Archives of “January 15, 2021” day

rssUS January Empire Fed +3.5 vs +6.0 expected

New York area manufacturing survey

- Prior was +4.9

- New orders +6.6 vs +3.4 prior

- Prices paid +45.5 vs +37.1 prior

- Six month conditions +31.9 vs +36.3 prior

- Employment +11.2 vs +14.2 prior

- Full report

If you’re a pessimist, you can start to see the makings of a crest in this report and a continued build-up in inflationary pressures.

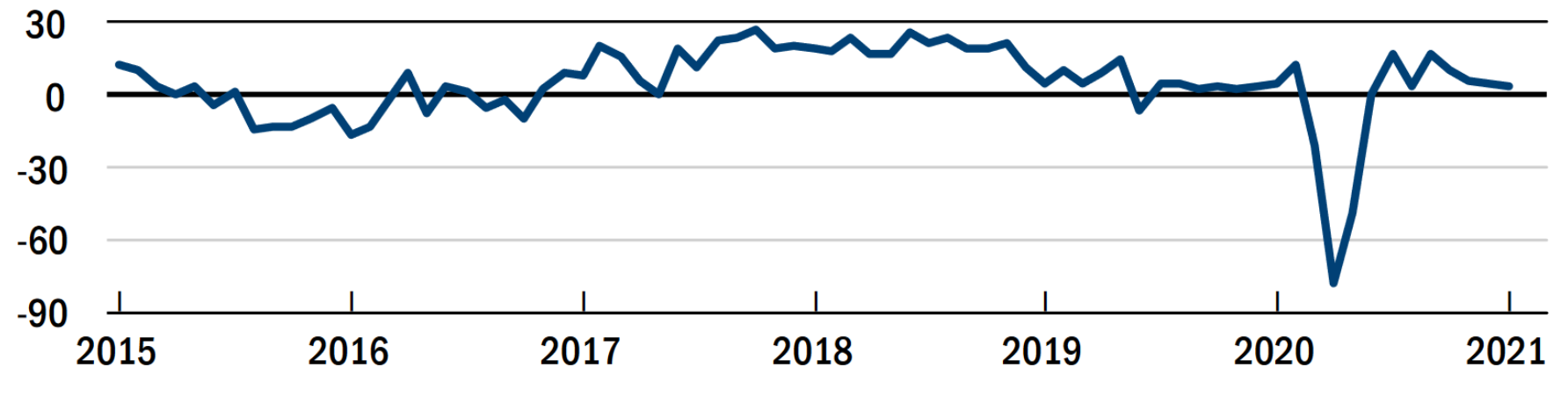

US Dec advance retail sales -1.4% vs 0.0% expected

December advance retail sales

- Prior was -1.1% (revised to -1.4%)

- retail sales ex auto -1.4% vs. -0.2% estimate

- retail sales ex auto and gas -2.1% vs. -0.3% estimate

- retail sales control group -1.9% vs. +0.1% estimate

This is a poor report and the November numbers were revised significantly lower as well.

- November retail sales ex auto revised to -1.3% from -1.1%

- November retail sales ex auto and gas revised to -1.3% from -0.8%

- November retail sales control group revised to -1.1% from -0.5%

So much for that strong Target same-store sales report.

The market might forgive this because of the huge stimulus packages that are in the pipeline but it’s also a reminder that the economy is a long way from a self-sustaining recovery.

Areas that were particularly weak were ‘food & beverage’ -1.4% m/m, department stores -3.8%, non-store retailers (online) -5.8%, eating/drinking -4.5%, and general merchandise -1.2%. The only positive surprises were building materials +0.9% and clothing +2.4%

A couple of outside risks to look out for going into next week

What are some other risk factors to be mindful of right now?

As the market settles into the Powell vs Biden debate, here are two other issues to be wary about in case it bubbles up into something bigger to impact market sentiment:

Italian politics

Another government reshuffle is on the cards in Italy and there are only a few options left, being a new majority being formed, a technical government takes over, or a very distinct possibility of early elections.

While most of the impact from the political unrest is largely confined to BTPs – even then, the reaction so far is relatively modest – it is still something to be mindful of in case it has a broader impact towards European equities and the euro in general.

