Archives of “May 21, 2021” day

rssLast 52 Weeks

S&P Real Earnings Yield hits 40 year low

S&P 500 vs Negative Real Earnings Yield

European indices end the day mostly higher

UK FTSE 100 lower on the week

The European major indices are ending the day mostly higher. The snapshot of the provisional closes are showing:

- German DAX, +0.4%

- France’s CAC, +0.7%

- UK FTSE 100 , flat

- Spain’s Ibex, +0.8%

- Italy’s FTSE MIB, +1.0%

For the week, the UK FTSE 100 felt modestly. The other major indices were higher:

- German DAX, +0.14%

- France’s CAC, +0.1%

- UK FTSE 100, -0.3%

- Spain’s Ibex, +0.6%

- Italy’s FTSE MIB, +0.7%

Looking at the daily chart of the German DAX, the index on Tuesday reached a new all-time intraday high of 15538.01 before rotating back to the downside. The move lower saw the price retest its 50 day moving average (white line in the chart below currently at 15075).

The price on Wednesday did dipped below that moving average level but recovered into the close. On Thursday, the low state above the level. Today the range was much more narrow with a higher bias.

In other markets as London/European traders look to exit.

- Spot gold is trading near unchanged at $1876.50 (down $0.70 or -0.04%).

- Spot silver, $-0.33 or -1.2% at $27.42

- WTI crude oil futures are recovering today and up two dollars or 3.26% at $63.96. The high for the day just reached $64.07

- Bitcoin is trading down $-2500 or -6.45% at $37,488

In the US stock market, the NASDAQ index has turned negative. The Dow industrial leads the way higher today.

- S&P +11.88 points or 0.29% at 4171.21

- NASDAQ index -21.08 points or -0.16% at 13514.30

- Dow industrial average up 250 points or 0.74% at 34333

UK May flash services PMI 61.8 vs 62.2 expected

Latest data released by Markit/CIPS – 21 May 2021

- Prior 61.0

- Manufacturing PMI 66.1 vs 60.8 expected

- Prior 60.9

- Composite PMI 62.0 vs 61.9 expected

- Prior 60.7

Despite a bit of a miss on the headline estimate, this is still a strong report with overall business activity expanding at its quickest pace on record – reflecting strong growth in both services and manufacturing activity as the UK reopening gathers pace.

Pent-up demand is the obvious driver here although strong price pressures are still a downside to note in this report, much like everywhere else at the moment.

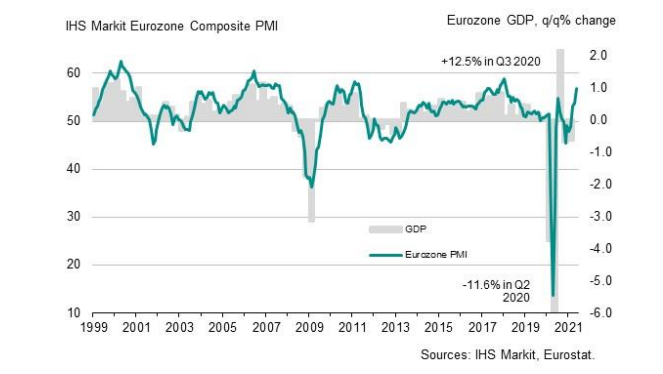

Eurozone May flash services PMI 55.1 vs 52.5 expected

Latest data released by Markit – 21 May 2021

- Prior 50.5

- Manufacturing PMI 62.8 vs 62.5 expected

- Prior 62.9

- Composite PMI 56.9 vs 55.1 expected

- Prior 53.8

This is an encouraging report as it reaffirms some pickup in services activity in the euro area as economies start to get back on their feet and move on from virus restrictions. The manufacturing sector is stalling a little but is keeping at robust levels overall.

Of note, new order inflows surged to its highest not seen in almost 15 years as business optimism continues to break new highs as sentiment surrounding 2H 2021 looks extremely positive. Markit notes that:

“Demand for goods and services is surging at the sharpest rate for 15 years across the eurozone as the region continues to reopen from covid-related restrictions. Virus containment measures have been eased in May to the lowest since last October, facilitating an especially marked improvement in service sector business activity, which has been accompanied by yet another near-record expansion of manufacturing.

“Growth would have been even stronger had it not been for record supply chain delays and difficulties restarting businesses quickly enough to meet demand, especially in terms of re-hiring. The shortfall of business output relative to demand is running at the highest in the survey’s 23-year history.

“This imbalance of supply and demand has put further upward pressure on prices. How long these inflationary pressures persist will depend on how quickly supply comes back into line with demand, but for now the imbalance is deteriorating, resulting in the highest-ever price pressures for goods recorded by the survey and rising prices for services.”

China 10 year yields fall 5 bps to 3.08% its lowest level since September 2020

FOMC Minutes: Tapering, gold and the USD

FOMC minutes

Two main points:

- Firstly, that supply chain bottlenecks and input shortages may not be solved quickly. In which case these factors could be putting upward pressure on prices beyond this year. The significance is that the FED may be a little more patient on inflation rising.

- Secondly was the reaction by the markets to this sentence: ‘ a number of participants suggested if the economy continued to make rapid progress towards the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing plan for adjusting the pace of asset purchases’ . Now this is very self evident. Of course at some point in the future it will be relevant. It is normally a filler line to the minutes. However, it send US 10 years flying high and the USDJPY higher with it.

This of course sent gold lower. However, crucially the $1860 level held and the short term upside bias remains in place technically. However, it tells you how jittery the market it to tapering. To even to begin to begin to think about them is enough to have that kind of reaction

In 2013 when tapering was announced by the then chair Bernanke US 10 year yields.

The takeaway

So with any surprise taper moves from the Fed the trade is buy USDJPY sell gold. The market is sensitive to tapering and the moves are likely to be accented.

Iran is readying a hike in its oil exports to “maximum capacity” within months

EnergyIntel website have the report. Citing two unnamed sources for the news.

The background being positive talks in Vienna with the US which could remove sanctions.

expectation of a deal next week

- sanctions to be lifted then in 2 to 3 months time

- Iran ready to boost exports

- ready to pump & export at maximum capacity, regardless of this does to price

- as much as 2 million barrels per day of Iranian crude returning to the market

Those above bullet points are pretty much what the oil market has expected anyway. Oil has dropped in past days on this.