Weekly US oil inventories

- Prior was -3248K

- Gasoline -259K vs +2425K

- Distllates +457K vs +1800K exp

API data from Wednesday:

- Oil +2500K

- gasoline +1100K

- Distillates +800K

- Cushing -4300K

That was a larger build in oil and prices have ticked lower but the product data is bullish. WTI last prices down 76-cents to $52.29.

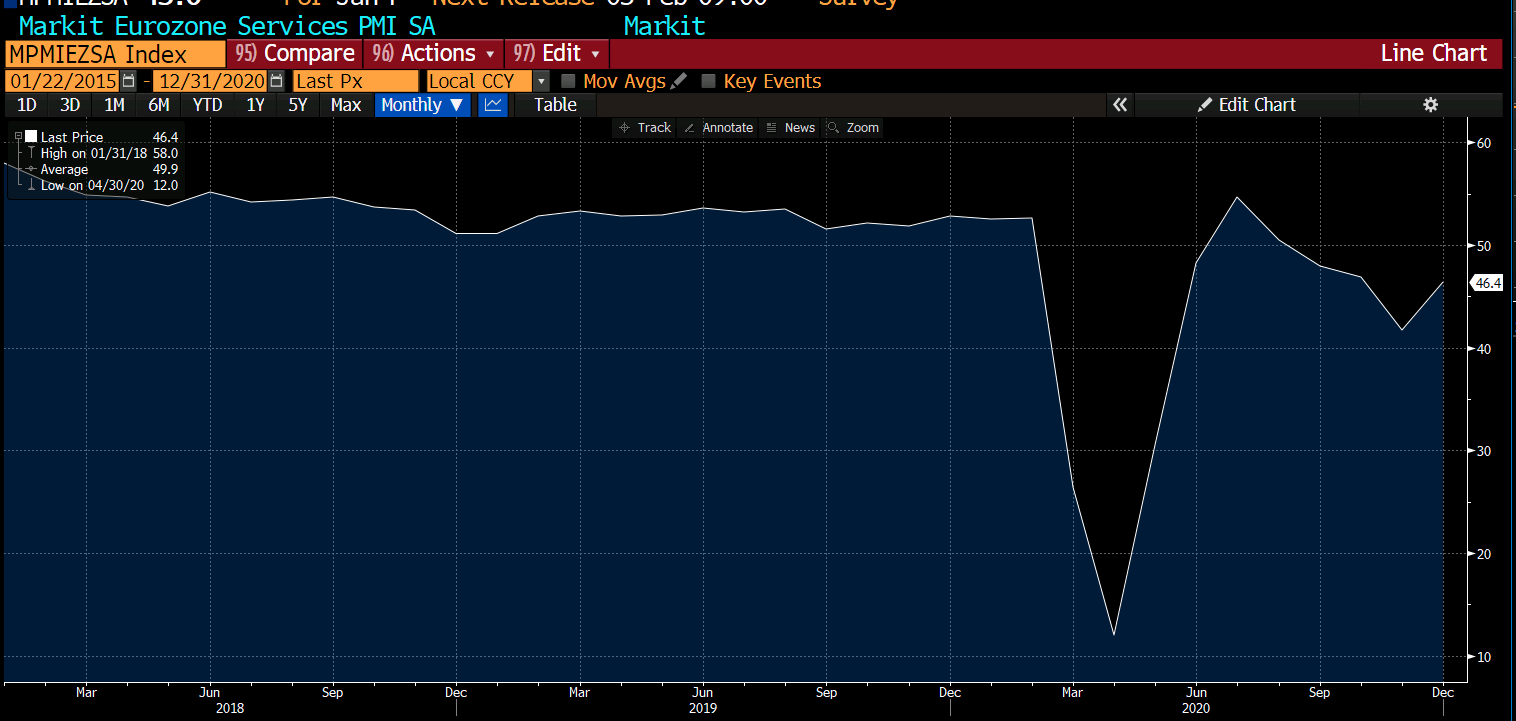

Earlier today it looked like crude might be falling below its recent range but it perked back up after the Markit PMI.