Archives of “May 11, 2021” day

rssNo fear from commodity currencies in quick turnaround

Quick turnaround

USD/CAD is near the best levels of the day as it quickly turns around. A big part of that is oil recovering to unchanged from a $1 loss.

But it’s the same story in AUD and NZD as they rebound from the lows.

The divergence in markets is remarkable right now. Coming out of the financial crisis there was a long time when all correlations were stuck at 1. Now, there’s a great rift opening up between tech and commodities, which is another way of saying no inflation (and low rates) versus reflation.

For those looking to where the action has been recently – great take on the market by Ed Carson.

From ‘How I Made $2 Million In The Stock Market’ – Darvas 1960

Australia forecasts budget deficit of A$106.6 billion in 2021-22

The Australian Treasury releases its annual budget for the coming fiscal year

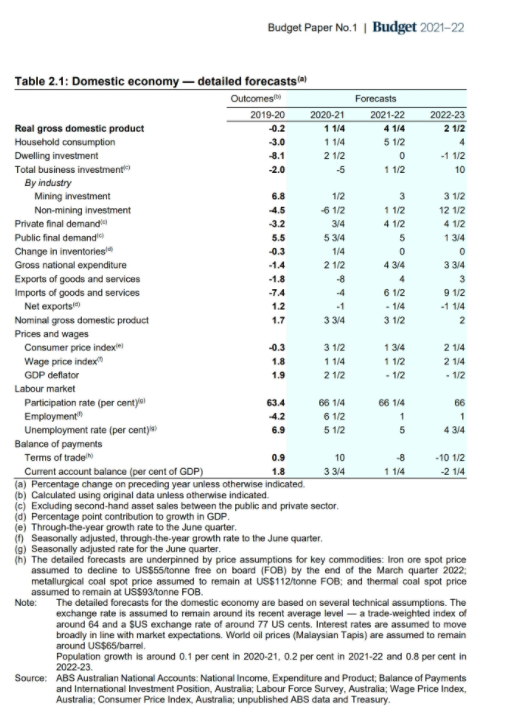

The forecast details:

Of note for the RBA, the government forecasts CPI to only return above 2% from 2022-23 onwards with wage growth keeping below 3% through the forecast period.

Germany May ZEW survey current situation -40.1 vs -41.6 expected

Latest data released by ZEW – 11 May 2021

- Prior -48.8

- Expectations 84.4 vs 72.0 expected

- Prior 70.7

- Eurozone expectations 84.0

- Prior 66.3

Treasury yields keep a touch higher so far on the session

10-year Treasury yields up just above 1.61%

It has been tough to keep bond sellers at bay since the turnaround after the non-farm payrolls miss on Friday. 10-year yields fell to around 1.48% at the time but is now trading up to 13 bps higher at around 1.61% in European morning trade.

There is still some room for trepidation at these levels as they are still fitting with the recent range and there is some topside resistance for yields closer to 1.65% before getting to the pivotal 1.75% level.

That said, the rebound on Friday coupled with the start this week suggests that bond sellers are still very much staying on top of things and that the inflation narrative isn’t something that will be going away any time soon.

In fact, 10-year breakevens have surged further to near 2.53% now – its highest level since March 2013*.

Platinum and catalytic converters

More platinum demand?

This is one area to watch/investigate further that I cam across this week and wanted to bring to readers attention. Some of the research I read is quite hard to actually extract the significant information from, so here is a potted summary of the main points:

