Archives of “October 2020” month

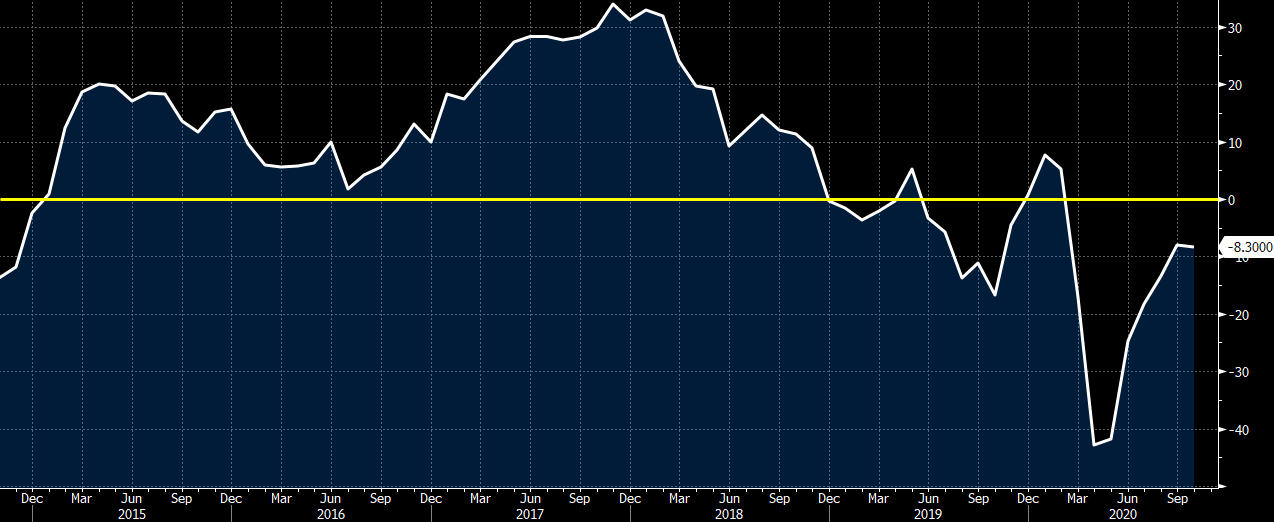

rssEurozone October Sentix investor confidence -8.3 vs -9.3 expected

Latest data released by Sentix – 5 October 2020

- Prior -8.0

Investor morale is seen dropping but less so than anticipated, though the fall adds to yet more question marks surrounding the pace of the recovery in the euro area and if it can be sustained towards the closing stages of the year.

