will fall at 1.4 mbpd in 2021 if production is held steady after July. That’s a chance from their 1.2 mbpd forecast previously.

Of course, those numbers could change dramatically if Iran begins to ramp up. They have at least 500kbpd ready to pump now and could add another 500kbpd before year end.

On the pricing side, the brent chart is the one to watch as it flirts with $70 again. That’s seen as a level where OPEC might be persuaded to pump additional barrels or where discipline at the cartel could break down.

On the technical side though, we keep knocking on this door. Two weeks ago there was some selling on Iran headlines and I have to think that’s largely priced in now. If OPEC stays the course, this is the week we might finally get a break but it’s a delicate balance.