Archives of “May 3, 2021” day

rssAs the rotation out of tech into cyclicals continues, what key earnings will be released this week

Earnings releases for this week

The rotation out of tech into cycles has the Nasdaq down and the Dow up today. The NASDAQ is currently down 57 points or -0.41% 13906.21. Meanwhile the Dow is up 313 points or 0.93% at 34189.

Last week was a key week for high tech/big cap with Microsoft, Apple, Amazon, Alphabet, Tesla all reporting. By and large the earnings outpaced expectations by healthy amounts. Nevertheless, investors could not keep momentum going (and for some the prices moved lower despite beats).

So what earnings are on the schedule this week:

Monday after the close:

- Robot

Tuesday:

- Pfizer

- CVS health

- Corsair

- Under Armour

- ConocoPhillips

- Skillz

- Activision/Blizzard

- Zillow Group

- Lyft

- Xilinx

Wednesday

- Hilton

- PayPal

- Rocket Companies

- Etsy

- Uber

- Tullio

- Marathon oil

Thursday

- Moderna

- Viacom CBS

- Regeneron

- Wayfare

- Square

- Roku

- AMC

- Peleton

- Beyond Meat

- Dropbox

- GoPro

Friday:

- Draft Kings

- Nikola

European shares end higher

German DAX realizes zero point

The major European indices are ending the day higher. German DAX rose 0.6%. France’s CAC is up 0.5%

A look at the provisional closes shows:

- German DAX up 0.6%

- France’s CAC up 0.5%

- Spain’s Ibex, up 0.9%

- Italy’s FTSE MIB, +1.1%

Recall UK markets are closed today for the early May bank holiday.

Other markets as European traders looked exit:

- Spot gold is trading higher by $22.24 or 1.26% at $1791.40. The high price reached $1797.98.

- Spot silver is up $0.93 or 3.61% at $26.85

- WTI crude oil futures are up $0.89 or 1.38% at $64.47

- The price of bitcoin is trading up $853 or 1.5% at $57,908.47.

In the US debt market, yields have reversed lower earlier higher levels. The 10 year yield reached a high of 1.653%. Is currently trading at 1.614%. That is still above the low for the day 1.576% in volatile trading.

Germany reportedly to seek easing restrictions on those vaccinated by Friday

Bild reports on the matter

This was already floated at the end of last week via German health minister, Jens Spahn, who said at the time that the government is looking at ways to exempt people who have been vaccinated or recovered from COVID-19 from current restrictions.

That should include nighttime curfews and limits on private gatherings among other things.

28 life lessons

1. No one has it all figured out 2. Being nice is overrated Be kind, be fair, not “nice” 3. To love is to be vulnerable, let your guard down 4.Good or bad, you can learn from everyone 5. Embrace all of your emotions. Don’t ignore them 6. Traveling alone is better than with bad company 7. Unlearning is just as important as learning 8. No one prepares you to watch your parents grow old 9. Own up to your mistakes 10. Maturity is accepting you won’t get answers to the things that hurt you most. Heal anyway 11. One of the most important life decisions you’ll ever make in this life is who you have children with. Choose wisely 12. Women friends are cool. Don’t try to sleep with them 13. You don’t have to learn everything the hard way 14. One day you’ll need to be forgiven so learn to forgive 15. Instead of buying your children what you didn’t have, teach them what you didn’t learn 16. Never let your inner child die 17. If someone doesn’t treat you as good as a chick fil a employee, they don’t deserve to be in your life 18. No one reads minds. Speak on how you feel 19. Never feel bad about promoting yourself 20. If you value your time, say no to anything you don’t want to do 21. Spending time alone is one of the best things you can do 22. Celebrate your accomplishments 23. If you care too much about what others think, you’re effectively their slave 24. Be so busy improving your life that you don’t have time to criticize others 25. Everyone you love will eventually die. Spend time with your loved ones 26. Listen to understand, not to respond 27. Hang out with people from different races, ethnicities and social economic statuses 28. You can’t pour from an empty cup. Take care of yourself first

US Dollar keeps more mixed so far on the session

Dollar trails slightly behind the euro, pound but gains against the yen, loonie

It has been a relatively quiet start to May proceedings as holidays in Japan, China, and now UK are keeping the market more tepid so far today.

