Archives of “January 14, 2021” day

rssMore than half of Americans between the ages of 18 and 29 live with their parents.

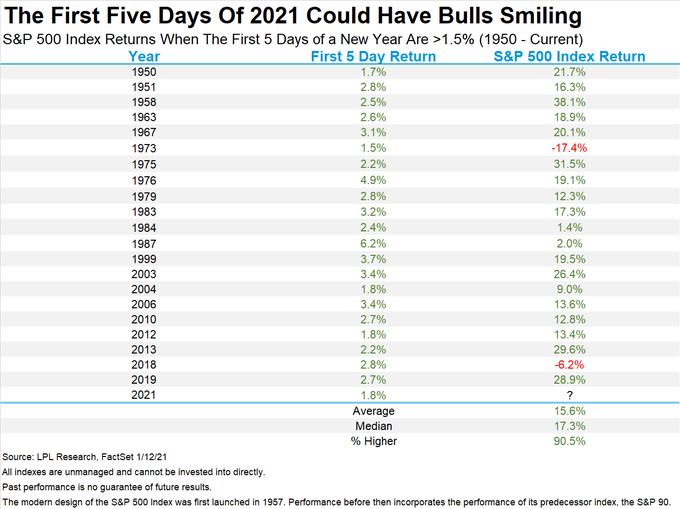

The January effect.

US initial jobless claims 965K vs 789K estimate

Initial jobless claims and continuing claims

- Prior report revised lower to 784K from 787K previously reported (minus 3K

- Initial jobless claims 965K vs. 789K estimate

- 4 week moving average initial claims 834.2 5K vs. 816K last week

- Continuing claims 5271K vs. 5000K estimate

- 4 week moving average continuing claims 5215.75K vs. 5274.75K last week

- Pandemic unemployment assistance claims 284K vs 161K last week

- Full report HERE

The jobless claims number is the highest since August 21 when claims were last above 1000 (at 1011K).

The jobless claims can have an impact around the holiday seasonals being out of whack. Also the extension of the benefits may have had an impact as well.

Nevertheless, the data is a worrisome trend. It also advances the storyline for the Fed to be on hold for a while still, and for Congress to pass more stimulus to counteract the impact from the Covid-19 spread.

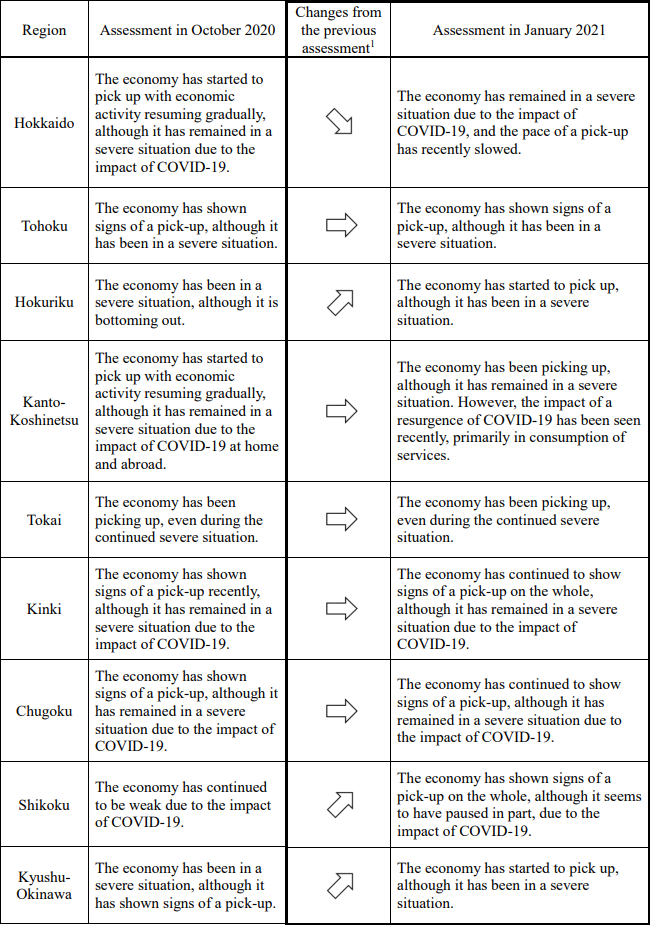

BOJ maintains economic assessment for 5 of Japan’s 9 regions

BOJ raises its assessment for 3 regions while cutting its assessment for 1 other region in its latest economic report

That said, with the reintroduction of state of emergency measures this month and the possibility of an extension to follow, that might temper with future assessments moving forward. The full report can be found here.

