Archives of “October 2020” month

rssPBOC reportedly asks banks to neutralise counter-cyclical factor in CNY fixing formula

Reuters reports on the matter

Spain says that it will raise corporate, wealth taxes

Spanish deputy prime minister, Pablo Iglesias, remarks

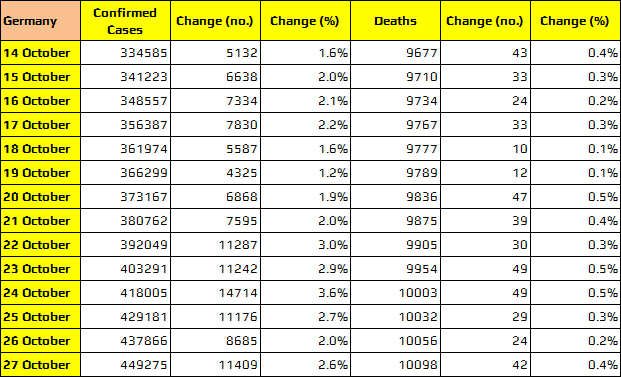

Germany’s Altmaier says will likely see 20,000 new daily virus cases at the end of the week

Comments by German economy minister, Peter Altmaier

- Number of new infections in Germany is growing exponentially

Nickel and Copper set to gain on electric vehicle surge

Commodities set to gain on green car shift

The rise of electric vehicles is gaining pace with more and more vehicles available and a growing infrastructure to support them. According to Morgan Stanley electric-car sales are seen to boost Nickel the most of all the commodities used in producing an electric vehicle. Here is a rundown of how they see this panning out:

Electric vehicles represent a new demand factor for Nickel which is only set to grow. They anticipate an exponential growth over the next 5-10 years from present levels of around 3%. Morgan Stanley expect a growing deficit after ‘years of underinvestment’ in new mine output, which should help support prices.

Cobalt to lose favour

Over time Cobalt is going to be filtered out of Electric vehicles batteries over the next decade in preference to Nickel. The demand for cobalt is expected to reach 71 kt by 2025 and then to drop down to 60kt by 2030.

Copper should gain

Electric Vehicles are thought to account for 9.4% of copper demand by 2030 compared with the current level of 2.4%.

Manganese set to benefit from Tesla demand

Tesla’s new manganese rich batteries are set to drive demand for manganese too.

So, over the medium to longer term there is upside pressure for copper, Nickel and Manganese

15 Trading Lessons from the The Big Short

It’s possible to be right about a market move, but your timing can be too early.

It’s possible to be right about a market move, but your timing can be too early.- If you trade too big, you can lose all your capital before you have the time to be proven right.

- AAA agency ratings are more to make their clients who sell bonds happy than to protect investors.

- In markets that are not liquid, you can get in trouble by being right but your assets not reflecting it with a big move.

- When there is no risk of ruin to bankers and mortgage brokers they will risk the ruin of their companies and the world economy in pursuit of quick and easy money.

- When there is little ‘skin in the game’ bankers and mortgage brokers take risks that they are not held accountable for.

- Macro traders have to be able to take a lot of heat and losses on their positions before they are right.

- Hedge fund investors want consistent returns on their money and not drawdowns. They are quick to pull their money out during a losing streak.

- You want to have a large risk/reward ratio on your trades. Betting $1 for a chance to make $20 is a good trade.

- There is a lot of fraud in the financial world.

- Financial fraud is almost never prosecuted in the banking world.

- The SEC has little oversight in the banking industry.

- Bailouts can cause you to lose on a trade you would have made money on.

- You have to take your profits off the table while they are available.

- “Whenever you find yourself on the side of the majority, it is time to pause and reflect.” – Mark Twain

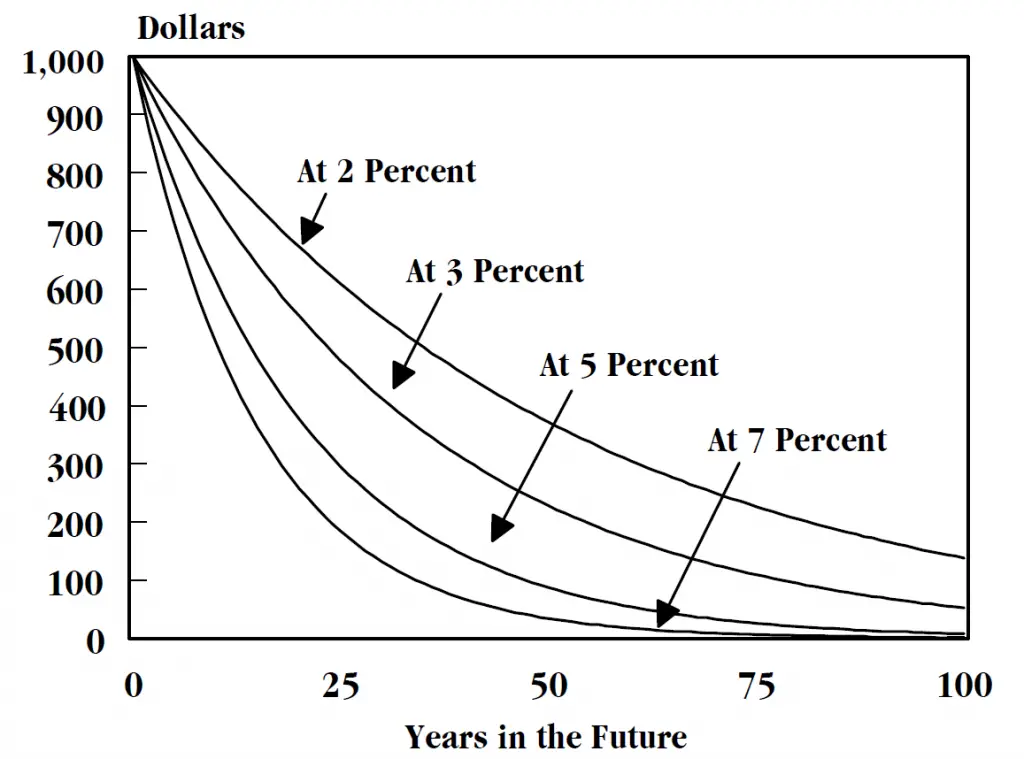

The time value of money formula is:

FV = PV x [ 1 + (i / n) ] (n x t)

- FV = Future value of money

- PV = Present value of money

- i = interest rate

- n = number of compounding periods per year

- t = number of years

One of the biggest filters to calculate the destruction of the value of money into the future is the current rate of inflation on a currency.

Germany reports 11,409 new coronavirus cases in latest update today

The trend resumes after the ‘Monday effect’ seen yesterday

It’s possible to be right about a market move, but your timing can be too early.

It’s possible to be right about a market move, but your timing can be too early.