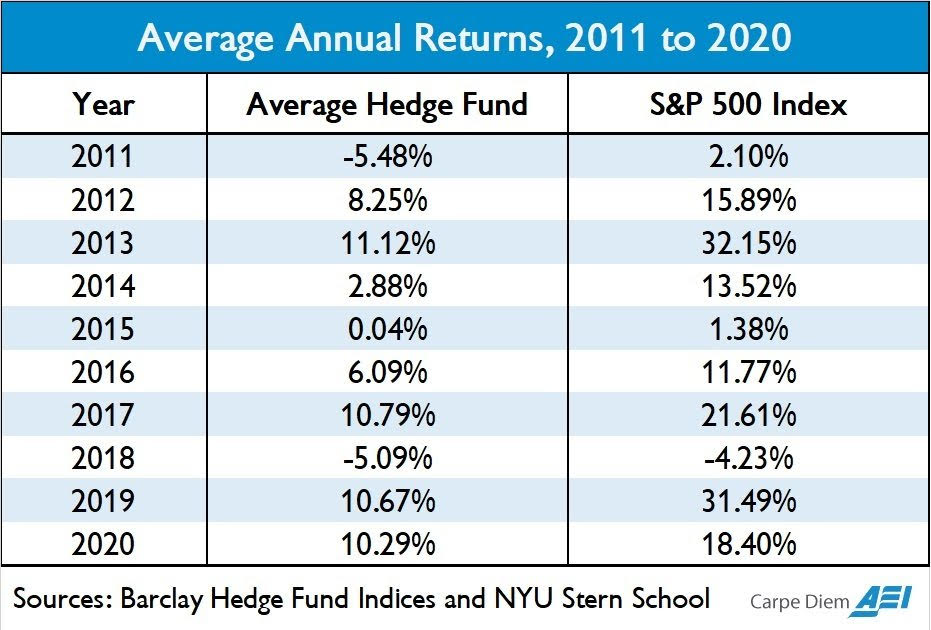

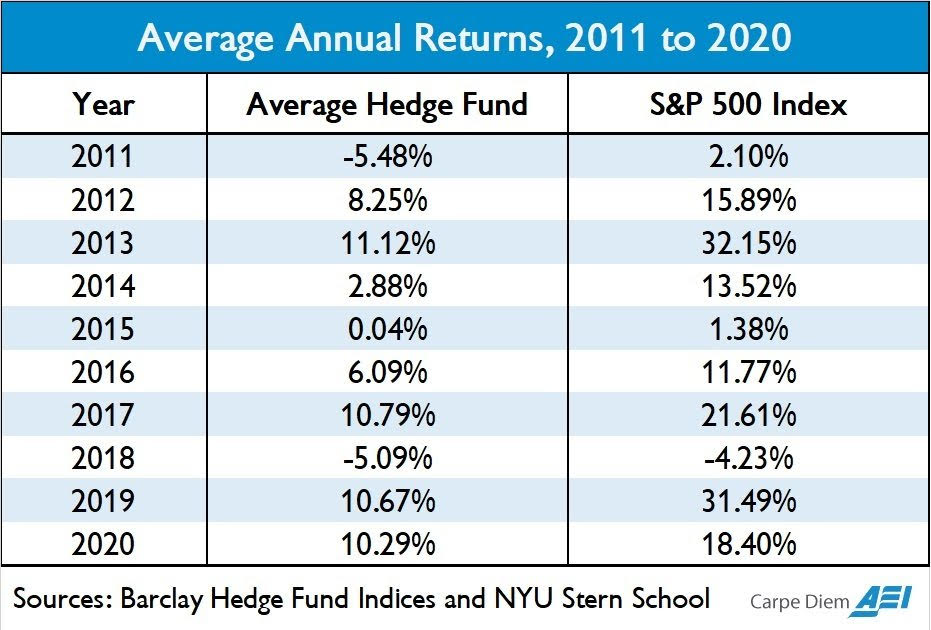

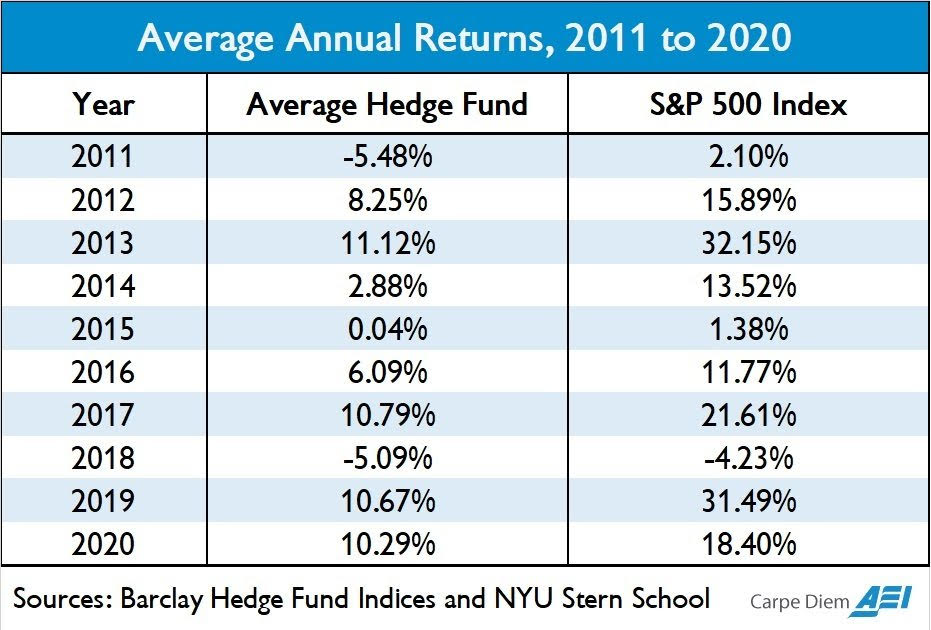

The S&P 500 index out-performed hedge funds over the last 10 years.

Overall there were small changes in the net currency positions. However the dollar range short/the currencies long across the board.

Meanwhile at WallStreetBets.com, the thread has been locked by the moderators. New comments cannot be posted.

Next week is another big earnings week. This week’s results, although mostly better than expectations, saw investor sell into the bounces (generally speaking).

All 3 of the major indices closed down around 2% on the day.