A trade deal was agreed but negotiations won’t stop there

Although both sides have come to some agreement on trade, Brexit isn’t quite over just yet as we look towards the new year.

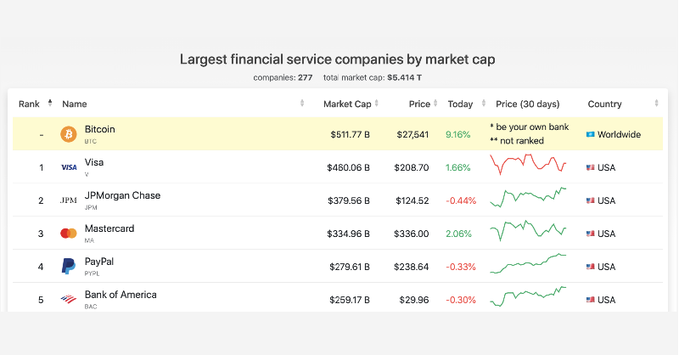

While there is an agreement for zero tariffs on trade of goods, just be reminded that there is no agreement whatsoever on services – and that includes financial services.

As things stand, the Commons will vote on the Brexit deal on 30 December with the EU set to also ratify the deal some time in early January (presumably next week).

All that is a formality but thereafter, we are likely to see further negotiations to try and broker a deal on financial services. That said, expectations are low for anything substantial.