China December trade data, CNY terms: Exports +10.9% y/y (vs. expected +7.1%) & Imports -0.2% y/y (vs. +0.1%)

Yuan terms

China trade balance CNY 516.81bn

- expected CNY 457.8bn, prior was CNY 507.1bn

Exports BEAT at +10.9% y/y

- expected +7.1%, prior was +14.9%

Imports MISS at -0.2% y/y

- expected +0.1%, prior was -0.8%

USD terms

- China trade balance $78.17bn: expected $72bn, prior was $75.4bn

- Exports beat +18.0% y/y: expected 15.0%, prior 21.1%

- Imports beat +6.5% y/y: expected 0.1%, prior was -0.8%

China’s trade surplus with the US was USD 29.92bn for the month of December

- vs. 37.42bn in November

China’s trade surplus with the US was USD 316.91bn for the whole of 2020.

more to come

China has had its biggest daily jump in COVID cases in more than 10 months

New infections still on the rise in China.

- Hebei province reported 81

- Heilongjiang ( in northeast China) 43 (nearly 3 times the new case number reported yesterday)

China’s week-long Lunar New Year holiday is coming up from February 12 (holiday period will be the 11th to 17th), there is talk of suspending some manufacturing businesses ahead of the holiday to try to counter the spread.

Biden’s aid plan may be about $2tln, up $700bn from the $1.3tn Schumer asked for 6 hours ago

Biden’s stimulus plan is ballooning according to this item

CNN with the report citing two people briefed on the deliberations

An eye-watering jump to $2tln. This will give ‘risk’ a boost, but that will be offset by rising US yields …. recent moves suggest its the rising yields that’ll impact most.

Combine the roll out of vaccinations with these huge levels of stimulus and the boost for the US economy will be substantial.

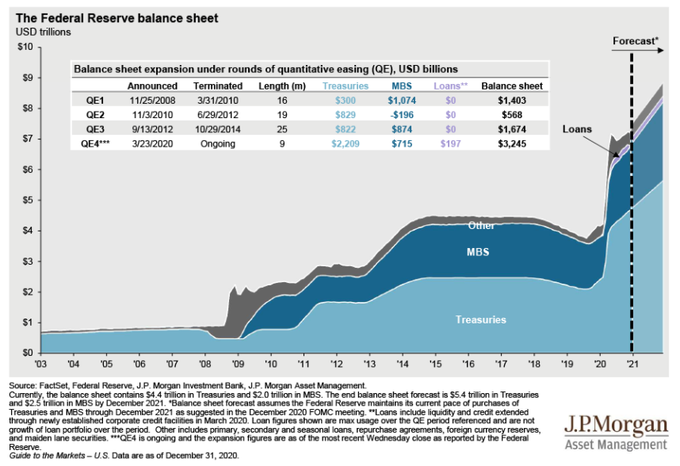

Plenty of Fed officials have been promoting talk of a tapering this year. How long can it be before rate hikes are considered (I am not suggesting this is imminent but US yields may very well do so).

Here is how the European Central Bank will cap the rising euro

ECB Governing council member Francois Villeroy de Galhaus (Governor of France’s central bank) spoke Wendesday.

He said (amongst plenty more) that the ECB needs the ability to exceed 2% inflation without it triggering monetary policy tightening

CIBC suggest that this is a piece of indirect jawboning that could help slow the rising EUR/USD

CIBC says the European Central Bank does not much room for more rate cuts and thus comments like this, allowing inflation to overshoot, is the best way to address the rising euro

stem the tide of EUR appreciation against the USD”

—

On a perhaps related note the Federal Reserve Vice Chair, Richard Clarida spoke afterwards and said the Fed too wanted to overshoot – wants inflation above 2% for a year (and achieving the employment goal) before hiking.

Schumer says Trump could be barred from running again

Interesting development

Democratic Senate leader Schumer says that a trial for Trump in the Senate likely won’t occur until after Biden takes over.

Many thought that would be the end of it but evidently not. Schumer said the trial will begin after January 19 and if he’s convicted, there will be a vote to bar him from running again.

That is a very interesting development, that would take Trump out of the 2024 equation. I imagine there might be 17 Republican Senators who want to be done with him. You can be Mitt Romney is one of them.