Archives of “December 2020” month

rssJapan maintains its assessment of the economy for the month of December

No change to the main language for a sixth straight month

The Japanese government still sees economic conditions as ‘severe’ though they are seeing some signs of improvement in trade, corporate earnings and bankruptcies. However, they lowered their assessment for private consumption.

A senior US senator says the Russia hack of US Treasury is worse than initially thought

A statement to the Wall Street Journal from the ranking Democrat on the Senate Finance Committee, Sen. Ron Wyden

- Suspected Russian hackers compromised dozens of Treasury Department email accounts

- had broken into systems in the Treasury Department’s Departmental Offices division, home to the highest-ranking officials

- Treasury Department still doesn’t know all of the activity the hackers engaged in or precisely what information was stolen

The above is the gist of the Journal report, but here is the link if you’d like more.

The US has further restricted visas for China

The US has brought in further additional visa restrictions on Chinese officials

Secretary of State Pompeo said the restrictions affected officials believed to be responsible for or complicit in repressing religious practitioners, ethnic minority groups, dissidents and others.

“China’s authoritarian rulers impose draconian restrictions on the Chinese people’s freedoms of expression, religion or belief, association, and the right to peaceful assembly. The United States has been clear that perpetrators of human rights abuses like these are not welcome in our country”

And these actions do not yet appear over, U.S. Department of Homeland Security chief Chad Wolf said it too was looking at further restrictions on China, including:

- tighter visa curbs on Chinese Communist Party members

- a broader ban on goods made with forced labor

Deutsche Bank argues that COVID-19 vaccine is USD positive

A Friday note from DB on how the coronavirus vaccine will impact on the USD. Its a no question positive for the dollar the analyst argues:

- If the vaccine fails (DB thinks this is a low probability likelihood) to lead to ‘herd immunity’ it would reverse the risk-on trade and strengthen the dollar

- But, if the vaccine proves to be effective it will cause the Federal Reserve to tilt to less dovish, prompting a stronger dollar (by pulling forward “not only a retreat in QE, but a rate hike expectations”)

As for timing:

- the optimistic vaccine scenario “is not likely to be a factor for at least three months”

- “This leaves a decent time gap of at least 3 months for the market to trade in ‘vaccine smile’ terrain that remains risk-positive and weighs on the USD – where there is great promise of a strong global growth rebound, but without the policy penalty of tighter policy”

Here’s a bank saying Bitcoin could reach $650,000 …. or it could fall (yes, really)

Scanning across some bank pieces, this from JP Morgan:

- Alternative ‘currencies’ such as Gold and Bitcoin have been the main beneficiaries of the pandemic in relative terms growing their assets (for investment purposes) by 27% and 227%, respectively”

JPM then go on to say that if investors (and in particular increased institutional adoption) continue to pour into the crypto the price could reach $650K US

On the other hand say JPM, a slow down in funds coming into BTC could trigger a price correction lower.

There you go ….

BTC update:

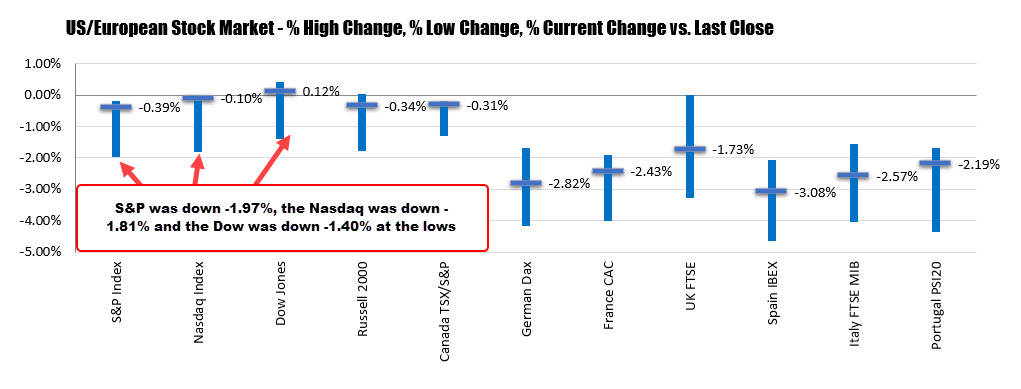

Broad indices close lower but well off the worst levels of the day

Dow closes marginally higher

The US border indices are closing lower on the day but well off the worst levels. The Dow industrial average is closing marginally higher.

A look at the final numbers are showing.

- S&P index fell -14.47 points or -0.39% to 3694.94

- NASDAQ index fell -13.122 points or -0.10% to 12742.53

- Dow rose 36.94 points or 0.12% to 30215.99

Although the broader indices close lower, the gains off the lows were impressive.

- The S&P index was down -1.97% the lows

- the NASDAQ index is down -1.81% the lows

- the Dow industrial average was down -1.4% at the lows

Despite the declines in the S&P and NASDAQ, the come back off the lows was significant.

Thought For A Day