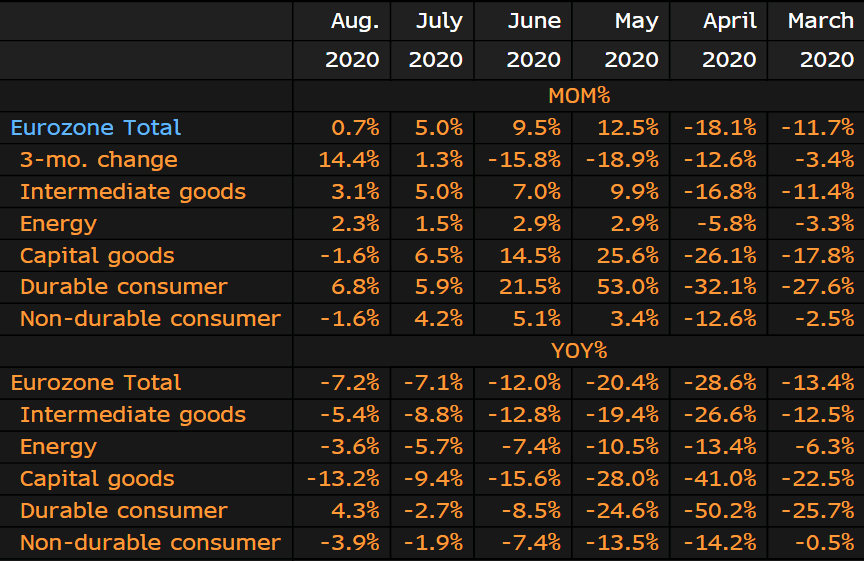

Latest data released by Eurostat – 14 October 2020

- Prior +4.1%; revised to +5.0%

- Industrial production -7.2% vs -7.0% y/y expected

- Prior -7.7%; revised to -7.1%

Euro area factory output continues to highlight an improvement in Q3 but the recovery pace is losing some steam with the August bounce, though expected, not all too robust.

That said, manufacturing PMI data for September provided some indication that the industrial sector is still holding up towards the end of Q3 but amid ongoing virus concerns, it remains to be seen how things will progress as we move towards the year-end.

![🔥 [ONE-TIME OFFER] => This item For basic survival guide looks entirely wonderful, will have to remember this next time I have a bit of money saved up .BTW talking about money... I always say shopping is cheaper than a psychiatrist #PreppingSpiritWeek #survivalpreppingBooks #PreppingHacks #survivalskillsPrimitive](https://i.pinimg.com/564x/25/11/04/251104cca82a1c0f89fa5c77480f7172.jpg)