Archives of “October 2020” month

rssMoody’s downgrades UK credit rating to Aa3 from Aa2, outlook stable

Moody’s cuts the United Kingdom

This isn’t entirely unexpected but you hate to see it. Fitch recently affirmed the UK at AA-, which is the equivalent of Aa3. S&P remains one notch higher at AA but it’s under review.

Moody’s cited three reasons for the sovereign downgrade:

US Indices fade to finish flat on the day with narrow gains on the week

Closing changes for Friday:

- S&P 500 flat at 3483

- Nasdaq -0.4%

- DJIA +0.4%

On the week:

- S&P 500 +0.2%

- Nasdaq +0.8%

- DJIA +0.1%

If you like doji stars just below the highs, then that S&P 500 chart is for you.

CFTC Commitments of Traders: Euro longs continue to lose enthusiasm

Weekly FX positioning data for the week ending October 13, 2020:

- EUR long 168K vs 174K long last week. Longs trimmed by 6K

- GBP short 10K vs 11K short last week. Shorts trimmed by 1K

- JPY long 20K vs 21K long last week. Longs trimmed by 1K

- CHF long 12K vs 13K long last week. Longs trimmed by 1K

- AUD long 4K vs 11K long last week. Longs decreased by 7K

- NZD long 6K vs 5K long last week. Longs increased by 1K

- CAD short 14k vs 18K short last week. Shorts trimmed by 4K

- Prior report

The euro net has fallen from a record as concern grows about the coronavirus resurgence in Europe.

Thought For A Day

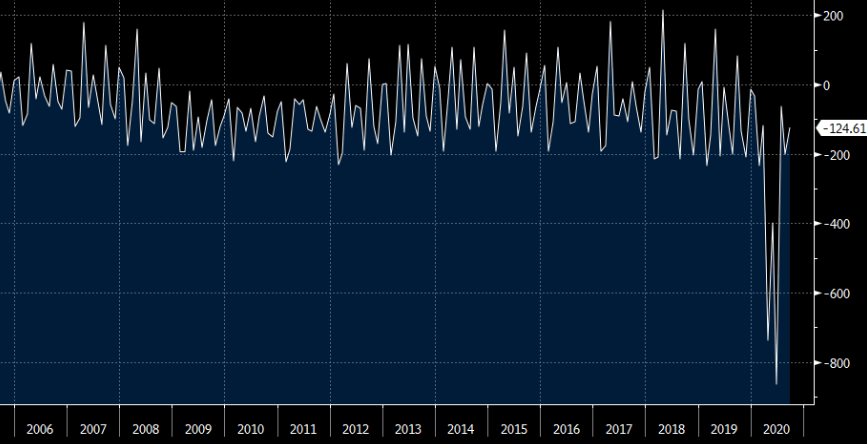

US posts record $3.1 trillion deficit in 2020 fiscal year

Three trillion deficit, largest ever by a margin

- Year-ago deficit $984B

- September deficit $125B vs 124B exp

- Sept 2019 $83B

- Outlays $498B vs $291B in 2019

- Receipts $373B vs $374B in 2019

The thing is, $3.1 trillion hides just how large it is. Much of the PPP money isn’t accounted for until it’s forgiven and there’s other COVID money out there that’s not accounted for yet either. Then there is the coming stimulus package and whatever else comes.

The prior record was in 2011 at $1.3 trillion.

It’s tough to see deficits falling below $1 trillion any time this decade.

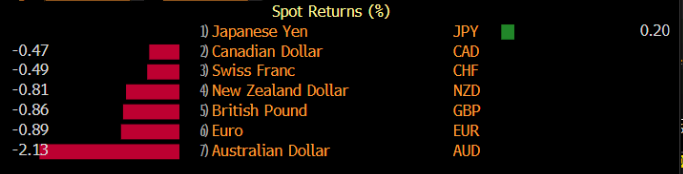

AUD/JPY shorts were the best trade this week

RBA cut talk and risk aversion dominated

The RBA offered its clearest indication yet that a rate cut is coming on the same day as the US election. That was one of the factors that weighed on the Australian dollar this week as it badly trailed its G10 counterparts.

The yen was on the flip side as risk aversion crept in.

Looking at AUD/JPY, it fell every day this week but found some bids under 74.50 yesterday and today. Technicians will be watching 74.00 in the week ahead. It’s a great spot to manage risk for anyone trying to buy the latest dip.

Authenticity is when you say and do the things you actually believe.