Major currencies are mostly little changed in general, though the yen is the notable laggard as USD/JPY hovers near the highs for the day at 109.68 currently.

Besides that, USD/CAD is a little higher at 1.2300-10 but the rest of the major currencies bloc are keeping in narrower ranges. EUR/USD is hovering around 1.2030 levels now but is holding within a 29 pips range (1.2013-42) in trading today.

US futures are keeping higher (S&P 500 futures up 0.5%) so keep that in mind in case there is more of a risk-on push later when Wall Street starts to enter the fray.

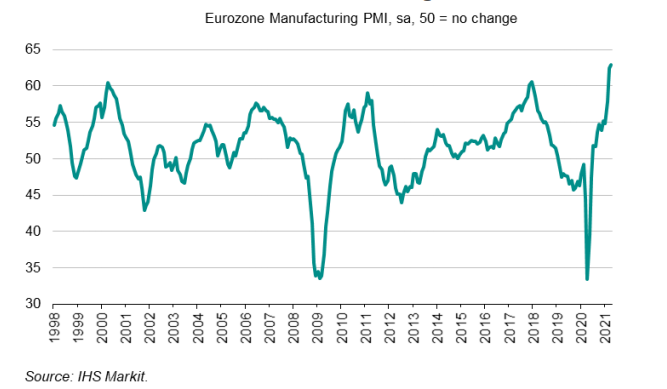

Eurozone April final manufacturing PMI 62.9 vs 63.3 prelim

Latest data released by Markit – 3 May 2021

The preliminary report can be found here. A slightly softer revision but the headline is still a record high reading as the manufacturing sector in the region continues to hold up strongly despite the virus situation and tighter restrictions since Q1.

Output and new orders are holding close to record highs seen in March while input cost inflation is seen ticking higher once again, which should feed back into higher consumer price inflation over the coming months. Markit notes that:

“Eurozone manufacturing is booming, with a new PMI record set for a second month running in April. The past two months have seen output and order books both improve at rates unsurpassed since the survey began in 1997, with surging demand boosted by economies opening up from COVID-19 lockdowns and brightening prospects for the year ahead.

“However, supply constraints are also running at unprecedented levels, leading to a record build-up of uncompleted orders at factories.

“The consequence of demand running ahead of supply is higher prices being charged by manufacturers, which are now also rising at the fastest rate ever recorded by the survey.

“The big uncertainty is how long these upward price pressures will persist for, and the extent to which these higher charges for goods and services will feed-though to consumers.

“Encouragement comes from the sharp increase in employment and investment in machinery and equipment signalled by the survey, which suggests firms are scaling up capacity to meet resurgent demand. This should help bring supply and demand more into line, taking some pressure off prices. But this will inevitably take time.”

Attempting to Time Different Strategies Is Very Difficult

- Few strategies outperform all the time, and you should thoroughly understand why and when underperformance is most likely to occur.

- Value-oriented strategies tend to perform poorly during economic recessions.

- The first step when a strategy fails is to compare the economic environments in which the strategy failed in the past, and to determine if the current environment is similar.

- When historical economic precedent can indeed explain the performance of a strategy, then the investor should probably continue using the strategy despite poor short-term performance because attempting to time different strategies can be a very difficult task. Short-term performance is typically very misleading, so the probability is reasonably high that you might give up on a strategy just before it begins to work again.

- If the economic environment is not one in which the strategy has historically fared poorly, then the next step is to be somewhat introspective. Is it I, the investor, or the strategy that is failing? Simply monitor the performance of the strategy’s entire portfolio versus that of the stocks selected by the investor. If the performance of the stocks is inferior to that of the entire portfolio, then the investor detracted from the strategy’s basic performance.