Hydrogen

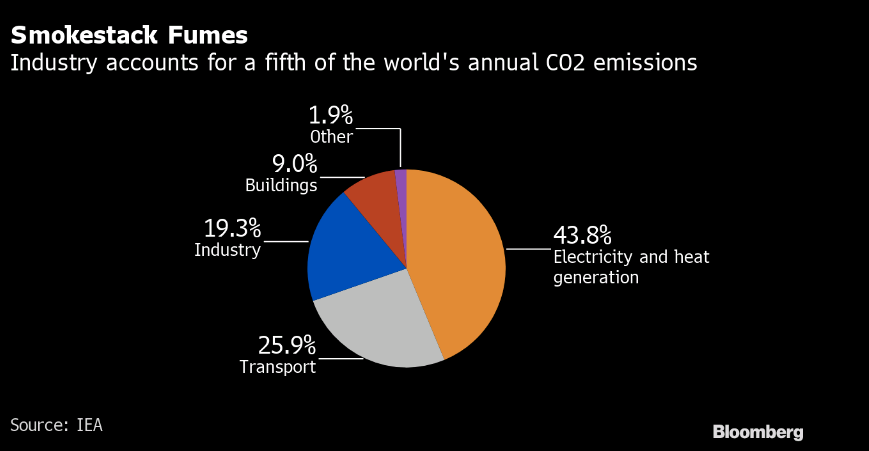

Hydrogen has a few key things going for it. Firstly, when it burns its burns clean, There are an ideal replacement for fossil fuels. Remember around 20% of all Co2 emissions come from industry.

Hydrogen could radically reduce this figure. For example hydrogen when removing the oxygen from Iron Ore creates water vapour rather than Co2.

Hydrogen could also be used as a clean solution for fuelling vehicles as well as heating buildings. Once again its clean usage makes it an ideal candidate.

How do you make Hydrogen?

The main technique is through electrolysis. Ideally that process itself would be funded by renewable energy like wind or solar. In this way the whole process can be become ’emissions free’ and hailed as a big win in the climate fight against Co2.

The drawback?

The cost. Current prices are around $2.50-4.50 per kg of green hydrogen. This cost needs to drop below $1 to start forming a competitive edge against fossil fuels

Storage: Hard to store, transport and deliver at present.

Who is involved?

Mitsubishi Power Americans Inc plans to build three hydrogen ready gas fired plants in the US.

Germany’s RWE plan to supply hydrogen to steel maker ThyssenKrupp AG.

UK’s ITM power, Ceres Power, and Norway’s Nel ASA are all listed as having a core business involving hydrogen tech.