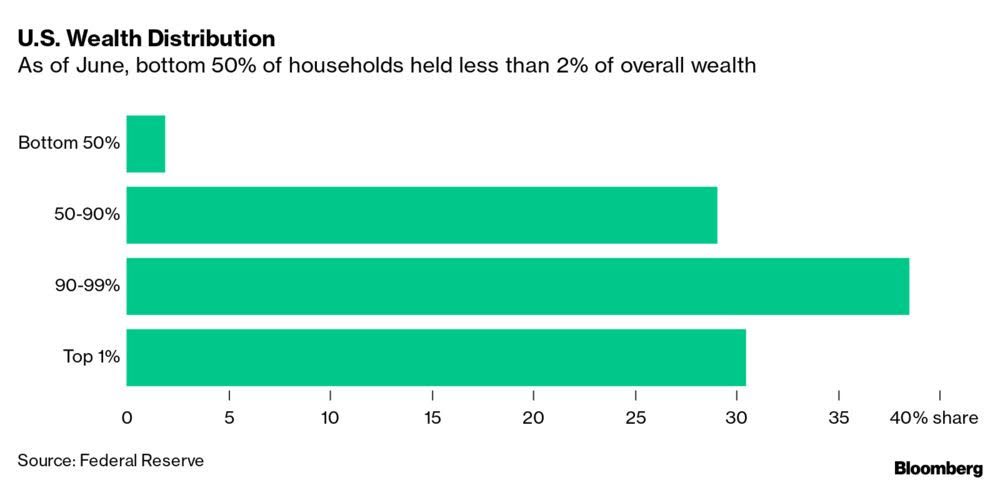

The 50 Richest Americans Are Worth as Much as the Poorest 165 Million

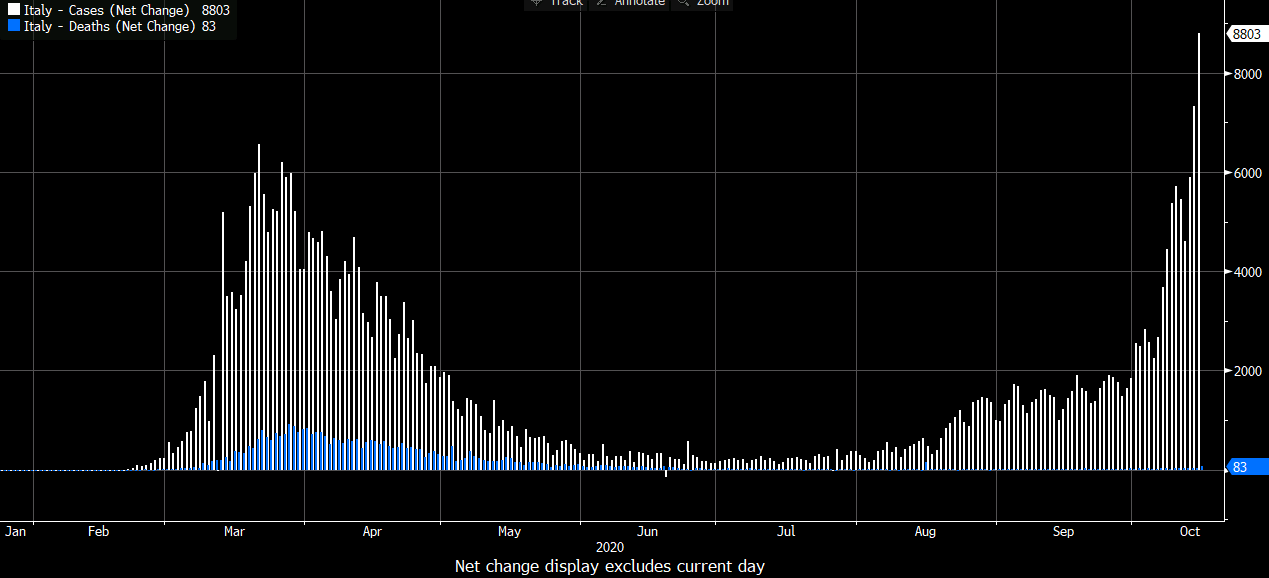

Italy reportedly weighs imposing curfew measure to limit virus spread

Corriere della Sera reports on the matter

The report says that Italian prime minister, Giuseppe Conte, does not want the country to return to a full lockdown or a two-week “reset” i.e. shutdown, instead weighing measures similar to some of that taken in France.

A 10pm curfew is said to be among those being considered with a return to virtual teaching for high schools as well. The government is also said to agree on the need for further efforts to expand/encourage working from home to curb the virus spread.