Archives of “December 16, 2020” day

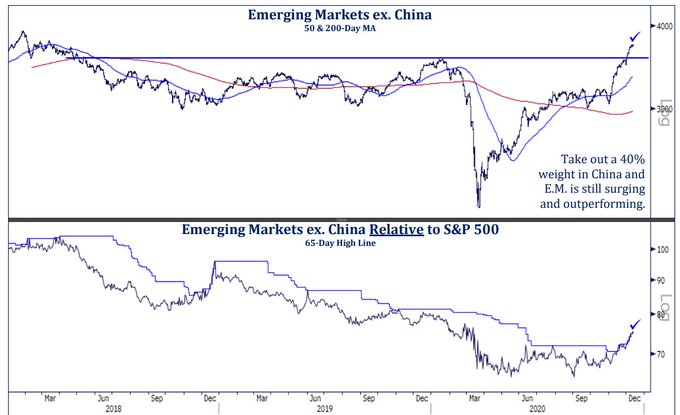

rssTwo big bases for 2021.

E.M. ex. China remains strong.

S&P as overbought as December 2009.

EIA weekly oil inventories -3135K vs -2200K expected

Weekly US oil inventories

- Prior was +15,189K

- Gasoline +1020K vs +1874K exp

- Distillates +167K vs +850K exp

- Refinery utilization -0.8% vs +0.5% exp

Private oil inventories from late yesterday:

- Oil +1973K

- Gasoline +828K

- Distillates +4762

The EIA numbers are less-bearish than the private numbers and that’s given crude a small lift but it’s still flat on the day at $47.65.

CME to launch Ether futures

More crypto news

About 140,000 people in the UK have been vaccinated so far

An update to the vaccine situation in the UK after the rollout on 8 December

There are 137,897 people that have received the first dose of the Pfizer vaccine so far across the UK, with lawmaker, Nadhim Zahawi, tweeting out that:

A really good start to the vaccination program. It’s been 7 days and we have done: England: 108,000 Wales: 7,897 Northern Ireland: 4,000. Scotland: 18,000 U.K Total 137,897. That number will increase as we have operationalised hundreds of PCN (primary care networks)

The number is going to pick up once the procedures are standardised and more vaccines are introduced to the general public. But this serves as a reminder that it is going to take a long time for this to have a major impact on the health crisis.

There are more than 52 million adults in the UK so while the vaccination program has kicked off, this weekly figure is still far too low for now.

Also, this is just the first dose of the Pfizer vaccine. Those who had it will require a second dose after 21 days. So, that may yet double any expected timeline.

Congressional leaders ‘on the brink’ of a stimulus deal – report

Politico report

Sherman earlier said he thought a deal was coming. The outline of this began to come together yesterday and last night there were positive comments from both sides.

The direct payments are a bit of a surprise and should boost the consumer and risk assets but the price tag is still $900B so that means something else is missing.

Nikkei 225 closes higher by 0.26% at 26,757.40

Asian equities keep higher on the day

Japanese stocks close near the lows but maintained its advance alongside equities in the region, as sentiment stays bolstered by US stimulus hopes among other things.

After the monstrous November rally, the Nikkei appears to be taking a breather and consolidating at the highs for the year currently.

The Hang Seng is up 0.9% while the Shanghai Composite is up 0.2% going into the closing stages of the day. S&P 500 futures are more flat so far ahead of European trading.

In the currencies space, the dollar is mostly little changed across the board and trading more mixed for the time being. USD/JPY is keeping lower though, around 103.50 and nears the early November lows around 103.35.