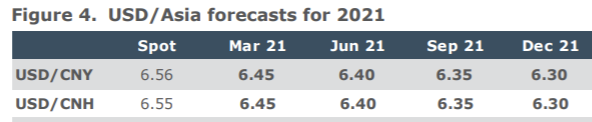

ANZ look for lower USD/CNH and, more generally, are bullish on Asian currencies for 2021

- and it is not just because of a weaker dollar, though it helps.

There are three key drivers … a winning trifecta that will see Asian currencies appreciate further next year:

1. the region’s relative success in virus containment.

- This means when the global vaccine roll-out eventually begins, eradicating the virus can be achieved more quickly, thus allowing a faster normalisation of activity.

2. the improved global growth prospects next year bodes well for Asian exports and the broader investor risk sentiment.

3. Asia should benefit from increased foreign investor allocation into the region, given ample global liquidity and a better growth outlook.

More specifically for the Chinese yuan:

- forecast CNY to strengthen towards 6.30 by the end of 2021, on the back of factors such as strong growth momentum, the PBoC looking to exit unconventional easing, and strong inflows on the back of bond index inclusion.

![🔥 [URGENT] => The real secret to Month weight loss challenge and weight loss meals for dinner appear to be entirely excellent. Follow the picture to discover more while you still can. This terrific limited time offer will be no longer available by Friday this week.](https://i.pinimg.com/236x/b5/43/e5/b543e5da37b75cff5ccdeae9245dc1d8.jpg)