Archives of “May 1, 2021” day

rssThese look like flash drives, but they’re actually made to hodl #bitcoin like a physical dollar bill.

Opendimes can be passed along multiple times, like handing a gift to a family member. Connect to any USB to check the balance and unseal to spend online. Pretty cyberpunk like.

“The premium for commodities that can be delivered now versus later into the future is the highest it has been since at least 2007, signaling just how strong the world’s demand is for raw materials and how tight supplies are.”

How it started: How it’s going:

The first house in the Netherlands 🇳🇱 to be bought entirely with #bitcoin was just sold for 21₿.

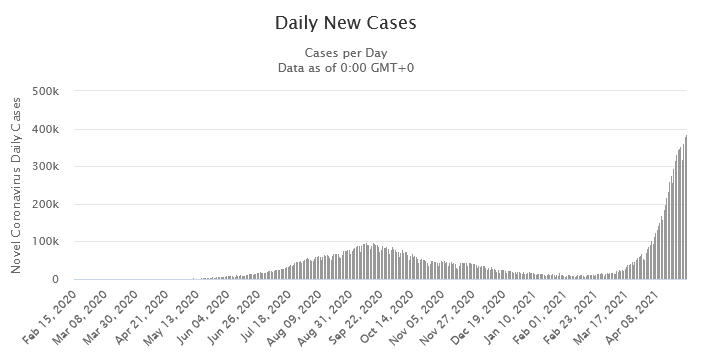

Time to cancel those travel plans to India

Biden to ban most travel to the US from India

On May 4, Biden will announce that non-US citizens won’t be able to return from India.

I’m surprised the US hasn’t done this already. I also believe the US was getting pressure from other countries for this because people were entering 3rd countries from India via the US.

CFTC Commitments of Traders: The slow CAD courtship continues

Weekly forex futures positioning data from the CFTC for the week ending April 27, 2021:

- EUR long 81K vs 81K long last week. No change

- GBP long 29K vs 25K long last week. Longs increase by 4K

- JPY short 49K vs 60K short last week. Shorts decreased by 11K

- CHF short 1K vs 2K short last week. Shorts decreased by 1K

- AUD short 1K vs 2K short last week. Shorts decreased by 1K.

- NZD long 7K vs 4K long last week. Longs increased by 3K

- CAD long 16K vs 13K long last week. Longs increased by 3K

The Canadian loon mates for life but the currency market has been slow to fall in love with loonie. Longs rose 11K last week and that was before the BOC. After the decision, buyers dipped another toe in but there’s plenty of room to run here. CAD longs are still below the February highs and miles away from the 2019 net long of +54K.

Equity close: A stumble to end a shinning month

Closing changes for the main North American bourses

- S&P 500 -31 points or 0.7% to 4180

- Nasdaq -0.9%

- DJIA -0.5%

- Russell 2000 -1.6%

- Toronto TSX -0.7%

On the week:

- S&P 500 flat

- Nasdaq -0.4%

- DJIA -0.5%

- Toronto TSX flat

On the month:

- S&P 500 +5.2%

- Nasdaq +5.4%

- DJIA +2.7%

- Toronto TSX +2.2%

What bothers me at the moment is that there is a double doji star on the weekly chart after a long, one-way rally. That’s setting up a big move.

Thought For A Day