Archives of “December 4, 2020” day

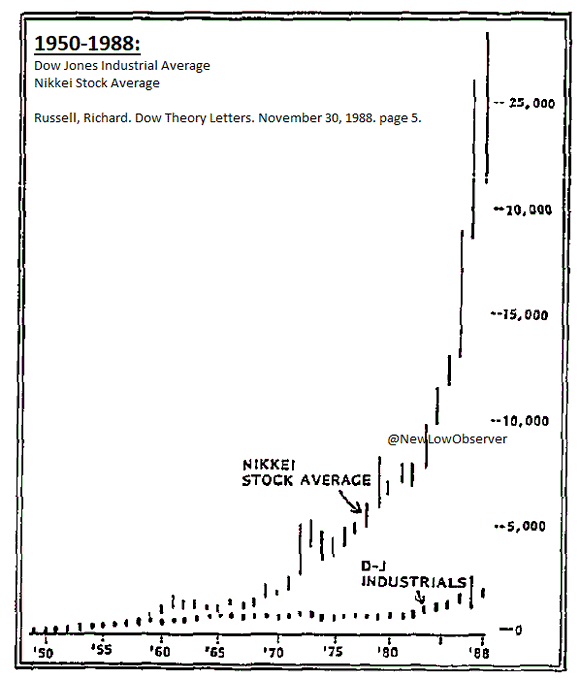

rss1950-1988: Nikkei Stock Average v. DJIA

464 shares of the S&P 500 closed with gains for the month of November.

Billionaires have increased their fortunes by more than a trillion dollars since the pandemic began.

Dow Jones 30 vs. Oro.

Projected capitalization of the stock exchanges for the year 2030.

Eurostoxx futures -0.2% in early European trading

Tepid tones observed in early trades

- German DAX futures -0.2%

- UK FTSE futures +0.4%

- Spanish IBEX futures flat

This largely reflects similar tones to yesterday, with UK stocks still benefiting from the vaccine news from earlier this week as well as some Brexit optimism; although the latter has been slightly tempered with since late trading yesterday.

S&P 500 futures are up 0.2% but not really doing a whole lot so far today.

The US has slashed visas for members of China’s Communist Party from 10 years to 1 month

Posting as an ICYMI on a move to substantially restrict travel to the United States by members of China’s ruling Communist Party and their families.

- The new policy reduces the maximum validity length of the B1/B2 non-immigrant business and tourist visas for party members and their immediate family members from 10 years to one month

- the US State Department said the measure was aimed at protecting the nation from the party’s “malign influence,”

China, unsurprisingly, says the visa changes are an “escalated form of political oppression”

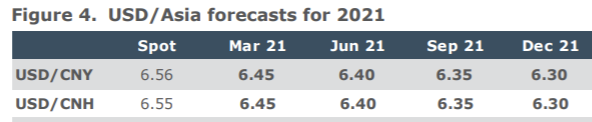

An ANZ ‘top trade’ for 2021 is for a stronger yuan – 3 key drivers of higher Asian currencies Thu 3 Dec 2020 23:23:25 GMT

ANZ look for lower USD/CNH and, more generally, are bullish on Asian currencies for 2021

- and it is not just because of a weaker dollar, though it helps.

There are three key drivers … a winning trifecta that will see Asian currencies appreciate further next year:

1. the region’s relative success in virus containment.

- This means when the global vaccine roll-out eventually begins, eradicating the virus can be achieved more quickly, thus allowing a faster normalisation of activity.

2. the improved global growth prospects next year bodes well for Asian exports and the broader investor risk sentiment.

3. Asia should benefit from increased foreign investor allocation into the region, given ample global liquidity and a better growth outlook.

More specifically for the Chinese yuan:

- forecast CNY to strengthen towards 6.30 by the end of 2021, on the back of factors such as strong growth momentum, the PBoC looking to exit unconventional easing, and strong inflows on the back of bond index inclusion.

Moderna is bullish on COVID-19 vaccine availability

The company affirms its expectation to have 20m coronavirus vaccine doses available in the US by the end of 2020

- and expects to have between 100-125m doses available globally in Q1 of 2021

And:

- study shows its vaccines has the potential for durable immunity, phase 1 participants high levels of antibodies after 119 days