Archives of “January 12, 2021” day

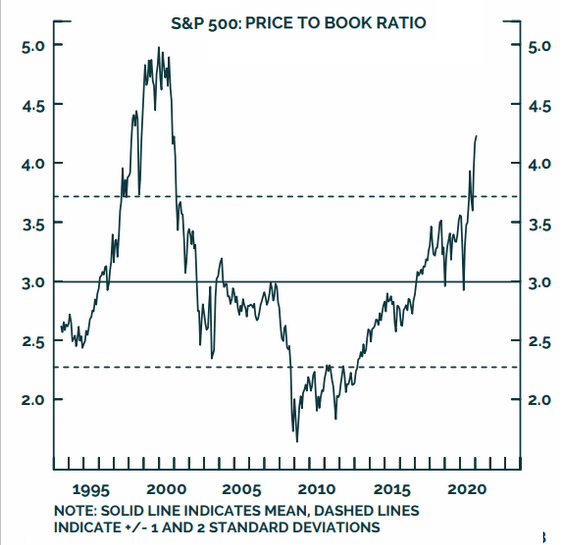

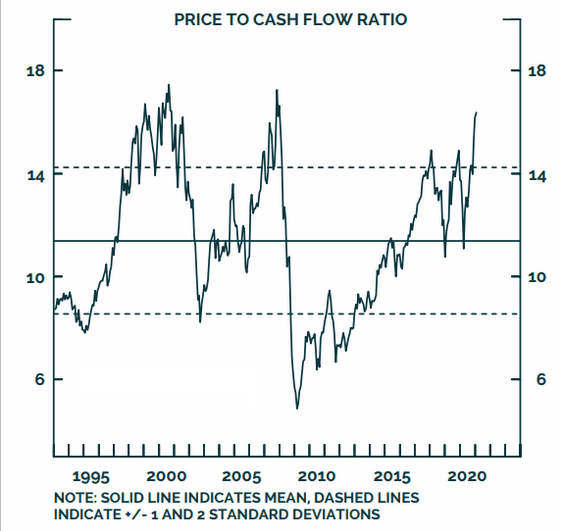

rssThe S&P 500 is currently trading at 17 times its cash flow.

Since 1990, personal income in the US has multiplied by 4. In this same period, the S&P 500 has multiplied by more than 10.

US 10-year yields continue to inch higher ahead of today’s auction

Where will real money land?

The US is raising $38B today via a 10-year auction at 1 pm ET. The bond market has been driving the bus in FX since the Georgia runoff and is increasingly driving it across broader markets.

Rates are up 3 bps and there’s no real barrier to a continued grind higher.

Interestingly though, there’s no follow-through in the US dollar today. I’ll be watching that closely.

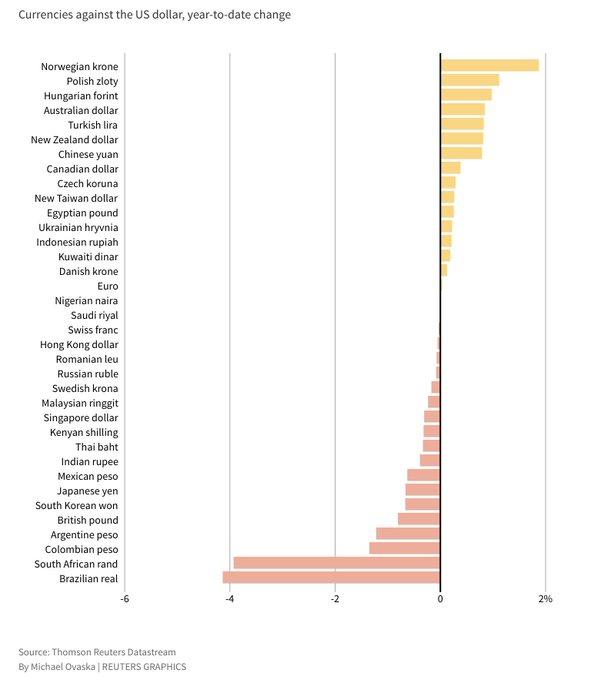

Top gainers/losers against the US dollar Thompson Reuters

10Y yields are up every day in 2021

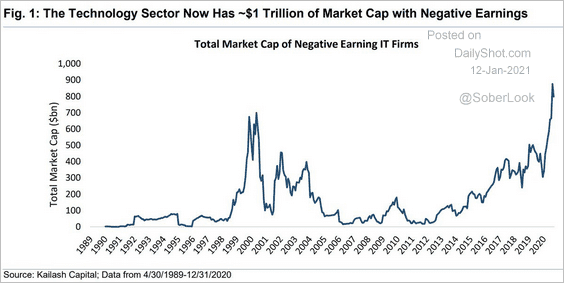

Negative earning tech firms by market cap. What a time to be a tech entrepreneur

The UK’s Sunak says the economy will get worse before it gets better

Rishi Sunak is the UK chancellor

ICYMI, he was speaking in the House of Commons, saying that while the vaccine provides hope, there was a need for tougher national restrictions to contain the spread of the virus and that this would have a “further significant economic impact”.

- and the economy is going to get worse before it gets better”

Guardian has more, although I’m sure there are other reports around in UK media should you prefer those.

Morgan Stanley is no longer looking for further USD weakness, turn neutral

MS had been looking for further weakness for the US dollar in the near term.

But have shifted the call now to neutral citing

- “an ongoing regime shift in US rates” (and the Fed could begin discussing normalisation in monetary policy as early as June this year)

- driven partly by “meaningful” fiscal expansion (The Democrat win in Georgia will result in further stimulus, MS looking for circa $1tln extra)

- also cite crowded short USD positioning

MS say they are seeking reasons to turn bullish.

US major indices close lower led by the NASDAQ index

The 1st down day in 5 trading sessions for the S&P

The major indices in the US are closing all lower. The Dow, S&P snap a 4 day winning streak. The NASDAQ closes down for the 1st time in 3 trading days. The Russell 2000 close lower for the 2nd consecutive day.

A look at the final numbers shows:

- S&P index -25.07 points or -0.66% at 3799.61. The high price reached 3817.86. The low price reached 3789.02

- NASDAQ index fell -165.54 points or -1.25% to 13036.43. The high price reached 13138.27. The low price extended to 12999.51

- Dow fell -89.28 points or -0.29% at 31008.69. The high price reached 31096.98. The low extended to 30832.06

Some of the big gainers today included:

- Doordash, +7.15%

- Nio, +6.46%

- US steel, +5.8%

- Walgreens, +5.53%

- Rite Aid, +4.72%

- General Motors, +4.46%

- Bristol-Myers Squibb, +3.98%

- Crowdstrike holdings, +3.88%

- Ford Motor, +3.33%

- Palantir, +3.06%

- Lam research, +2.89%

- AMD, +2.80%

- Nvidia, +2.52%

- Northrup Grumman, +2.23%

- Charles Schwab, +2.19%

- Corsair, +2.14%

- Exxon Mobil, +2.02%

- Pfizer, +1.75%

Big losers today included:

- Tesla, -7.91%

- Square, -6.61%

- Twitter, -6.43%

- Live Person, -4.74%

- Box, -4.3%

- Facebook, -4.01%

- Alibaba, -3.81%

- Albemarle, -3.7%

- Zoom, -3.4%

- Rackspace, -2.59%

- bookings, -2.47%

- Snowflake, -2.33%

- Apple, -2.32%

- Adobe -2.29%

- Alphabet, -2.28%

- Netflix, -2.19%

- Amazon, -2.18%

- PayPal holdings, -2.07%

- salesforce, -1.72%