Eurozone September final services PMI 48.0 vs 47.6 prelim

Latest data released by Markit – 5 October 2020

- Composite PMI 50.4 vs 50.1 prelim

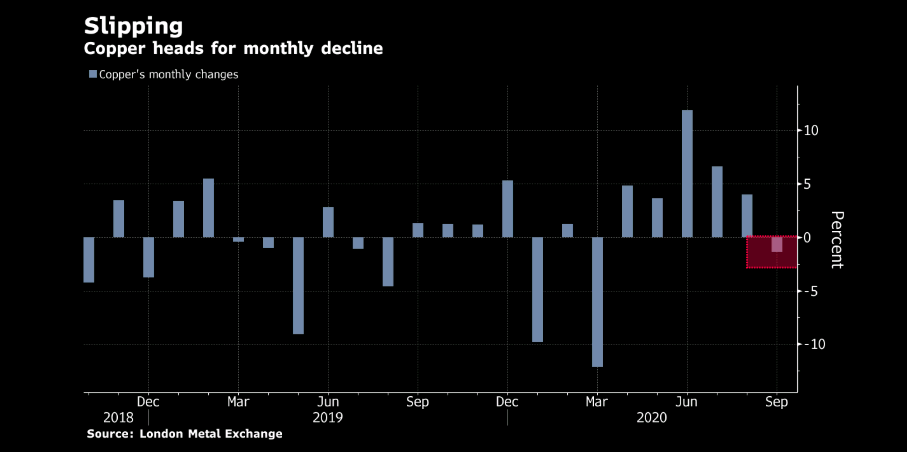

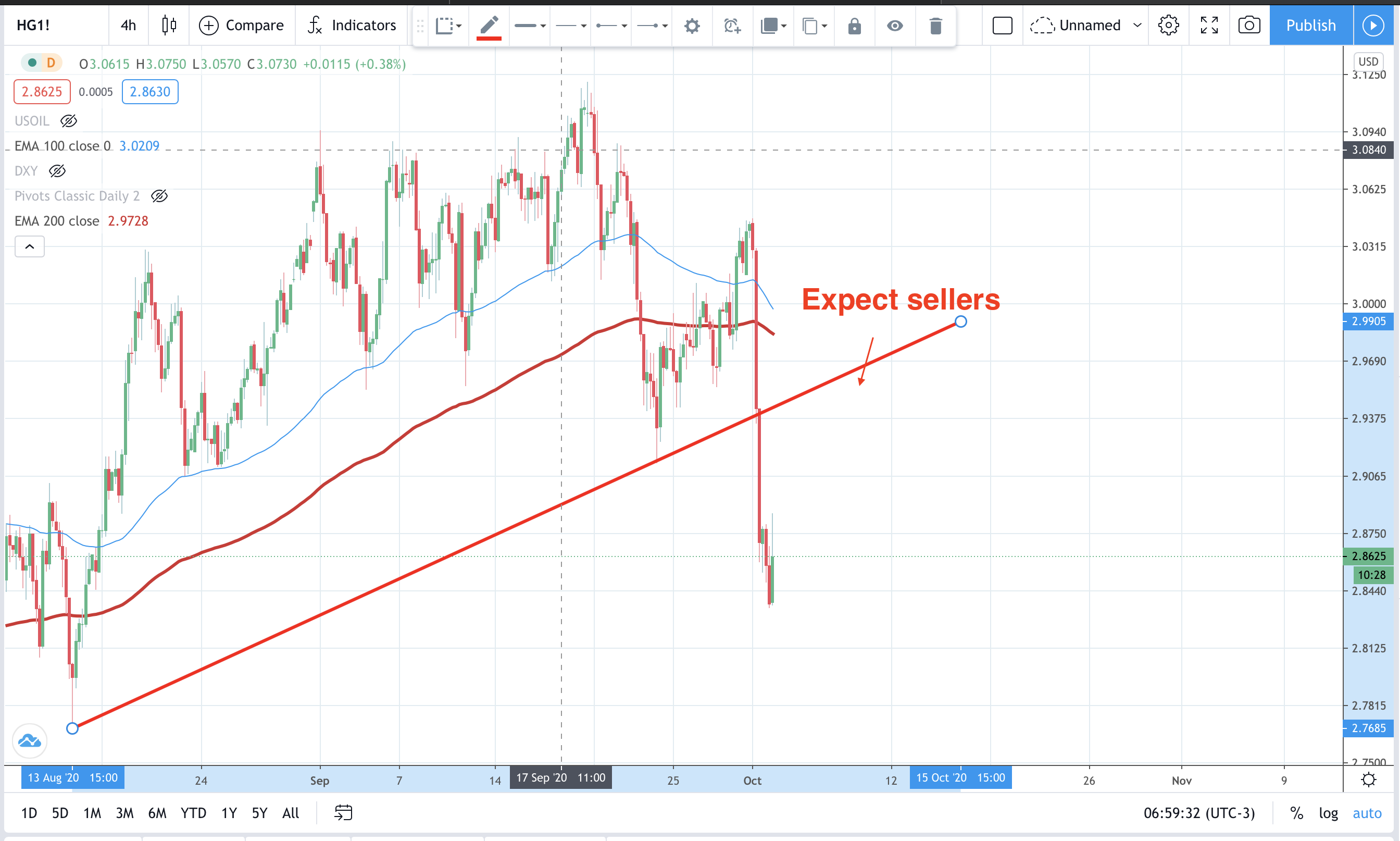

Meltdown in Copper to continue ?

Copper sellers on pullbacks?

Copper prices took a tumble last week as Copper took its first monthly decline in 5 months.

Rising COVID-19 cases and falling expected global demand has been the reason. Furthermore, mine output is now increasing.

