Archives of “October 2020” month

rssEuropean shares in the session mixed. Higher for the week

German DAX unchanged on the day. Spain’s Ibex lower on coronavirus concerns

The European equity markets are closing for the day with mostly higher results. The German DAX did underperform enclosed unchanged on the day. The provisional closes are showing:

- German DAX, unchanged

- France’s CAC, +0.6%

- UK’s FTSE 100, +0.7%

- Spain’s Ibex, -0.5%

- Italy’s FTSE MIB, unchanged

For the week, the major indices all moved higher:

- German DAX, +2.8%

- France’s CAC, +2.4%

- UK’s FTSE 100, +2.0%

- Spain’s Ibex, +2.9%

- Italy’s FTSE MIB, +2.7%

Silver rises by 5% on the day

Rises to $25.06

The price of silver has moved up to a high price of $25.06. That has taken the price over 5% on the day. The current price is trading at $25, up $1.17 or 4.92% on the day.

Technically, looking at the daily chart above, the price bottomed in September right near the 100 day MA (blue line). In October, the swing low has stalled at the 38.2% at $22.90. The price high today has taken the price to the highest level since September 22.

The next major target on the daily chart comes in at swing lows from August and September between $25.85 and $26.04.

Baker Hughes oil rig counts rises to 193 from 189 last week

Weekly Bakers Hughes rig count

The Baker Hughes rig counts have seen an increase this week.

- Oil rigs 193 vs 189 last week. The est was for a rise to 190

- Natural gas rigs fell to 73 from 74 last week

- Total rigs rose to 269 from 266 last week.

Norwegian oil strike called off

Crude oil has moved lower on the news

A headlines crossing the wires saying that Norwegian oil strike has been called off. That has led to a move back down in the price of WTI crude oil futures. After trading as high as $41.47 today, the price has moved back down to a low of $40.58. We currently trade at $40.64 $-0.55 for -1.3% on the day.

Technically, the price moved above its 200 day moving average at $41.12 on its way to the high price of $41.31. However the news did send the price back below that level and toward the rising 100 day moving average at $40.27.

Moment of truth for $DXY. Approaching MA50 support.

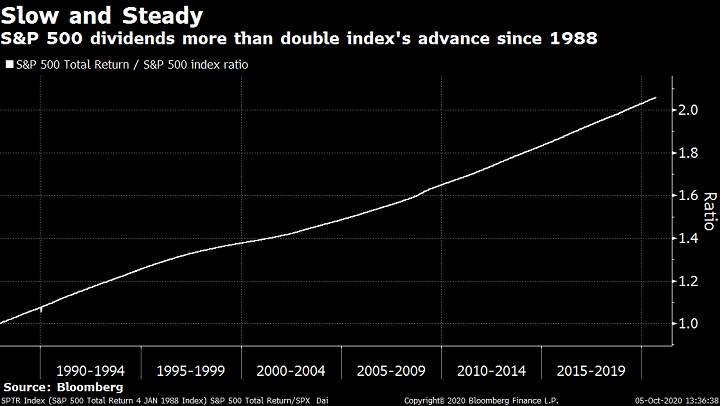

S&P 500 Dividends Show How Slow and Steady Wins the Race

‘Blue wave’ election outcome has flipped from bear catalyst to bull catalyst – BofA

BofA says the market is pricing in a Democratic victory next month, which could mean even more fiscal stimulus to follow

The firm notes that bond funds have seen their second-largest weekly inflows ever of $25.9 billion, with the market starting to adjust to the current election odds by pricing a a ‘blue wave’ outcome in November.

Adding that riskier high yield bond funds attracted $5 billion in the week to 7 October, the highest amount in 11 weeks.

“Blue wave election outcome (Democrats winning) has curiously flipped from consensus bear to bull catalyst in recent months.”

Further noting that the market sees that as hopes for more fiscal stimulus to follow, before adding that they expect US stocks to “top” between election day on 3 November and the inauguration of the new president in 20 January 2021.

China says will take measures to protect interests of Chinese firms against US ‘economic bullying’

China responds to the report of the US exploring restrictions into Ant Group as well as Tencent Holdings

- US has been abusing national security concept

- US hasn’t produced any substantial evidence

- Ant Group, WeChat exposes ‘economic bullying’ by US

The latest salvo between the two countries sees the Trump administration looking into restrictions against Ant Group and Tencent over concerns that their digital payment platforms threaten US national security.

The move comes as a major annoyance to China as the above is disrupting Ant Group’s progress towards what could possibly be the world’s largest IPO.

In the bigger scheme of things, this just continues to define growing tensions between the two countries. But hey, at least there’s the Phase One trade deal right. Ugh.

Gilead releases data on Remdesivir that shows larger improvements

Company publishes open letter on the drug treatment

Gilead now says:

- Patients receiving the drug recovered five days faster on average; and that in cases of severe disease they recovered seven days faster

- The drug reduced the likelihood of patients progressing to more severe stages of the disease

- For patients on low-flow oxygen there was a significant reduction in mortality

This is another set of great pandemic news.

Trump received a five-day course of Remdesivir.