Archives of “January 2021” month

rssELECTORAL CERTIFICATION UNDERWAY

Coronavirus – London’s hospitals less than 2 weeks from being overwhelmed, even under the “best” case scenario

Comments from the UK’s National Health Service England London medical director Vin Diwakar set out the stark analysis to the medical directors of London’s hospital trusts on a Zoom call.

- even if the number of covid patients grew at the lowest rate considered likely, and measures to manage demand and increase capacity, including open the capital’s Nightingale hospital, were successful, the NHS in London would be short of nearly 2,000 general and acute and intensive care beds by 19 January.

Chilling stuff.

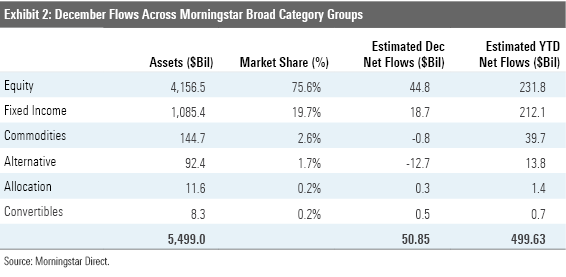

Bank analyst highlights the risk of a 20% drop in the USD

Citing the result of the Georgia senate election where the Democrats swept to victory, taking both of the available seats.

The analysts (at a trading bank I can’t really name) say the there is now a materially increased risk of a slide ion the US dollar, by as much as 20% over this coming year. Further:

- it heightens expectations of 1. a bigger fiscal stimulus, 2. hedging of dollar-denominated assets and 3. asset rotation.

The same analysts said back in November they expected the dollar to drop in 2021 due to the wide distribution of vaccines which would assist in boosting economy growth and trade.

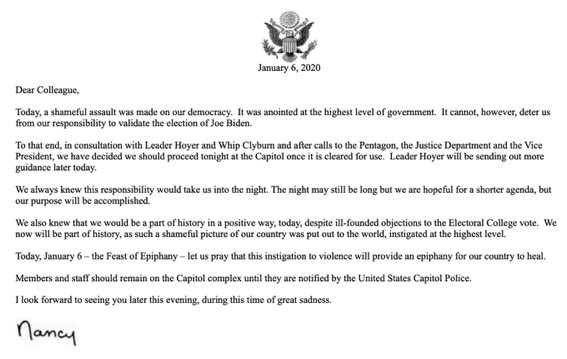

US Congresswoman preparing Articles of Impeachment against the US President

The last time Trump was impeached it didn’t have too much financial market impact.

I suspect the same this time given his lame duck status.

Anyway, for your notes: US Congresswoman Ilhan Omar is preparing articles of impeachment against Trump

FOMC minutes: Some participants noted that the Committee could consider future adjustments to its asset purchases

Minutes of the December 15-16 FOMC meeting

- Most officials saw inflation risks weighted to the downside

- Full text

- December statement

It sounds like a small minority of FOMC members were in favour of taking more action:

Some participants noted that the Committee could consider future adjustments to its asset purchases-such as increasing the pace of securities purchases or weighting purchases of Treasury securities toward those that had longer remaining maturities-if such adjustments were deemed appropriate to support the attainment of the Committee’s objectives. A few participants underlined the importance of continuing to evaluate the balance of costs and risks associated with asset purchases against the benefits arising from purchases.

There was also some taper talk:

A number of participants noted that, once such progress had been attained, a gradual tapering of purchases could begin and the process thereafter could generally follow a sequence similar to the one implemented during the large-scale purchase program in 2013 and 2014.

Here is the view on the economy:

“The recent sharp resurgence in the pandemic suggested that the near-term risks had risen, while the recent favorable developments regarding vaccines pointed to some reduction in the downside risks over the medium term.”

Thought For A Day

US weekly EIA oil inventories -8010K vs -2700K expected

Weekly US oil inventories

- Prior was -6065K

- Gasoline +4519K vs -900K exp

- Distillate +6390K vs +1200K exp

- Refinery utilization +1.3% vs +0.4% exp

Oil rose about 20-cents on the headlines as it focuses on the headline, not the product builds.

API late yesterday:

- Oil -1633K

- Gasoline +5473K

- Distillate +7146K

NYSE to proceed with delisting three Chinese telecom companies

The delisting is back on

Evidently Mnuchin’s call yesterday swayed the decision, which has been back and forth.

In a statement, the NYSE said it will move forward with the decision on January 11, removing CHA, CHL and CHU.

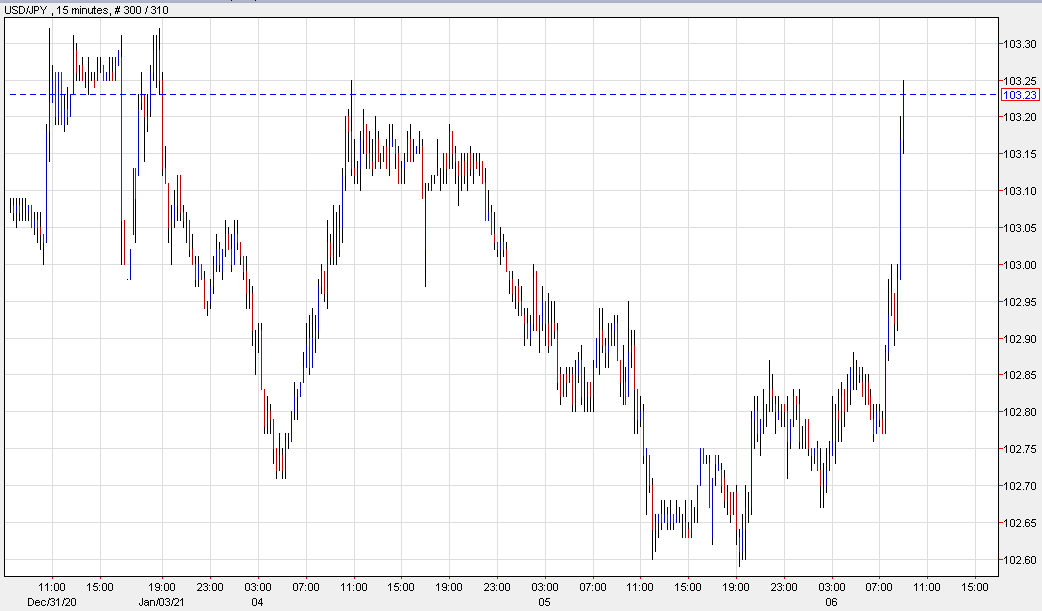

US dollar springs to the best levels of the day

Dollar higher across the board

USD/JPY is up a half-cent to a session high of 103.22 as part of a broader US dollar move.

The move higher in the dollar is coinciding with a further fall in tech stocks. The market unsure what the agenda is going to be for Democrats now that they have control of the House. There’s fear they will go after big tech and that’s causing some risk aversion.

At the same time, there is an expectation of more spending. Ultimately that could lead to higher rates if it creates inflation but the market is also unsure how taxes will develop.

This all adds up to a bit of a confused flight to the safety of the US dollar but I don’t expect that to last.