Archives of “October 2020” month

rssGerman Chancellor Merkel says in a serious stage of the COVID-19 pandemic

Merkel met with state leaders, says there are great challenges ahead for the winter months

- What we do in coming days will be decisive for how we get through the pandemic.

- We are in an exponential growth phase for infections

- Germany must do everything it can to control the spread of the virus

- German economy is not able to afford a second wave

—

Chalk Germany up as another country about to bring in tighter restrictions. Earlier on Wenesday French PM Macron introduced a fresh curfew to Paris, and 8 other cities in the country. 9pm to 6am, which could last for up to 6 weeks.

Major indices close lower for the 2nd consecutive day

NASDAQ leads the way lower

The major indices close lower for the 2nd consecutive day. The NASDAQ index was the weakest

of the majors today.

Some highlights:

- S&P and NASDAQ index is trading lesson 3% from the all-time high

- Stocks have their first 2 day losing streak since September 18

- The Dow industrial average turned back for 2020

- UnitedHealth care was the biggest drag on the Dow

- Russell 2000 of small-cap stocks fell by -0.93%

The final numbers are showing:

- The S&P index fell -23.32 points or -0.66% to 3488.61. The high price reached 3527.94. The low price extended to 3480.55

- The NASDAQ index fell -95.166 points or -0.80% to 11768.73. It’s high price reached 11939.91. The low price extended to 11714.35

- The Dow industrial average closed down -165.83 points or -0.58% to 28513.98. The high price reached 28792.56. The low extended to 28461.73.

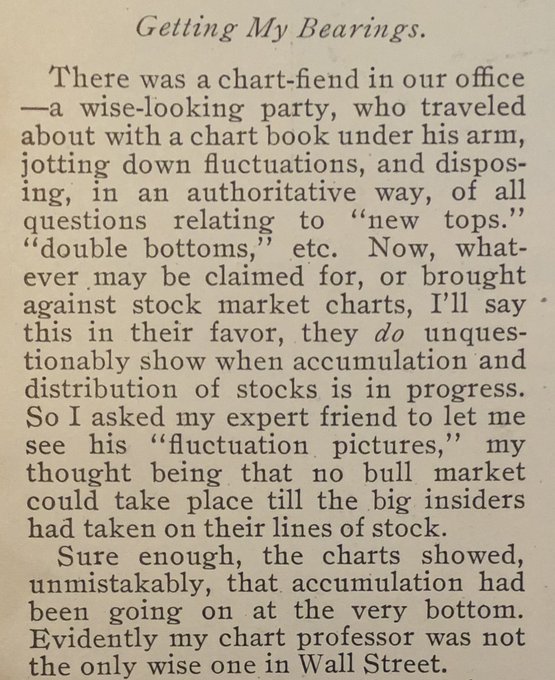

Thought For A Day

US considers placing China’s Ant Group on the trade blacklist

Ant Group owns Alipay

The US State Dept has submitted an application for the Trump administration to put China’s Ant Group on the trade blacklist, according to sources cited by Reuters.

That would be a significant escalation in the trade war, which is morphing into more of a tech war.

By some measures, the Ant Group is the largest Fin Tech company in the world. It owns Alipay and these other subsidiaries:

- Alipay – a mobile wallet app supports make and accept payments

- Huabei (Ant Credit Pay) – a virtual credit card type of product that facilitates credit payments

- MYbank – a private online bank that lives entirely on the cloud

- Jiebei (Ant Cash Now) – a consumer loan service

- Ant Fortune – a comprehensive wealth management app

- Ant Insurance Services

- Zhima Credit – an independent credit filling and scoring service for individuals

- Ant Financial Cloud – a cloud service for financial institutions

- ZOLOZ – a global biometric-based identity verification platform

New York Times, Siena poll shows Biden 46% to 42% Trump in North Carolina

The last poll had Biden up by 1%

A New York Times/Siena poll is showing Dem presidential candidate Biden leading Pres. Trump 46% to 42% in the key battleground state of North Carolina. The last poll had Biden leading by 1%.

European major indices end the session with mixed results

Mixed results for the major European indices in trading today

The European stock markets are closed and the results are mixed. The provisional closes are showing:

- German DAX, +0.1%

- France’s CAC, -0.1%

- UK’s FTSE 100, -0.5%

- Spain’s Ibex, +0.6%

- Italy’s FTSE MIB, +0.3%

In other markets as European/London traders look to exit:

- S&P index -2.84 points or -0.08% at 3509.30

- NASDAQ index -10.38 points or -0.09% at 11853.42

- Dow industrial average -34.6 points or -0.12% at 28645.98

- spot gold is trading up $18.09 or 0.96% at $1909.54

- spot silver is up $0.29 or 1.22% $24.43

- WTI crude oil futures are up $0.78 or 1.94% at $40.99

In the forex market, the USD has moved lower against all the major currencies (near unchanged vs. the CAD). It is the weakest of the majors. The GBP has extended its move to the upside in the NY session. It is the strongest currency by far today.

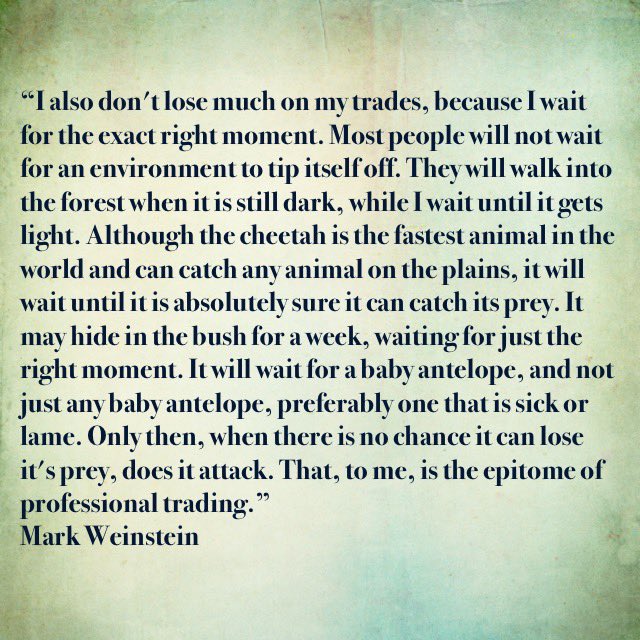

Be a cheetah

Remember that it’s not just about setups. You want tailwinds behind you on new buys. Feedback on other new buys, status of TMLs, leaders, breadth, indices, and sentiment. Align this with a solid buying strategy and you increase your odds on the trade greatly.

Heavy dose of central bank speakers coming up in New York trading

Lots of talk but few of them have anything to say

The PPI report is due at the bottom of the hour but it’s not likely to be noticed by the market. Prices are expected to rise 0.2% y/y with a large drag coming from energy.

The main news will be a steady stream of central bank comments but we’re just not at the point where any imminent action or theme is in play. Perhaps Haldane offers something new on negative rates but it will probably be a reiteration that they’re studying the issue. For Fed speakers, I’m looking for any insight on high-frequency indicators. All times GMT:

- 1235 Fed Barkin

- 1300 Fed Clarida

- 1600 BOE Haldane

- 1400 ECB Villeroy

- 1415 ECB de Cos

- 1430 BOC Lane

- 2200 Fed Kaplan

- 1900 Fed Quarles

- 2200 RBA Lowe

On the PM earnings calendar:

- United

- Alcoa