According to a Bloomberg Intelligence Analysts reports copper mining output will rise 3.5% from 2021 to 2023 after a fall of almost 3% in 2020 based on individual forecasts for 127 mines covering 80% of the global industry. A key quote from the report is that ‘While growth on a sequential basis tails off as each successive year passes, the market’s ability to digest this new supply will be put to the test quickly’.

Stockpiles increasing

Last week LME Copper stockpiles hit two month highs. Copper inventories tracked by the London Metal Exchange jumped by 33,200 tons to 136,325 tons. This put copper inventories at their highest last week since late July.

Strike risk from Escondida

One area to watch for short term copper sellers is if there is a strike in the world’s largest copper mine, Escondida. It is located in Northern Chile. Here is a picture of it.

The Union members have rejected Escondida’s final offer in wage talks and the BHP owned operation have requested a five day mediation period. These talks could be extended but a shutdown in the mine could offer copper some near term support.

The big picture for copper remains bullish as green technology is going to be heavily dependent on copper. Once global growth gets back in track you would expect copper gains. However, for now it is reasonable to expect sellers on pullbacks for the short term.

Nikkei 225 closes higher by 1.23% at 23,312.14

A positive day for Asian equities

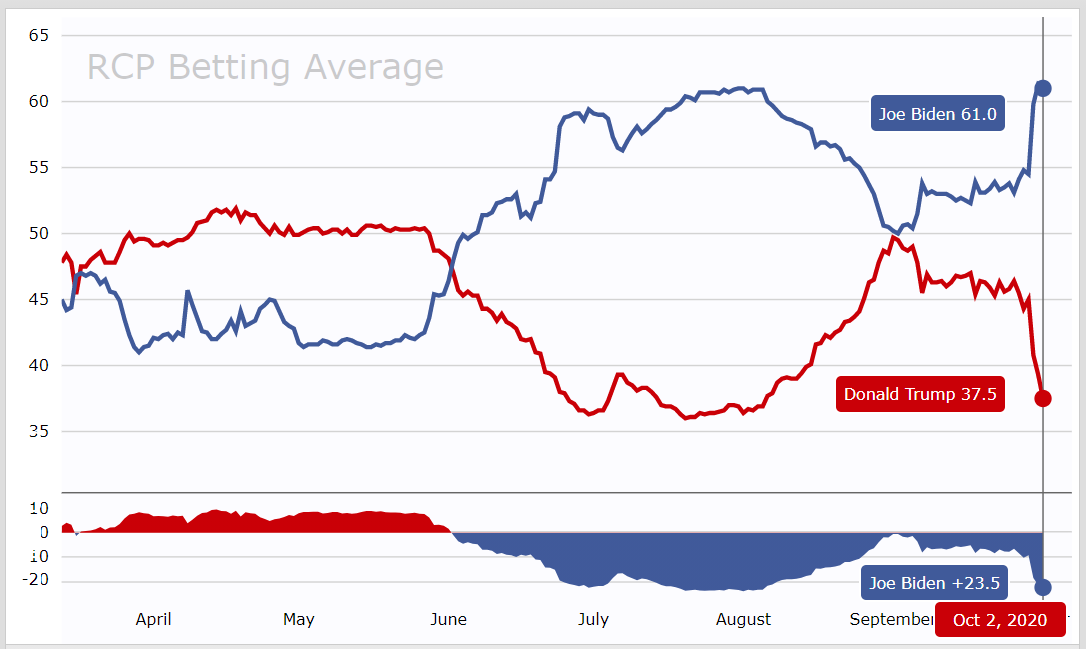

Odds for a close US election may have declined – Citi

Citi says that Trump’s health condition may mean a less closely contested election ahead of the November vote

The betting markets are showing a Biden win, but awaiting an update

This is via Real Clear politics but I’m awaiting a clearer picture after weekend developments on, specifically, Trump’s COVID-19 infection progress.

Currently the picture is stark – a Biden win and its not even close. Polling is showing similar. Back in 2016 Clionton’s lead was not this big at this stage.

3 warning signs Trump may be sicker than we are being led to believe

Disentangling information and misinformation on Trump’s condition is complex, there is so much political spin involved.

- “I think today’s news means he’s sicker than I thought he was on Friday and Saturday,” said Nahid Bhadelia, the medical director of Boston Medical Center’s Special Pathogens Unit.