According to Fox’s Gasparino

According to Fox’s Charlie Gasparino, Sen. Mitch McConnell is to unveil a $900 billion GOP stimulus around 3 PM.

Gasparino adds:

- Evaluating liability protections

The Dems are likely looking for more, but the proposed bipartisan $900 billion package (don’t know if this is the same), at least stirred the embers a bit from both sides of the aisle.

The US employment statistics on Friday were weaker than expected and the trends into the new year are not great with the surge in Covid cases and the potential for more lockdowns. The airline/travel, restaurant, entertainment industries remain depressed.

UPDATE: There is a separate report that this is false.

- S&P index is trading down -3.81 points.

- The NASDAQ index is up 47 points the

- Dow industrial average is down 111 points

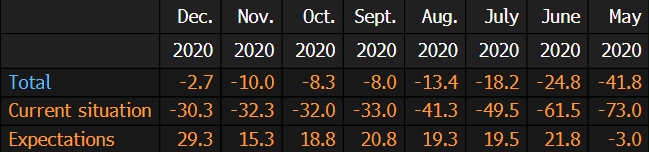

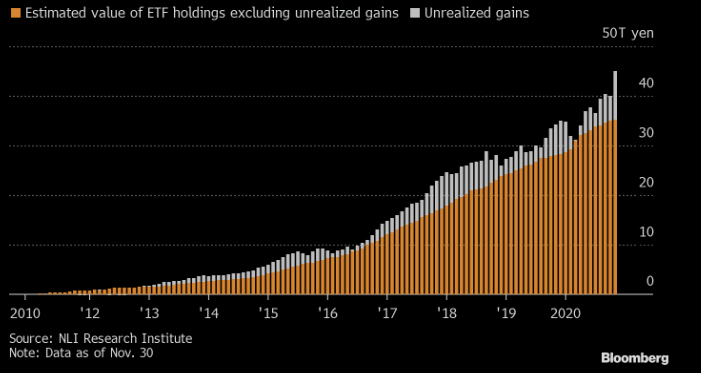

BOJ equity holdings

BOJ equity holdings