Thought For A Day

The major European stock indices spiraled to the downside today as Covid cases are soaring and restrictions are being implemented. The provisional closes are showing:

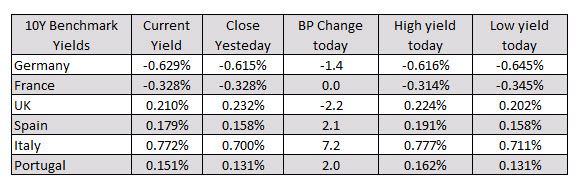

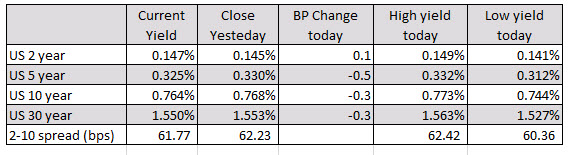

A look at other markets as London/European traders look to exit shows:

A look at other markets as London/European traders look to exit shows:

.jpg)

Hedge fund are reported to have purchased crude futures and options at the fastest rate for six months as portfolio managers grow in confidence that OPEC+ will delay their scheduled output increases until demand is stronger. Net position on crude has increased over the two most recent weeks to 464 million barrels rising from a low of 380 million on October 06. The net position is now in the 44th percentile for all weeks since the start of 2010 up from the 26th percentile on October 06.

What’s the trigger for this

Well, it is rising COVID-19 cases hitting oil demand. Yesterday, OPEC’s chief said that rising infections may delay oil’s recovery. The funds are getting one step ahead expecting OPEC+ to delay cuts to support oil prices. As things currently stand OPEC+ is scheduled to increase production by almost 2 million barrels per day in January.

When might they do this?

The JMMC meeting is due November 17 and OPEC+ are due to meet in November 30/December 01. So, a buy in oil could make sense for some traders in the run up to the meeting. Certainly after the US elections, as the risk is that the USD takes a bull run on a surprise Trump victory. However, a Trump victory is the outlier result.