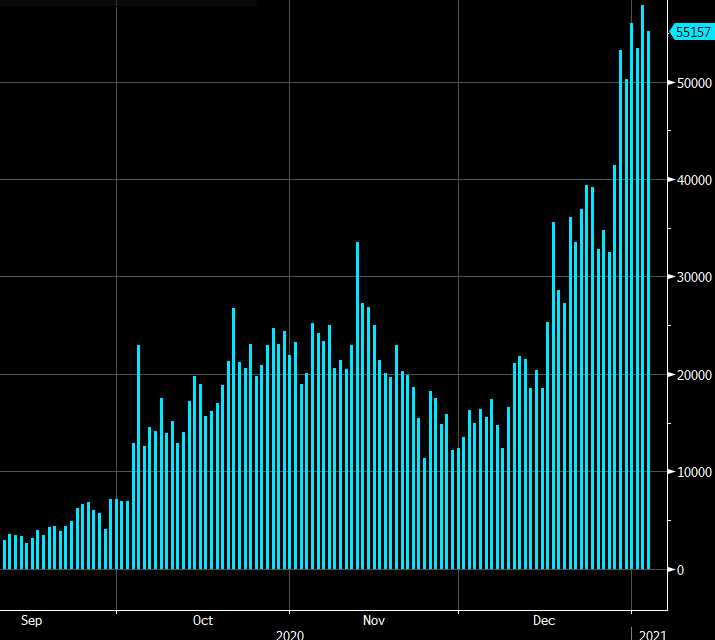

US cases remain high but pace of growth slows

This is another record in UK cases but it’s only marginally higher than two days ago.

Can we take any comfort in the plateauing of cases in the past week? I don’t because there’s usually a weekend effect on Mondays and we’ve got a record anyway. Given all the holiday mingling and lagged effects of symptoms, it’s tough to see any improvement in the near term, even with lockdowns.

At the present case, one in every 1200 people in the UK is being diagnosed positive every day.