Archives of “December 21, 2020” day

rssFrom Darvas – ‘How I Made $2 Million…’ Make sure you have solid sell rules that you stick to and control euphoria so you avoid that last sentence.

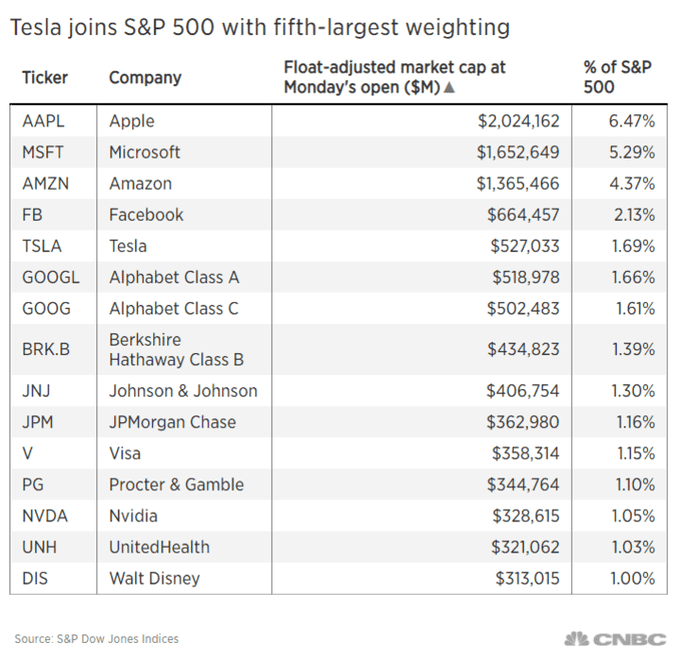

Tesla enters the S&P 500 with a weight of 1.69%, the fifth largest share of the index (sixth largest company after Alphabet).

Iron Ore flying in China market (Dalian) – Friday landslide at Vale mine

There was another accident at a Vale mine on Friday, leaving one person dead.

Iron ore has been on an uptrend and that is continuing in China today, and on other exchanges also.

Iron ore is a key Australian export to China and so far been it has remained unattacked by Chinese authorities trade war on Australia.

UK Lloyds Business Barometer for December -4 (prior -21)

That is the biggest one-month gain in 4 years.

Lloyds:

- “The news of the vaccine progress has bolstered this month’s confidence figures, more than offsetting uncertainties around the UK’s new trading relationship with the EU”

- 32% of firms it surveyed expected to cut staff next year

- 22% planned to increase numbers

—

Survey of 1,200 firms conducted between November 25 and December 10.

Yellen being told to endorse a strong US dollar

Previous Chair of the Federal Reserve System Janet Yellen is to be incoming President Biden’s Treasury Secretary.

Some dudes are lining up already to give her advice.

Larry Summers, who was Treasury secretary under Bill Clinton and national economic adviser under Barack Obama, said:

- “It would be unwise to appear actively devaluationist or indifferent to the dollar,”

Hank Paulson, who served as Treasury secretary under George W. Bush, made the same point.

Via a Bloomberg piece, more here if you are interested.

Janet Yellen does not need advice on how to do her job from these chaps.

Japanese Prime Minister Sugua has painted a target on USD/JPY – don’t let it fall under 100

PM Suga has told officials at Japan’s Ministry of Finance not to let USD/ yen drop under 100

Japanese media, Nikkei with the info:

- “Make sure the yen-dollar exchange rate does not cross the 100 yen mark”

- confirmed by multiple sources

- came with an unspoken message: Be prepared to sell yen for dollars in case the Japanese currency breaches the key threshold.

- Suga’s willingness to consider an intervention — an option often seen as a last resort — took many by surprise.

Suga’s order came just after US election day.

Economic calendar due from Asia today – PBOC interest rate setting

0130 GMT – China’s 1- and 5-year Loan Prime Rate (LPR) is today.

The LPR is set in reference to the rate on the PBOC’s medium-term lending facility (MLF), its a lending reference rate set monthly by 18 banks with a spread above the MLF.

At the previous monthly setting :

- 1 year loan prime rate was set at 3.85%

- 5-year LPR at 4.65%

There are no expectations of any change today.

Also coming up during the session:

0001 GMT UK Lloyds Business Barometer for December, November was -21. Its not generally much of an FX rate mover upon release but nevertheless offers a glimpse into business confidence in the UK, where coronavirus and Brexit are twin challenges.

0110 GMT Bank of Japan Japanese Government Bond purchase operation.

0200 GMT New Zealand Credit Card Spending for November

- priors +1.5% m/m and -6.3% y/y

Thought For A Day