ECB concern about the EUR strength

ECB Lagarde after the meeting last week, spoke about the currency and how it’s strength was impacting inflation.

An ECB sources now on the wires saying that:

- ECB said to query dollar weakness despite stronger US economy

- Will study impact of ECB vs. Fed policy on exchange rates

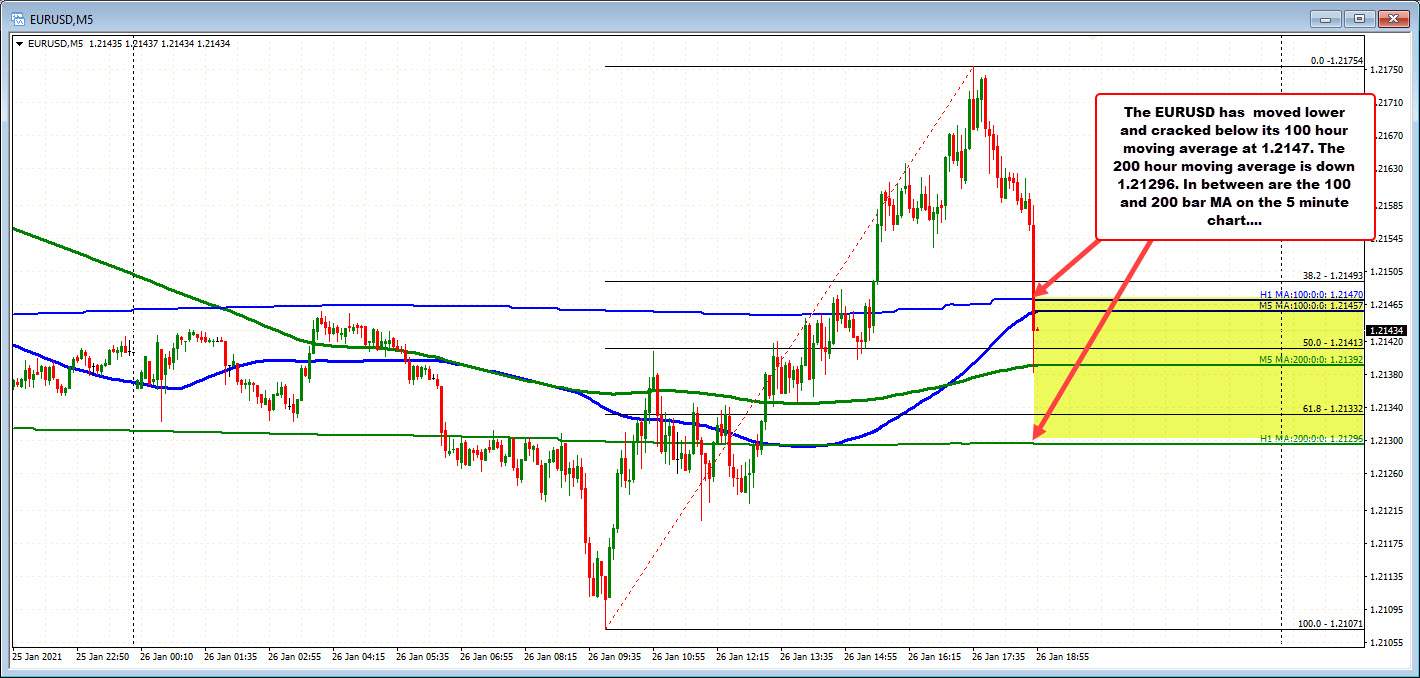

The EURUSD has moved lower on the headline and as now moved back below its 100 hour moving average 1.21471. The 200 hour moving average is down at 1.21296.