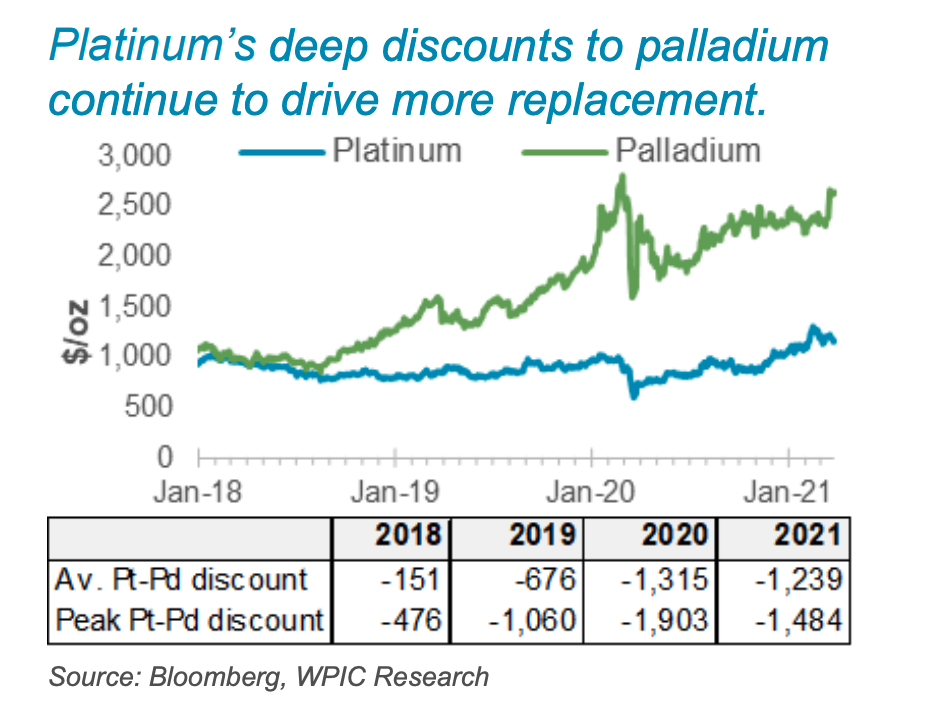

- Platinum is discounted in price compared to Palladium. See the chart below and notice how from 2018 the price of Palladium went soaring higher, while Platinum moved flat to sideways.

- Since 2016 car makers have been in discussion about replacing Palladium with Platinum. This was due to Palladium shortage and not Platinum prices. See here.

- Fabricators expect platinum demand to increase from c.150koz this year to c1.5moz in 2025.

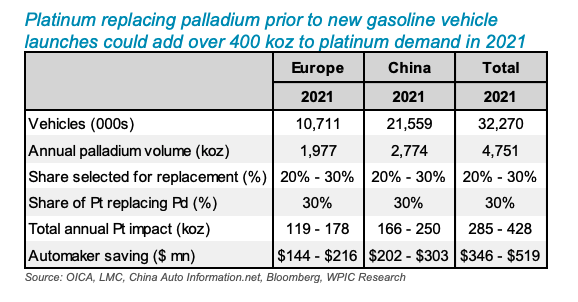

- In Europe and China new lower emission levels have to be met by a specific data so all car models to be sold in Europe and China in 2021 had their emissions systems redeveloped over the preceding three years. This means that Platinum could already be used in place of palladium. This could add as much as 400koz to platinum demand in 2021

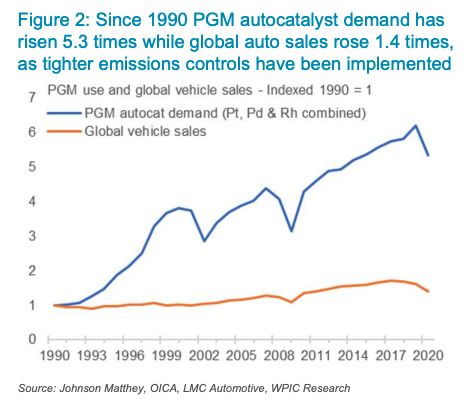

- The drive for better emission levels means that more active metal is needed to work it’s purpose. This means that more platinum will be needed in each catalytic converter, so demand would only grow in order to meet higher emission standards. Look at the chart below to see how the combined demand for Platinum, Palladium and Rhodium is growing

See here and here for some more detail on the above points from the World Platinum Investment Council. The caveat is that the group’s purpose is to stimulate Platinum investment, but facts are facts so don’t dismiss the research out of hand.

Eurostoxx futures -1.2% in early European trading

Risk on the defensive in early trades

- German DAX futures -1.2%

- UK FTSE futures -1.2%

- Spanish IBEX futures -0.9%

There is some slight catching up involved to the declines in US stocks yesterday but for the most part, this reflects the defensive and sluggish sentiment today as well.

US futures are also marked lower, with S&P 500 futures down 0.4%, Nasdaq futures down 0.7%, and Dow futures down 0.2% to get things started on the session.

Major currencies are little changed but if the defensive posture keeps up, we may see some risk aversion flows start to seep in later in the day.

Nikkei 225 closes down by 3.08% at 28,608.59

A torrid day for Japanese stocks

Meanwhile, the Topix closes down by 2.4% at 1,905.92. This is the worst showing by the Nikkei since the 4% plunge at the end of February trading.

The decline today sees both indices slip just below their respective 100-day moving averages with the Nikkei nearing support from the March and April lows at 28,300-400.

The drop here follows the sluggish sentiment since US trading yesterday, though mainland Chinese stocks are defying the odds late in Asia currently.

The Hang Seng is down 1.7% but the Shanghai Composite is up near the highs for the day now as it climbs by 0.4% after keeping lower earlier in the day.

US futures are still keeping rather defensive, with S&P 500 futures down 0.4% and Nasdaq futures down 0.7% ahead of European trading.