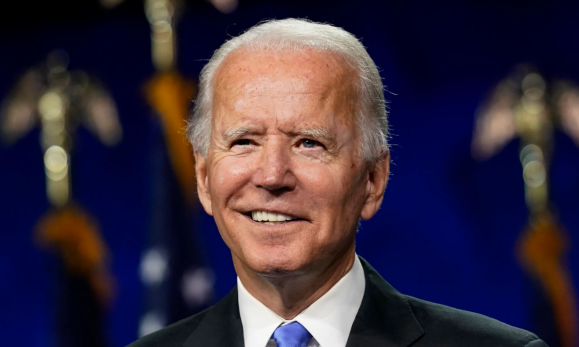

More unrest ahead of Biden’s inauguration?

There is still a few days before inauguration day for US president-election elect, Joe Biden. And while a lot of the focus is now on his stimulus proposal, just be cautiously aware that there are still chances of seeing more public unrest like the one in Capitol Hill last week.

It is something worth thinking about when gauging risk sentiment/exposure as we look towards 20 January next week.

Could Alibaba and Tencent face a US ban?

Via Reuters

As President Trump moves to the exits, albeit in a bumpy fashion, one of his last acts before leaving office has been issuing a ban on Americans investing in 35 companies considered to have links to China’s military. The emerging market rally has largely taken that piece of news in its stride. However, Reuters report that Washington sources said Trump is considering adding Alibaba and Tencent to that list of banned firms. That’s big news.

Alibaba and Tencent have a value worth $1.3 trillion combined and are th second and third biggest EM stocks in the world held by almost every major U.S investment fund. If they are banned and $1 trillion dollars is unwound via an Alibaba and/or Tencent ban then that is big. According to UBS they think that just over one third of Alibaba’s $616 billion market is held by US investors and 12% of Tencent’s $35 billion value is. The firms combined make up around 11% of MSCI’s $7 trillion emerging market index and Chinese firms make up around 40% of that index which is up from around 17% a decade ago.

This is one area to watch as it could push some risk off selling if they are banned, so watch out for these headlines as a risk to stay on top of.

What now for Biden’s stimulus proposal?

It will be a major test for Biden to see if he can gather bipartisan support in the weeks ahead

Now that we’ve gotten what we need to know about the $1.9 trillion proposal. What is next on the agenda for the market to look forward to?

The key timeline to watch here will be the end of March – that is when a number of special unemployment benefits in the US will expire. Hence, the market will have many more weeks and months to focus on all this stimulus talk in Congress.

First off, the package should at least pass the House rather easily but it will prove to be more of a challenge in the Senate as the Democrats hold the slimmest of majorities there (50-50 with the tie broken by US vice president-elect, Kamala Harris).

A good summary of the situation via ING (h/t @ AWMCheung):

PBOC reaffirms that will prioritise stability in monetary policy, no sudden shifts

Comments by PBOC deputy governor, Chen Yulu

- Prudent monetary policy this year will be more flexible, targeted, appropriate

- Monetary policy will provide necessary support for economic recovery

This is basically a reiteration of their current policy stance since last year in handling the virus crisis. So, there’s no change on that front.

Other than that, there’s not much urgency for them to make mention about the recent yuan strength all too much although there has been some degree of intervention (at least enough to cause state banks to purchase dollars) after the early moves last week.

In the past 30 days, the volume traded in Tesla shares far exceeds the volume of the SPY ETF and Apple shares.

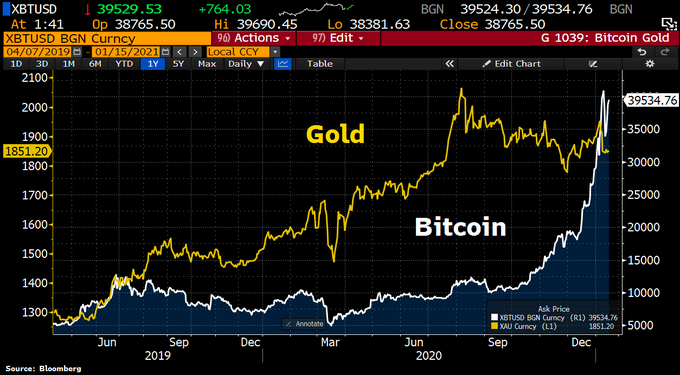

The comparison of two assets should always be done in relative terms, not absolute.

The short term lid on the US dollar

Comments from Westpac senior currency analyst Sean Callow quoted in a Reuters piece in response to Powell speaking on Thursday (US time).

- “Shorter-term, Powell just put a lid on the US dollar”

- “The baseline case is still for a substantial acceleration in the global economy, which historically has proven to be positive for most currencies against the USD, but I think there is potential to at least have a debate over whether us USD will be quite as weak as people expect. “