Archives of “January 16, 2021” day

rssS&P 500 declines since 1835.

S&P 500 major declines since 1835.

This time it is different.

EU to set out plans to lessen its reliance on the USD

Media reports on moves from the European Union to lay out plans to limit its reliance on the USD

Citing a draft policy paper from the European Commission that will be adopted on January 19.

The paper points to the EU’s vulnerability to US sanctions and to financial risks. Measures proposed include

- tighter controls on foreign takeovers

- boosting the use of the EUR in financial markets.

Reminder: Monday is a holiday in the US

Markets closed on Monday

Monday is Martin Luther King Jr Day in the US, making it a market holiday. US equity and bond markets are fully closed.

Of course, the FX market never closes for holidays but liquidity will be considerably constrained. Canadian markets are open but the economic calendar is light, with only December housing starts.

On the weekend, we get Chinese Q4 GDP, industrial production and retail sales.

CFTC commitments of traders: EUR longs move back up to December highs

Weekly forex futures positioning data from the CFTC

- EUR long 156K vs 143K long last week. Long increased by 13K

- GBP long 13K vs 4K long last week. Longs increased by 9K

- JPY long 50K vs 50K long last week. Unchanged

- CHF long 12K vs 9K long last week. Longs increased by 3K

- AUD long 5K vs 4K short last week. Longs increased by 9K

- NZD long 15K vs 12K long last week. Longs increased by 3K

- CAD long 12K vs 14K long last week. Longs trimmed by 2K

Highlights:

- EUR longs remain the largest speculative position at long 156K. That equals the December high long position.

- JPY longs at 50K are unchanged but remain the next largest net speculative position

- AUD position switched to long 5K from short 4 last week.

- All major currencies are now long the currency (short the USD).

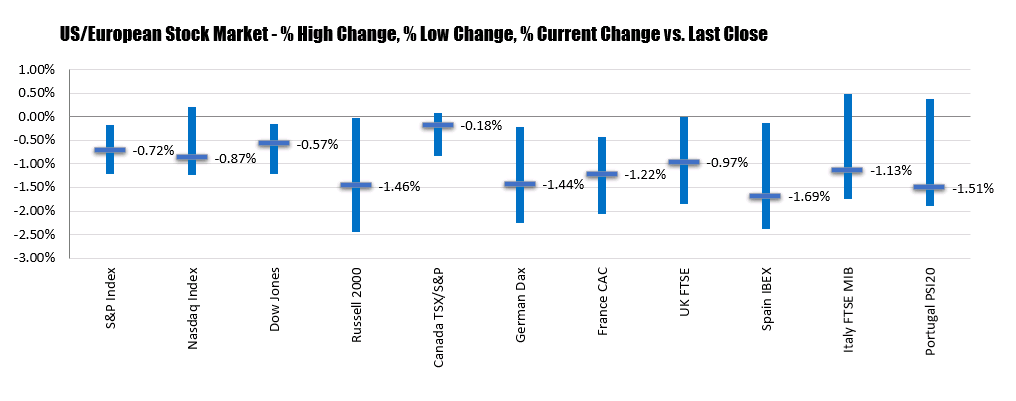

Major indices close lower with the NASDAQ leading the way

NASDAQ down -0.87%

All 3 major indices are ending the day lower. The NASDAQ led the way with a decline of -0.87. Both the S&P index and Dow industrial average never traded above unchanged on the day. The Russell 2000 which outperformed yesterday, underperform today with a decline of -1.46%

The final numbers are showing:

- S&P index -27.29 points or -0.72% at 3768.25

- NASDAQ index -114.13 points or -0.87% at 12998.56

- Dow -177.26 points or -0.57% at 30814.26

- Russell 2000 index -33.107 points or -1.53% at 2122.26.

Below are the percentage changes and ranges of the major indices. European shares also ended lower with the Spain Ibex leading the way at -1.69%. The German DAX fell -1.44%.

For the week, the major indices all ended lower:

- Dow industrial average -0.91%

- S&P index -1.48%

- NASDAQ index -1.54%

In the European markets:

- German DAX, -1.86%

- France’s CAC, -1.67%

- UK’s FTSE 100, -2.0%

- Spain’s Ibex, -2.11%

- Italy’s FTSE MIB, -1.81%

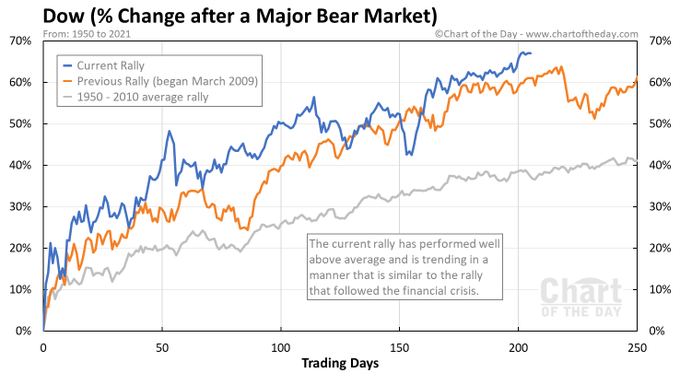

Behavior of the Dow Jones 30 after a bear market.

Thought For A Day