Add the OPEC decision into the mix

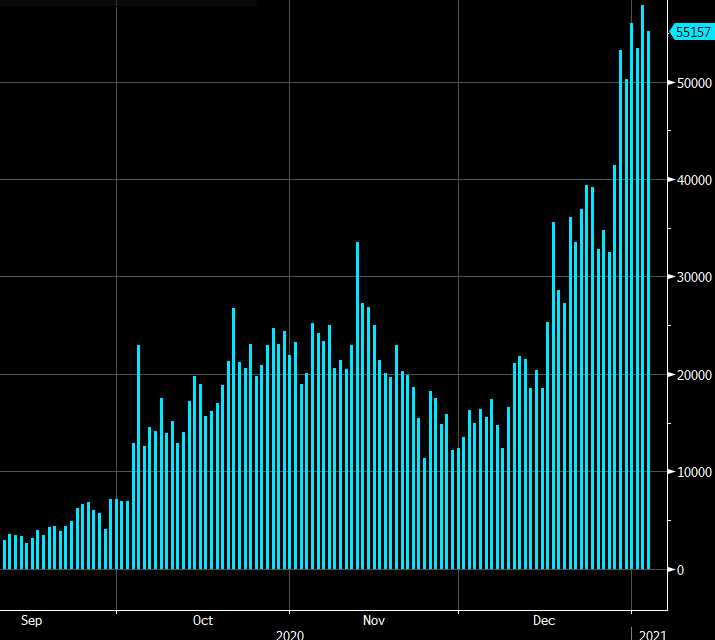

The trading year started off with some unexpected drama as equities were slammed and early weakness in the US dollar evaporated.

The day ahead will feature even more for market participants to think about, especially with the OPEC meeting slated for a second day. Given that the meeting won’t start until 330 pm in Vienna, it’s sure to bleed into New York trade.

On the formal calendar, we get the ISM December manufacturing survey. The consensus is 56.7, down from 57.5 but given the strong numbers from today’s Markit survey, I’ll take the upside — especially on prices paid.

We also hear from the Fed’s Williams at 2045 GMT as he participates on a panel.

The main event though will be the Georgia runoff. Don’t expect any results until late in the day and it may be a few days before the results are clear. Three million votes have already been cast and that’s a large turnout for a runoff but it also means the counting will take more than a week. In the general election, it looked like Trump had won early but as the mail-in votes were tallied, Biden took the state.

I expect a quicker result this time, if only because you can model out the results against what we saw in the general election. If the Democratic Senators are outperforming by 3-4 percentage points, then they have it. If not, it’s the status quo.