Archives of “December 2020” month

rssBOJ December monetary policy meeting Summary of Opinions

Bank of Japan Dec 17 and 18 policy meeting summary

Main Headline points via Reuters:

- BOJ must examine extending deadline, possibly expand content, of fund-aid programme timing with compilation of govt’s new stimulus package

- important to examine BOJ’s monetary easing as pandemic means it will take even more time to achieve BOJ’s price goal

- good to eye March meeting in laying out findings of BOJ’s policy examination as it will focus on operation of current framework

- BOJ must comprehensively review anew what strategy it should take in hitting its price goal

- BOJ must examine its strategy, policy means and communication to ensure japan does not return to deflation

- BOJ doesn’t need to tweak YCC, can also maintain its commitment including its pledge to hit 2% inflation

- BOJ must examine pros and cons of its policy, must seek ways to enhance sustainability, effect of its policy as needed

- BOJ must seek ways to more flexibly adjust its ETF buying as its monetary easing is prolonged

- BOJ must be ready to effectively respond to changes in economy, financial conditions by heightening sustainability of YCC, asset buying via more flexible operation

- more meticulous control of yield curve will become necessary as moderate steepening of yield curve has some merits

- important for BOJ to take swift, effective policy response in coordination with govt, other central banks

- appropriate for BOJ to cut short, long-term yield targets, strengthen commitment on monetary easing

- BOJ must help companies achieve sustainable growth, creating bigger corporate bond market important

- BOJ must continue to keep eye out on risks including abrupt moves in FX market

- there is considerable risk japan will return to deflation

More of the same from the Bank, there is no indication of any winding back of easing. The BOJ highlight March as a meeting to watch for perhaps even more.

Interesting the summary makes specific mention of ‘abrupt moves in FX’. This is code for strengthening yen, the BOJ does not want the yen to gain and will attempt to jawbone it lower if it does. You may recall the news from last week that Prime Minister Suga has drawn a line in the sand at 100 for USD/JPY.

Here’s the official confirmation Trump has signed the coronavirus relief bill

US press says Trump has indicated he will sign coronavirus stimulus bill

The Washington Post with the reoprt:

- Trump has indicated that he will sign the stimulus bill into law … two people familiar with his plans said Sunday evening

If you need a giggle, the piece goes on (bolding mine):

- The people spoke on the condition of anonymity because the matter remained fluid and they weren’t authorized to disclose Trump’s plans. They said Trump had repeatedly changed his mind on the matter.

The bottom line is no-one knows until the next tweet hits. From January 20 there will be an adult presence in the White House, so at least there is that.

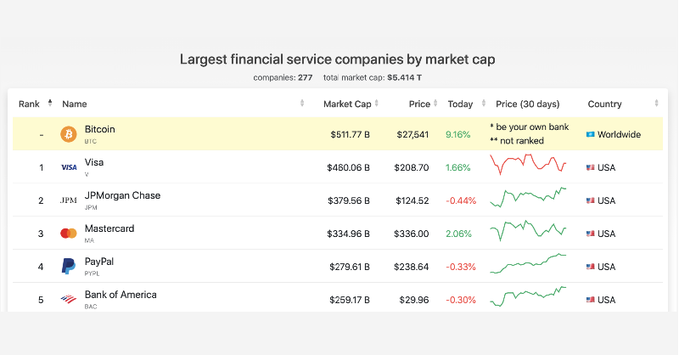

#Bitcoin has ranked as the largest financial service in the world based on market cap.

Coming up – the European Parliament will meet on December 28 to discuss the Brexit trade deal

During European time, of course, but something to keep an eye open for.

With the agreement being finalised just prior to Christmas the European Parliament has indicated its will not have time to hold an emergency voting session before December 31. Instead, they plan to apply the EU-UK agreement provisionally. That’s what today’s meeting is about.

Background:

- Brexit deal done, UK parliament to vote Dec 30

In addition to the UK parliament voting every one of the EU member states has to sign off on the agreement. Once done the deal goes to the European Parliament for members to vote on ratification of the deal.

Monday morning open levels – indicative forex prices – 28 December 2020

Good morning, afternoon or evening to all ForexLive traders and welcome to the start of the new FX week – the final one for 2020.

On a Monday morning, market liquidity is very thin until it improves as more Asian centres come online – and its even less liquid than usual today due to the holiday mode many liquidity providers are in.

Prices are liable to swing around on not too much at all, so take care out there.

Guide:

- EUR/USD 1.2188

- USD/JPY 103.56

- GBP/USD 1.3574

- USD/CHF 0.8883

- USD/CAD 1.2848

- AUD/USD 0.7601

- NZD/USD 0.7105

Thought For A Day