German DAX -1.7%. France’s CAC -1.6%. UK’s FTSE -0.9%

The major European indices are ending the session sharply lower. Germany’s IFO data this morning came in weaker than expected at 90.1 vs. 91.4 estimate and 92.2 last month. The expectations index was also lower at 91.1 vs. 93.6. The current assessment came in at 89.2 vs. 90.6 estimate.

The provisional closes are showing:

- German DAX, -1.7%

- France’s CAC, -1.6%

- UK’s FTSE 100, -0.9%

- Spain’s Ibex, -1.8%

- Italy’s FTSE MIB, -1.7%

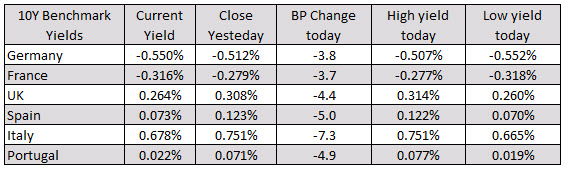

in the European debt market, the benchmark yields are all trading lower as concerned about growth sends yields lower.

In the forex market, the strongest and weakest currencies moved closer together relative to the New York opening. The NZD remains the strongest but has given up some of its early gains in the NY session. Likewise, the EUR and CHF (which were the weakest currencies at the NA open) are still the weakest currencies at the London close, but have recovered some of its earlier losses. The USD has moved higher from lower mixed levels. The greenback is mostly higher vs the majors (marginally), and is near unchanged vs. the JPY and NZD now.